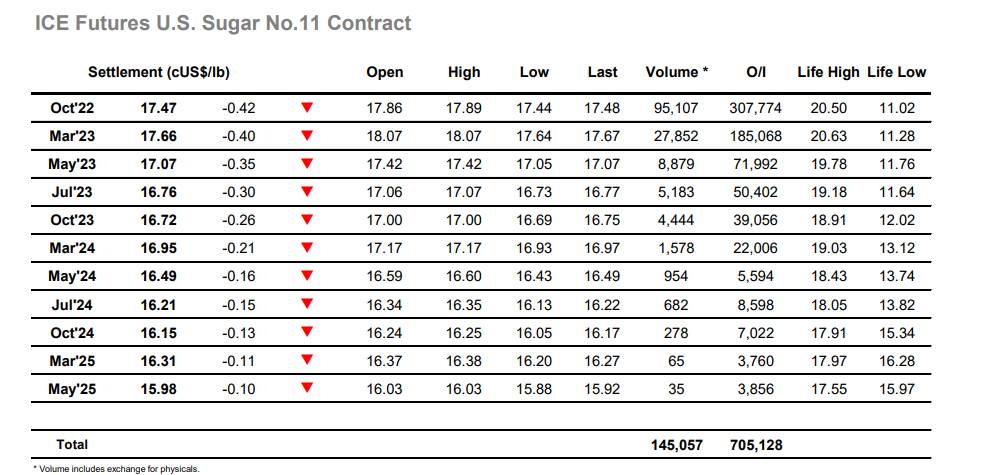

With last week having seen Oct’22 decline from 19.59 to 17.87 the market is under a good deal of technical pressure, though one would expect some larger quantities of consumer pricing to kick in around these levels. Friday’s COT meanwhile showed that as at cob 19th July the specs had increased holdings to 40,089 lots long, though action over the three days which followed would suggest that most of this holding has likely been liquidated with the live position far closer to flat. Once the day got underway there was the expected support for Oct’22 which held the price to a narrow band centred on the 17.80’s through the morning, but tellingly the lack of any bounce despite a mixed macro hinted that the slide is not over just yet. So proved to be the case as we reached the start of the US Day with increased spec activity coming to the fore (both long liquidation and new selling) to quickly punch beneath this month’s 17.71 low and continue downward into the 17.50’s. Spreads were mildly weaker on the move though not so badly as may be expected given the relative weight of selling to the front of the board, and with scale buying continuing ahead of Q1 lows at 17.46/17.38 the market settled down to hold at the bottom end of the range. This proved successful until aggressive spec selling gathered for the close, forcing a new session low at 17.44 and yet another negative settlement at 17.47. The sheer scale of the fall over the past five sessions unwinding a good deal of work suggests that unless the commodity macro finds some incredible strength the market is happier to play the lower end of the range, and while continuing bargain hunting from end-users will be seen around here whether it is sufficient to hold the market from making new yearly lows remains in the hands of specs who currently appear intent on turning to the short side once again.

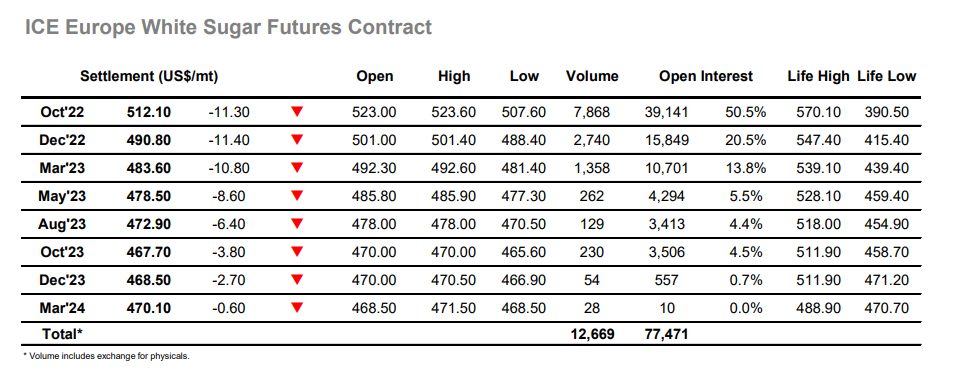

Recent struggles continued during early trading as the new week saw a familiar pattern of spec selling pushing down into consumer scale buying. Early volumes were not overly significant however some more solid buying was placed ahead of the 2-month Oct’22 low of $519.10 to keep the technical picture from breaking down any further through the morning. The structure remained intact during the early afternoon however as 1,800 lots Oct’22 traded with sell stops triggered that spiked the price all the way down to $507.60 before returning to the lower teens. Not that much was trading however this movement briefly narrowed the Oct/Oct’22 white premium to $121 before it was able to recover and be touching to $130 later in the afternoon. Despite the best efforts of consumer buyers combining with some short covering to pull prices back upward over the final three hours the work was undone over the closing minutes as renewed selling sent Oct’22 back down to settle at $512.10. Support now rests at $501.10 against the May low, and while the recent movement is sending short-term systems into oversold ground the lack of interest in macro movements suggests any recovery may be hard to sustain longer-term with a lot of damage done over the past week.