Sugar #11 May’21

A mixed opening period saw May’21 briefly recoup initial losses on the back of a firmer whites opening, however this merely proved to be a short term period of respite and the market soon resumed a downward trajectory. It seemed that the concerns raised over the spread weakness yesterday were proving well founded as the morning saw prices enter a steady downtrend, the lack of sizable buying until nearer 15c making the sellers job rather easy while May/Jul’21 being sold back in to 0.15 points aided the sentiment. By early afternoon the decline had reached 15.11 and it was only at this stage that a little more support began to appear, both from consumers and also from the usual array of day traders/specs who were content to lock in some P&L ahead of the technical support residing either side of 15c. The underlying support led to a more stable afternoon with prices tapering to a narrow band at the bottom end of the range, and for some time it seemed as though we may make a double of bottom with a succession of lows at 15.05. All that changed during the final hour as some more aggressive selling sent May’21 to a new recent low at 15.01, though with sizable buying at each point downward the 15c handle held firm. Short covering ahead of the close pulled May’21 back into the teens however the recovery did not last and settlement was established at 15.09 while May/Jul’21 ended at 0.14 points. While 15c remained in tact today the sentiment of today’s decline will be negative and further tests of the underlying support are to be anticipated.

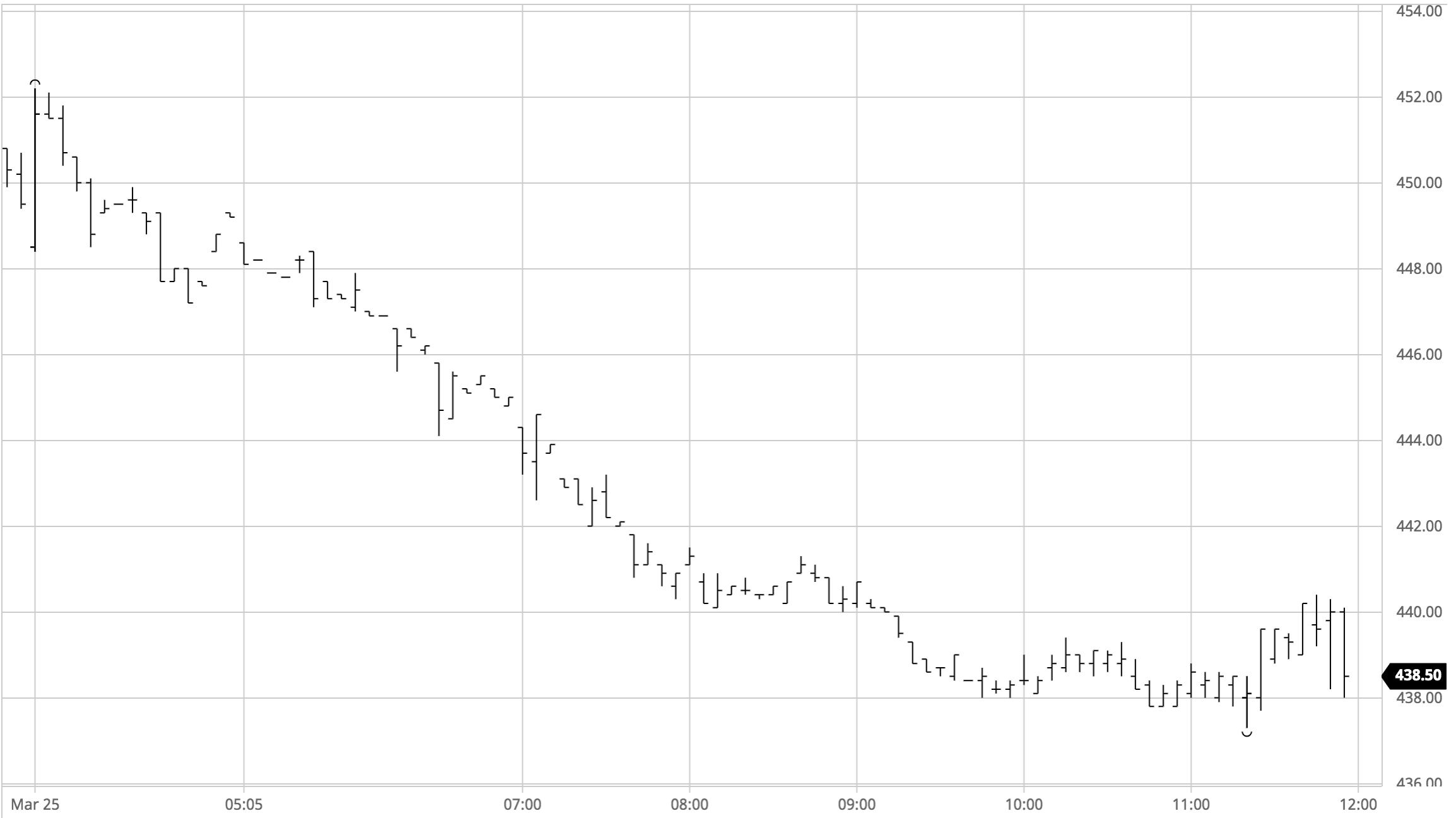

Sugar #5 May’21

espite a lower call versus No.11 we saw the London whites surge out of the blocks to trade up to $452.20, rather unexpected action which briefly sent the May/May’21 white premium out to a recent high of $109. With the initial flurry of buying concluded we saw prices set back to unchanged levels, and though we were continuing to hold onto some of the white premium gains the drag factor of No.11 and macro weakness started to pull us backwards also. Volume fell away as we slowly slipped back through the ground that had been recovered just yesterday and with buyers few and far between the market was touching to $440 by early afternoon. It was not just the outright prompts under pressure with spreads too seeing weaker values, and though we looked to stabilise this area there seemed to be little prospect of recovery. The afternoon saw calmer movements within a tighter range though all impetus remained form the short side with May’21 pushing beneath yesterday’s lows to reach $473.30 during the final hour. There was some late profit taking which pilled us back to the $440 area once again however it merely proceeded MOC selling as the shorts look to set up for further downside testing. Settlement at $439.20 combining with an outside day suggests this is the most likely direction for the market looking towards tomorrow.

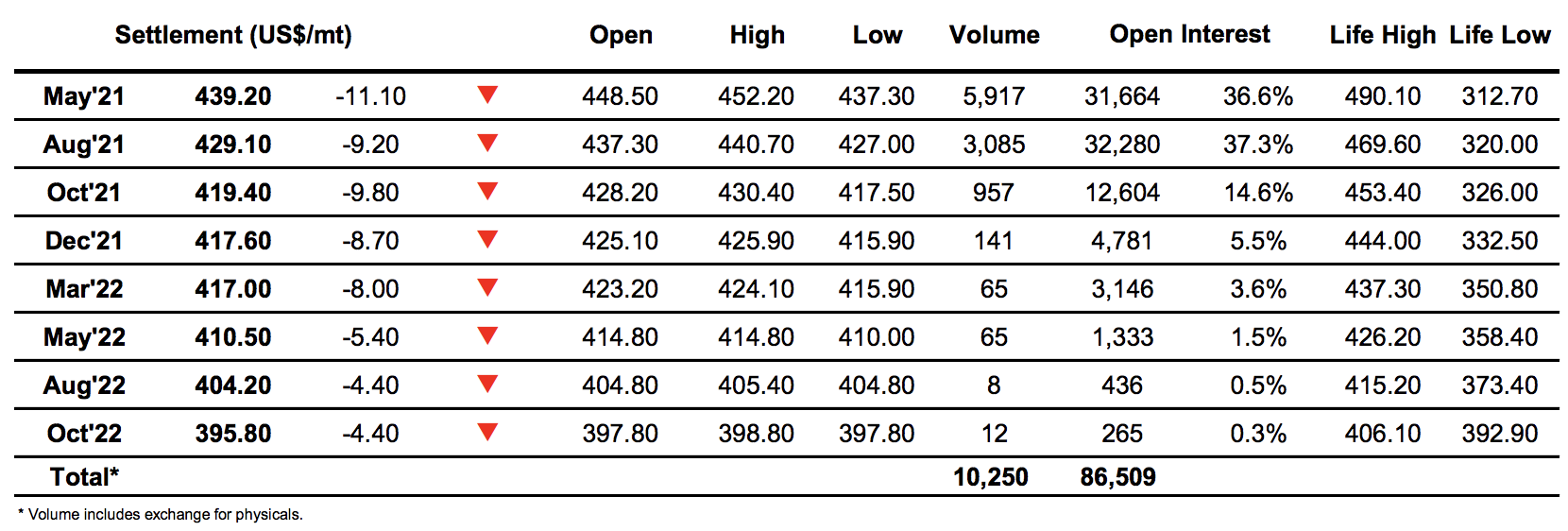

ICE Futures U.S. Sugar No.11 Contract

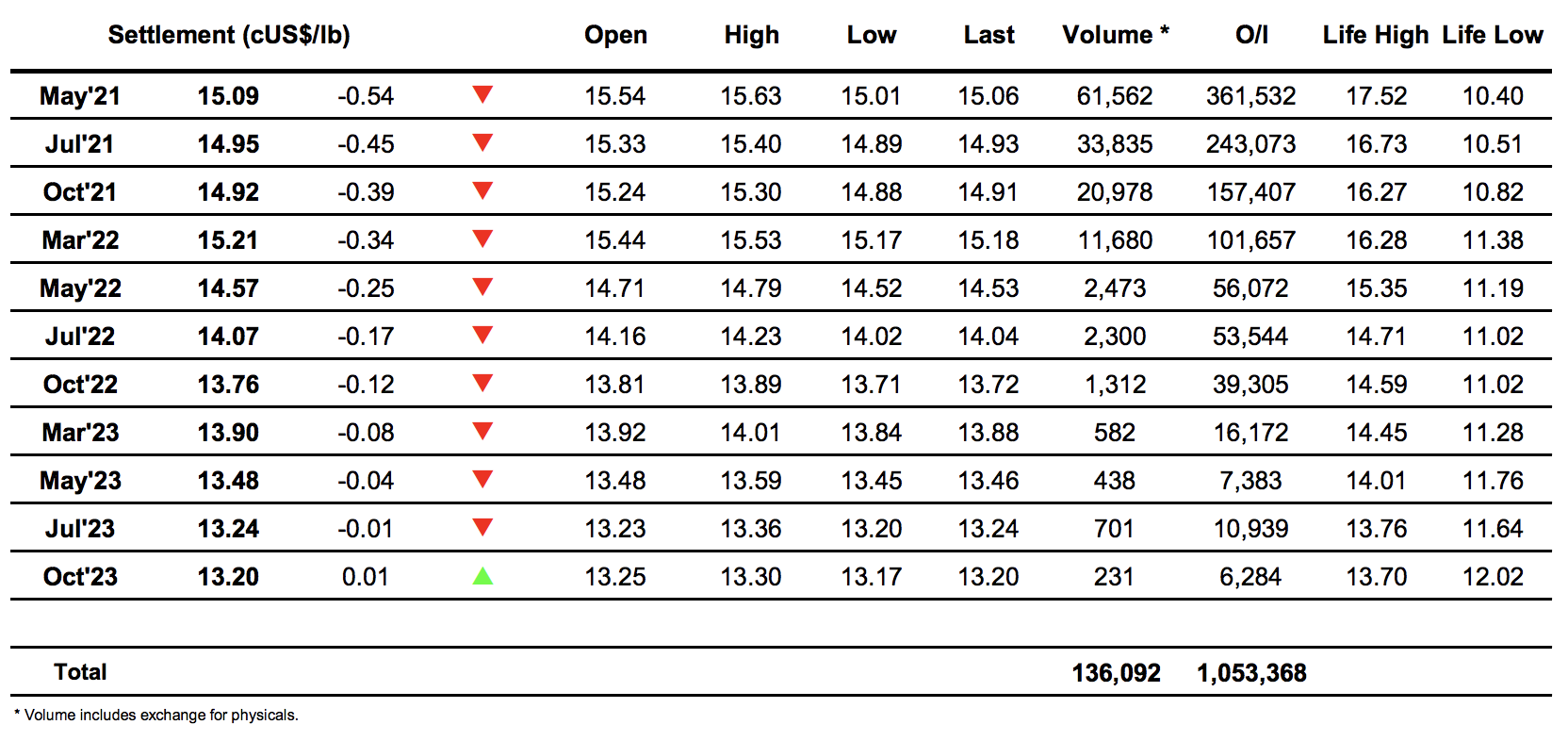

ICE Europe Whites Sugar Futures Contract