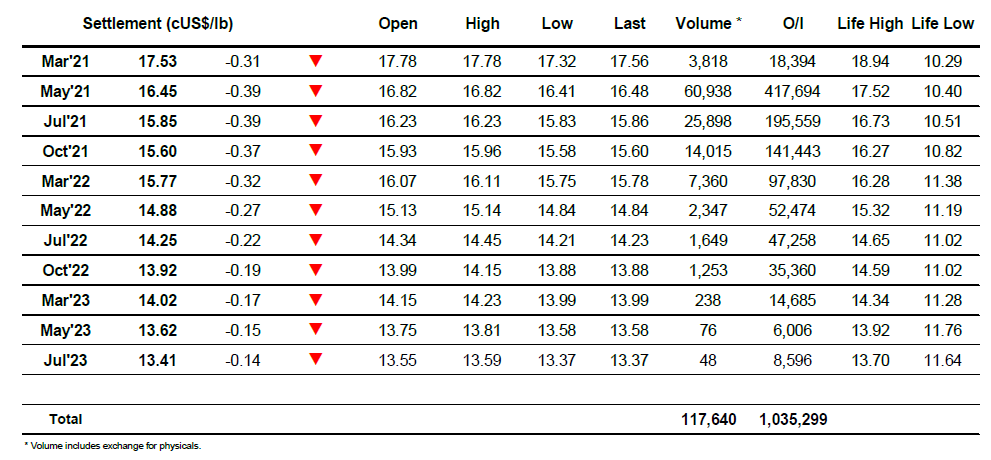

Sugar #11 May’21

A firmer USD and macro weakness meant that there was little desire from buyers this morning and in a thin trading environment it was not until May’21 reached the 16.60 area that we found the first worthwhile buying. This enabled the market to consolidate for a couple of hours but the general weakness took over once again with some spec selling sending the price down further to 16.45 around mid-session as they looked to try and generate some momentum. Of course while we may be over 100 points from Tuesdays contract high mark there remains a strong desire from trade and fund longs to maintain the broader structure of the market and this could be seen in the actions during the afternoon with prices pulled back towards 16.70 on a few occasions as they looked to defend the move and ensure a weekly close away from the lows. The attempts at recovery were proving hard to maintain with the May’21 and Jul’21 spread values under pressure and despite the fact that there was no producer pricing on show despite the USDBRL being back to 5.57 we were again below 16.50 by the final hour. Session lows were recorded late on as May’21 touched 16.41 and with settlement just a few points above this level at 16.45 it was a disappointing conclusion to a week that started so strongly.

Sugar #5 May’21

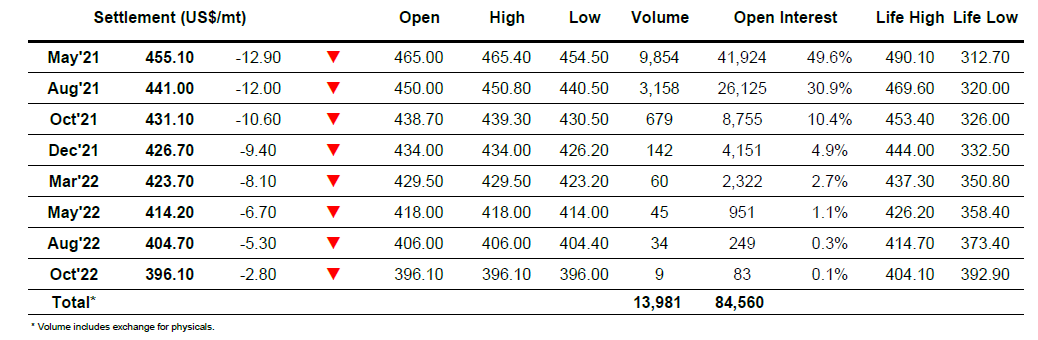

The day began with the market immediately on the backfoot as May’21 established a small gap on the daily chart between $466.00/465.40 before accelerating lower to the $460 are where some support emerged. This early movement was in keeping with the wider commodity macro with weakness across the board against a firmer USD value and in such a thin environment it really did not take too much selling to send us downward. With the initial flurry done the market did what it always does when quiet and entered a narrow sideways trading band though with so little buying for the nearby prompts the action maintained a slight downward bias which continued through the day. On a few occasions we would extend the range a little lower and this resulted in a session low mark of $454.50 which was sufficient to fill the gap established on 16th February when the surge higher began. Ending the week around session lows we have wiped out the rally of last week in its entirety and unless the macro gets back on the front foot quickly it may be difficult to recover in the near term. White premiums were under pressure once again today with significant losses again incurred for nearby prompts. May/May’21 did nudge above $96 during the morning however with the whites finding few friends and No.11 looking to try and dig in the differential fell to $92 before and continued near to session lows as we ended. Aug/Jul’21 meanwhile reached $91 before ending at $91.50 while Oct/Oct’21 concluded the week at $87.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract