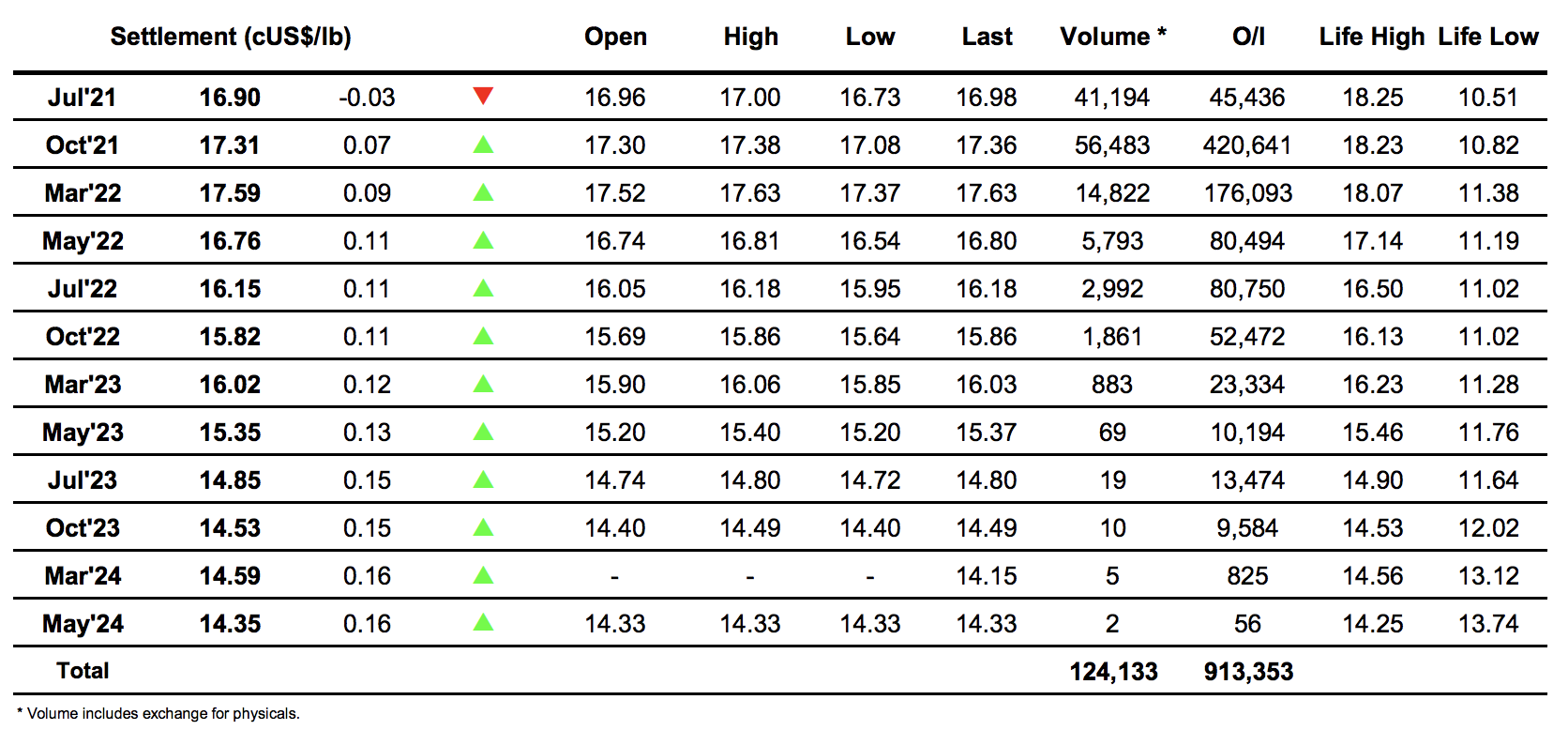

Sugar #11 Oct’21

Consolidation was the watchword for the market this morning as we began broadly sideways to maintain yesterday’s late push and provide the most constant action seen throughout this see-saw week. Oct’21 edged as far as 17.33 but with progress limited to this we saw the first signs of some concern from day traders as the price was pushed down to 17.08 before being supported back into the range. Meanwhile there was little occurring outside of the Jul/Oct’21 spread which despite seeing lower volumes as would be expected just four days from expiry was continuing to weaken and reached -0.35 points. Little changed through the early part of the afternoon however the announcement of lower than anticipated UNICA numbers for FH June’21 showing cane at 35.959m tonnes, with 2.192m tonnes of sugar produced and a sugar split at 46.25% sparked a rally up to 17.37. The rally failed to sustain however with the positive connotation of these numbers quickly forgotten as we slipped back down to be trading back at unchanged within the hour. Jul/Oct’21 continued to struggle and lost more ground as the day wore on to record a low at -0.44 points while the flat price was largely unphased and consolidated the range. The final hour saw longs return to the fore and bid values back towards session highs, achieving the third consecutive positive settlement at 17.31 as they look to try and continue the recovery with the wider aim of challenging the congestion/resistance up ahead of 18c.

Sugar #5 Aug’21

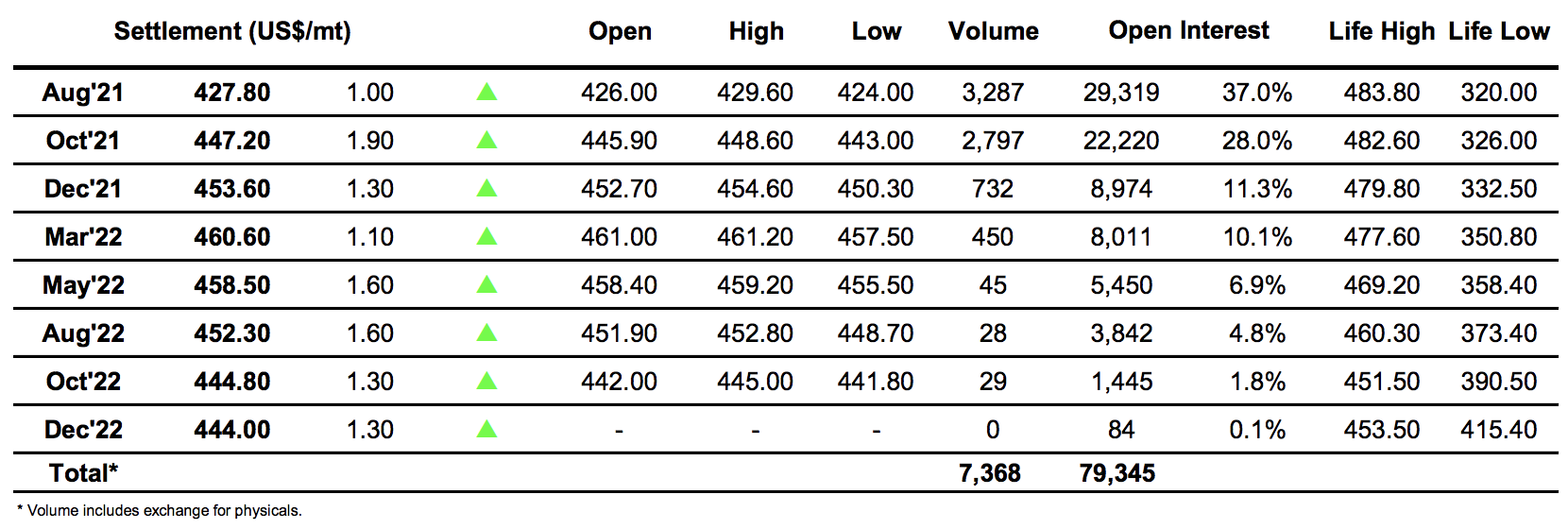

Early buying led to a continuation of yesterday afternoons momentum with Aug’21 pushing ahead on to $429.50 before pausing. The move was then ended with some long liquidation which took values back into the red though with volume proving to be extremely limited the lows were restricted to the mid $420’s with no apparent sign that we would revisit the underlying support area down in the teens. What the follow3ed was a very uneventful session during which we swung around the mid to upper $420’s and extended the extremities to $429.60 / $424.00 respectively but without ever looking likely to make a clean break in either direction. In low volume conditions around half of that traded for the front two prompts came via the Aug/Oct’21 spread which slipped yet further to be trading at -$19.50 by the end of the day. Prices were sitting in mildly positive territory as we headed towards the close and though the call saw some choppiness the final settlement was net positive at $427.80.

· A mixed day for the white premiums saw some light movement based upon changes to the spreads, and we head into the weekend valued for Aug/Jul’21 at $55.20, Oct/Oct’21 at $65.50 and March/March’22 at $72.80.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract