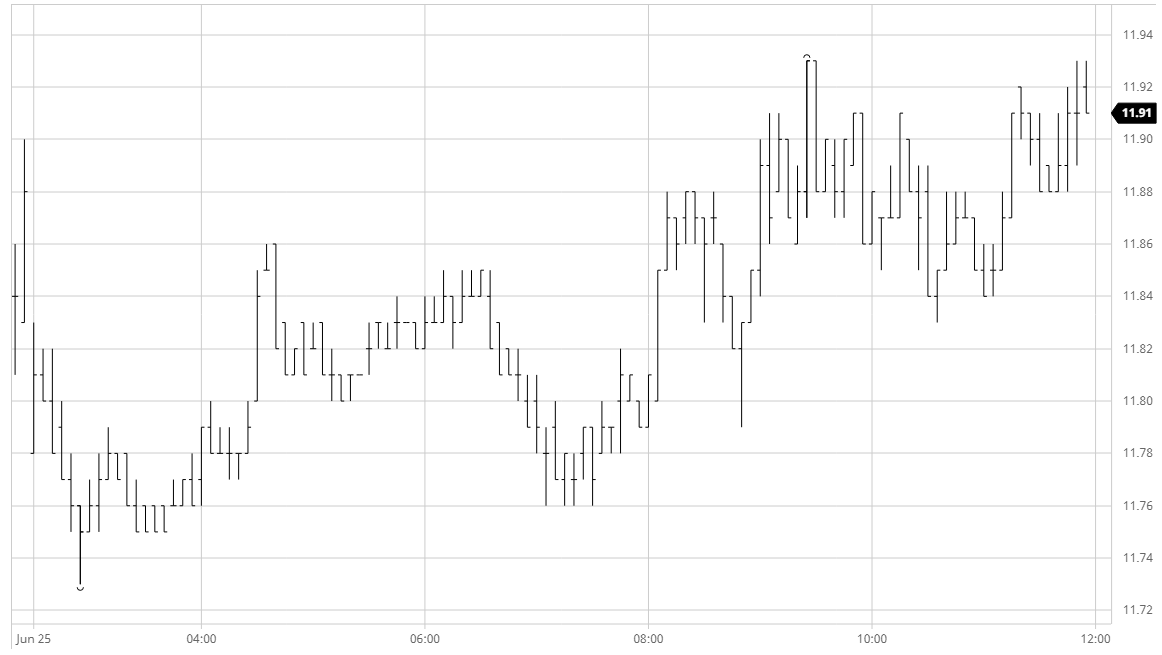

Another incredibly slow morning saw the market repeat a now familiar pattern, making early losses before trading sideways on extremely low volume. The succession of failures to break beyond the 12.30 area last week appears to have dented the enthusiasm of the spec buyers and this has left the market feeing rather directionless, struggling to find some news which will act as a catalyst in a featureless environment. Macro activity is clearly insufficient to provide this at present, hence the recent disassociation from crude and the CRB, but it will be interesting to see if that continues should we see fresh weakness for softs/energy sectors as moving back towards 11c may prove to be the path of least resistance particularly given the recent whites weakness. The afternoon failed to see the usual uptick in activity that we have come to expect and instead we continued to work sideways. A push to 11.93 for Oct’20 was the most excitement that we were allowed and though this acted to keep nearby values in credit for the rest of the day it remained quiet as a dull session concluded near to daily highs.

SB Oct- Sugar No.11

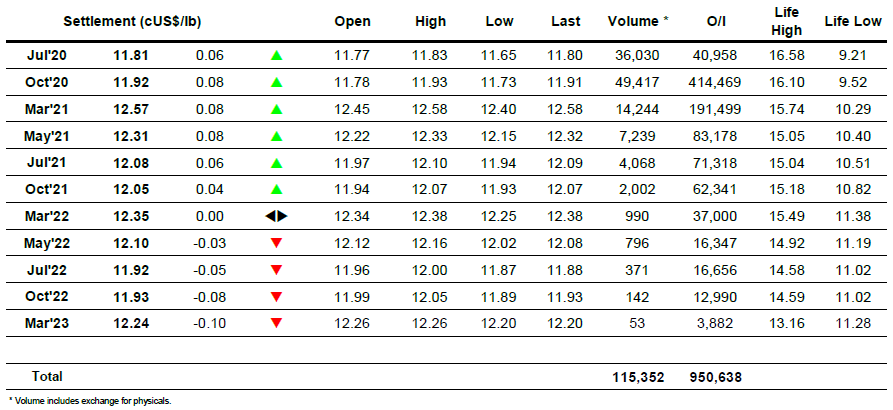

ICE Futures U.S. Sugar No.11 Contract

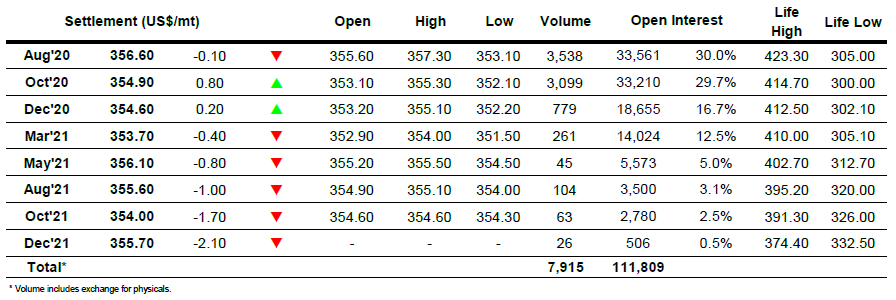

ICE Europe White Sugar Futures Contract