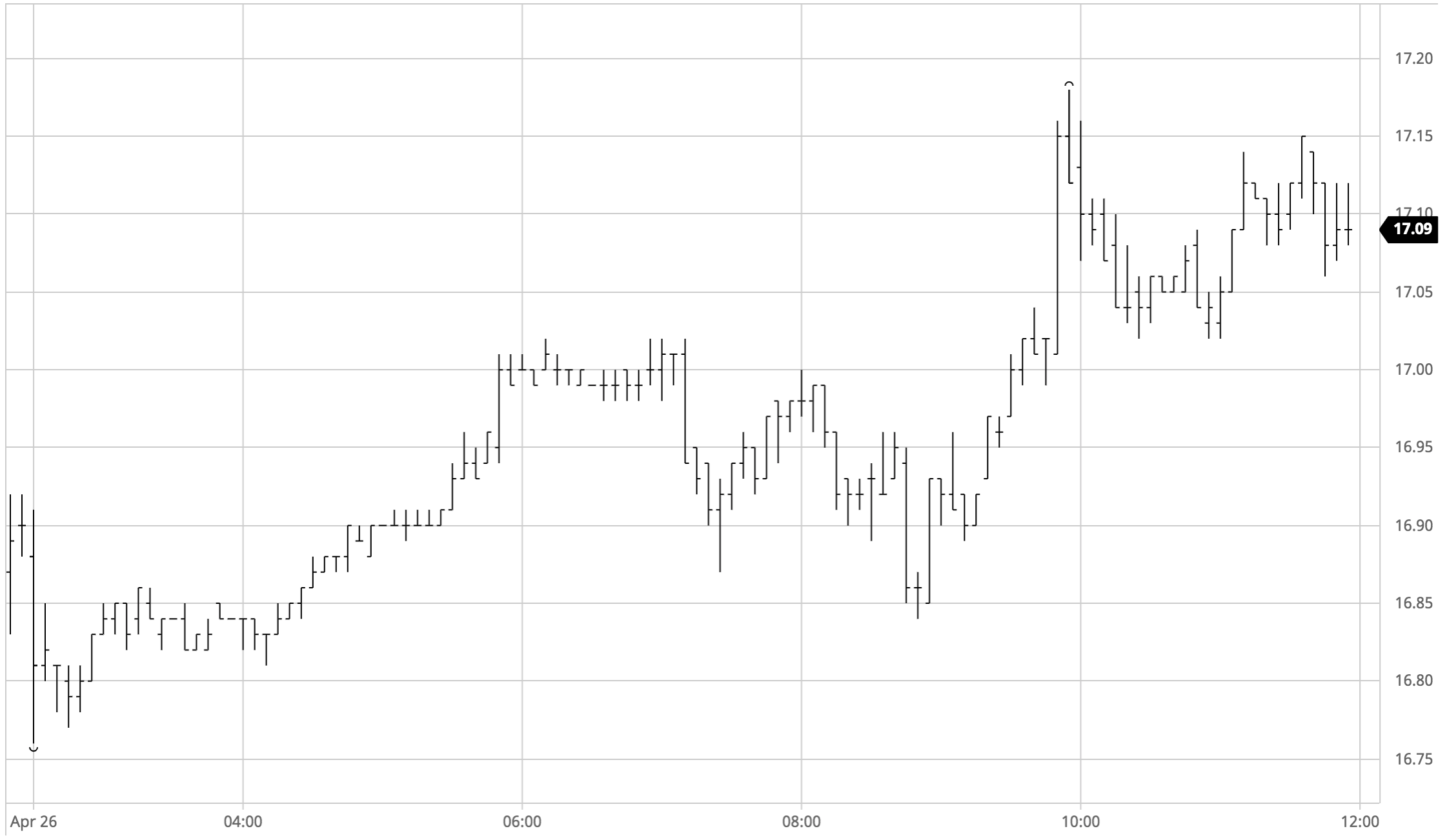

Sugar #11 Jul’21

Friday’s COT report came as a surprise to many with a larger than anticipated growth of 50,000 lots taking the net speculative long position to 220,078 lots long. This still places the net long position a little way short of the January long of 247k lots which represents the largest recent holding and there remains no doubt that the funds have plentiful additional capacity to buy should the so desire, but it does bring us back into the range of position which was held for the first couple of months of the year and so begin to raise questions as to how much more they may feel comfortable adding at the present time. The initial response from the market was muted with prices edging along quietly within a narrow band a little beneath settlement values, though gradually we saw some support emerge to bring values positive by last morning. Volumes were on the low side so while there was a push through 17c for Julk’21 during the early afternoon as some day trader interest looked to fish for additional buyers it merely nudged into the overhead resistance placed ahead of the 17.05 contract high and we soon continued back into the range. Despite this there was an undeniable lure of the contract high and the specs mustered some better volume buying to kick through 17.05 with the resultant flurry of activity taking Jul’21 quickly onward to 17.18 before pausing to consolidate. Despite further half-hearted overtures to the upside we did not revisit the highs and spent the final couple of hours consolidating above 17c though with support sufficient to ensure a settlement value for Jul’21 at 17.09 the technical outlook remains positive.

Sugar #5 Aug’21

The slowest of starts for the market saw nearby values flit either side of unchanged levels during early trading though volume was so light that for periods it felt as though the market could have been closed. Though we raised the narrow Aug’21 range up to $463.00 during the early afternoon it remained on VERY low volume which some size hours into the session had barely surpassed 1,000 lots in total, around 800 of which were in the front month. The featureless environment was brought to life during the second half of the afternoon as we followed No.11 upwards with a sharp push to $465.80 that single-handedly doubled the day’s volume, however the buying lacked sustainable substance and we soon eased back from the highs. While the outright prompts were not seeing much selling aside from the spec profit taking there was again some resistance seen for the spreads with Aug/Oct’21 continuing its contrarian path and nudging in a touch to $4.60, while white premiums also came under pressure with the Aug/Jul’21 trading down to $87 and Oct/Oct’21 towards $84. Following a period of consolidation some late buying emerged to give values a shot in the arm and ensure that we ended the day at new session highs, with Aug’21 settling positively at $465.50.

· White premium value recouped losses on the late rally to end the day only marginally down, Aug/Jul’21 at $88.75, Oct/Oct’21 at $85.00 and Mar/Mar’22 at $81.00.

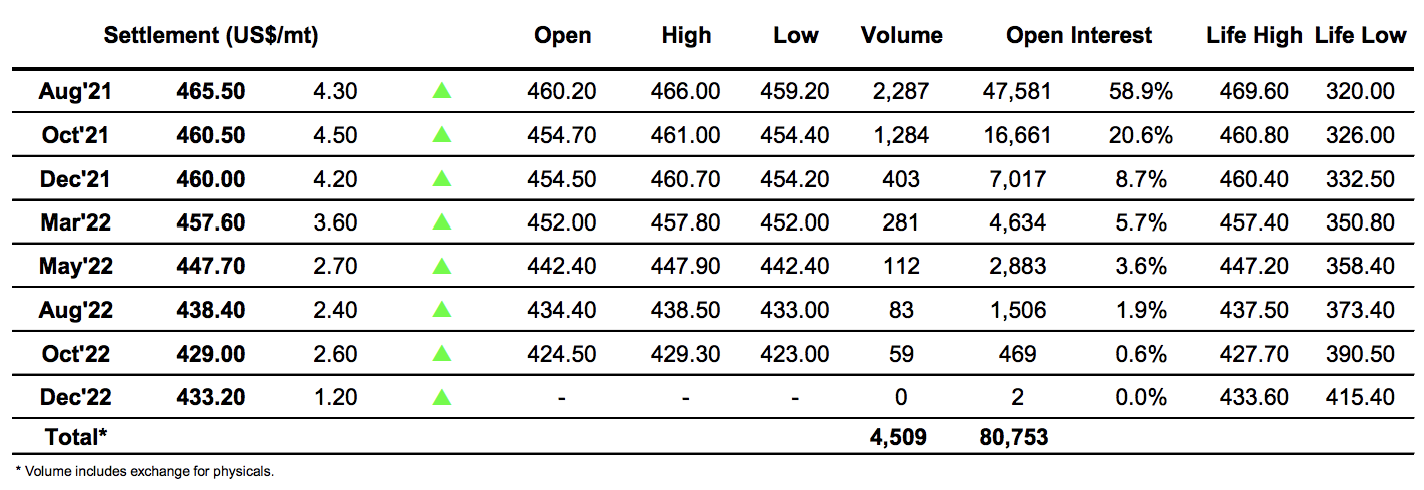

ICE Futures U.S. Sugar No.11 Contract

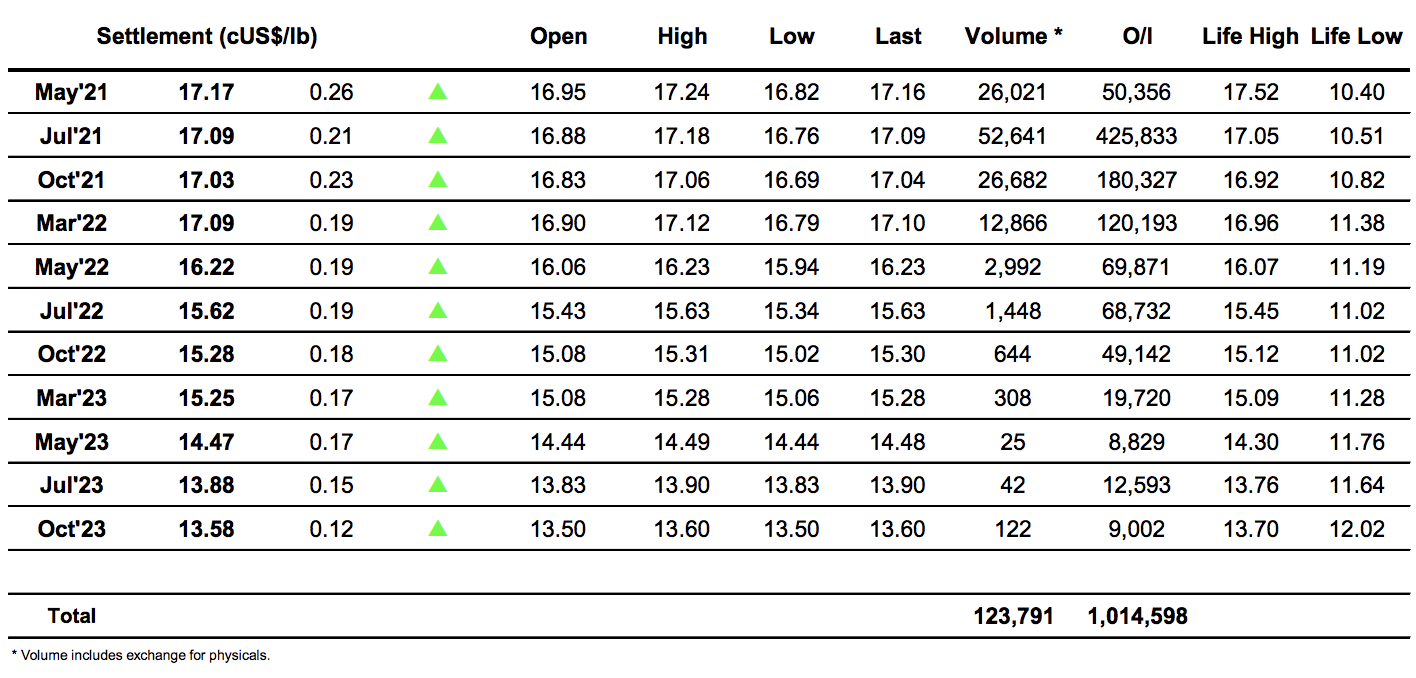

ICE Europe Whites Sugar Futures Contract