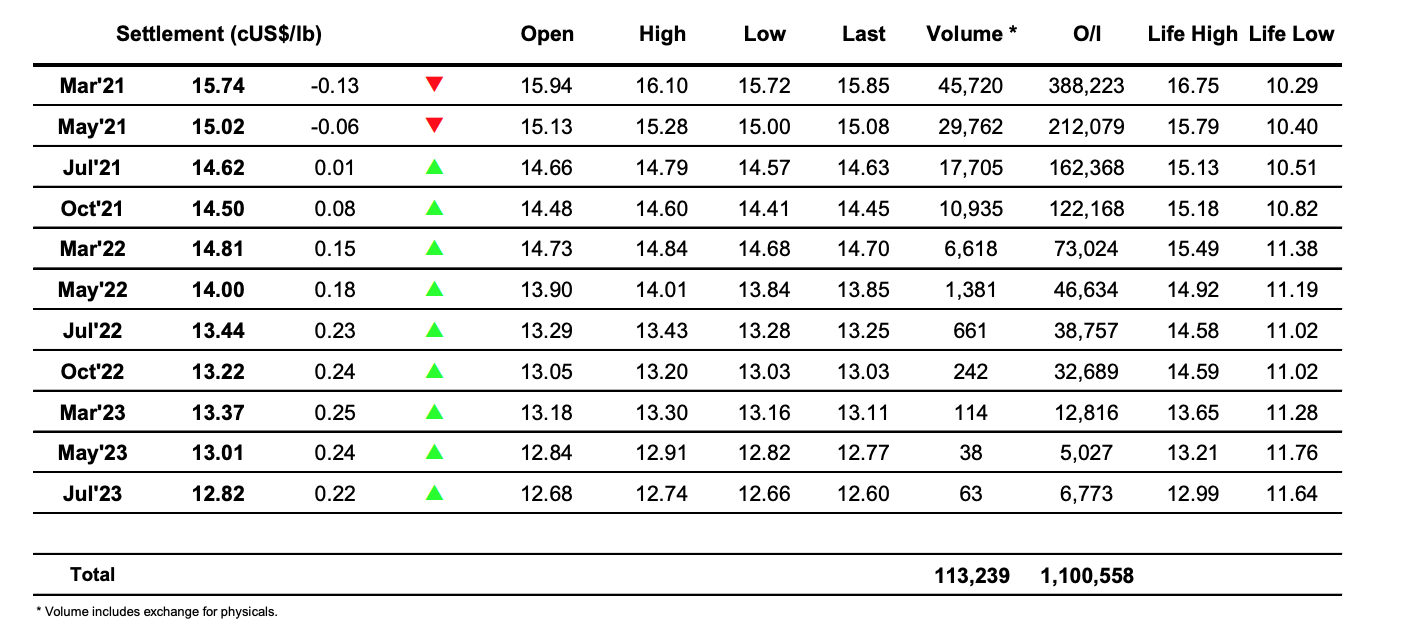

Sugar #11 Mar ’21

Having seen prices pull back beneath 16c during the latter part of the week and with the COT showing a smaller increase in the speculative long than some had anticipated as at last Tuesday (236,786 lots, an increase of 2,340 lots) it was unclear just how the market would respond this morning. In the event we initially followed the broader commodity macro with early gains that pushed March’21 back above 16c, aided by some light consumer pricing and hedge lifting of business conducted over the weekend. Having reached 16.10 the rally began to stall and in quiet trading we eased back to be mid-range at 16c by the end of the morning. Spread values were struggling despite the net gains showing down the board and this seemed to unsettle the market with renewed selling pushing back down into the 15.80’s before running into scale buying placed ahead of Fridays 15.73 low mark. On continuing low volumes the afternoon was spent swinging between 15.80 and 16c with most of the activity from algo’s and day traders while many simply took a step back and observed. Pre-close selling sent March’21 to new session lows and damaged already weaker spreads which narrowed into 0.71 for March/May’21, 0.40 points for May/Jul’21 and 0.11 points in Jul/Oct’21, while the call itself saw March’21 trade marginally below Fridays levels as we touched 15.72. Another lower close and weaker spreads suggest we may continue to investigate down into the range with initial underlying support found at 15.42 basis a 50% retracement of the move higher since mid-December and the 2021 low mark of 15.40.

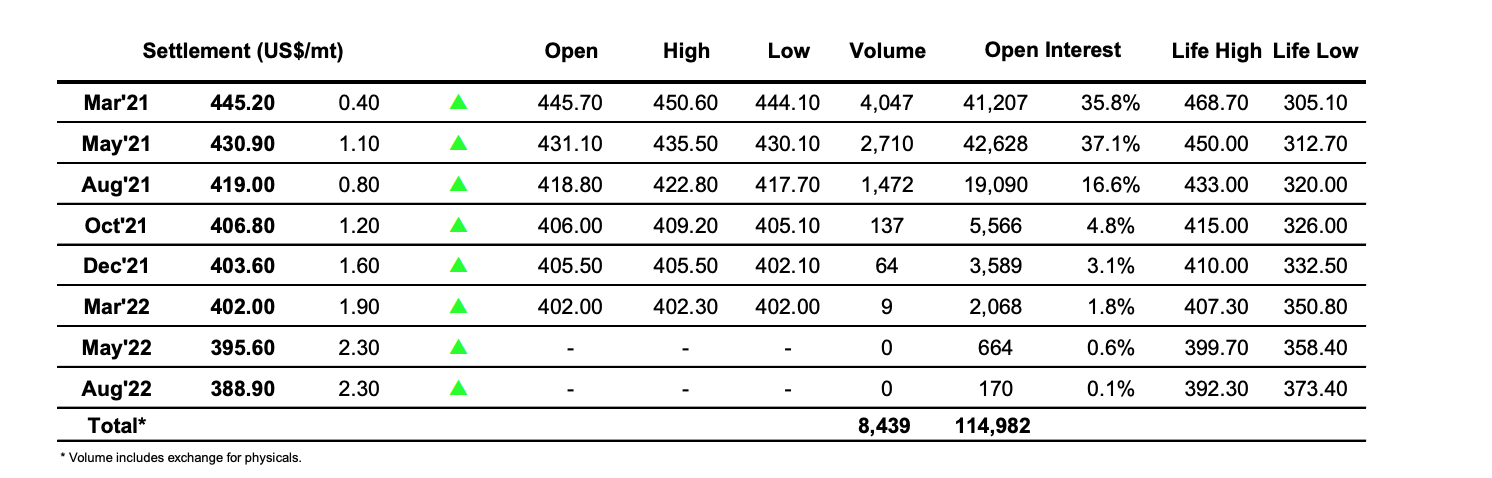

Sugar #5 Mar ’21

London whites followed in the path of No.11 to begin the day a little higher and in a very thin trading environment forged ahead to reach the $450 area for March’21 before pausing. With the upward momentum lost so support began to fade and the latter part of the morning saw prices begin to ease back into the range once more with activity falling to minimal levels as we awaited some kind of move to develop. This slight decline continued through the early afternoon however aside from some selling of the nearby spreads that saw March/May’21 trading back down to $13.80 the picture remained largely featureless and we sat comfortably above Fridays lows. A mid-afternoon low mark of $444.10 held in place despite some renewed closing selling which put the market under late pressure, but unlike the No.11 we showed good resilience to hold, strength which widened white premiums to session highs at $98 for March/March’21 and $99.50 for May/May’21. March’21 futures settled just 0.40c higher at $445.20 to appropriately conclude a slow session.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract