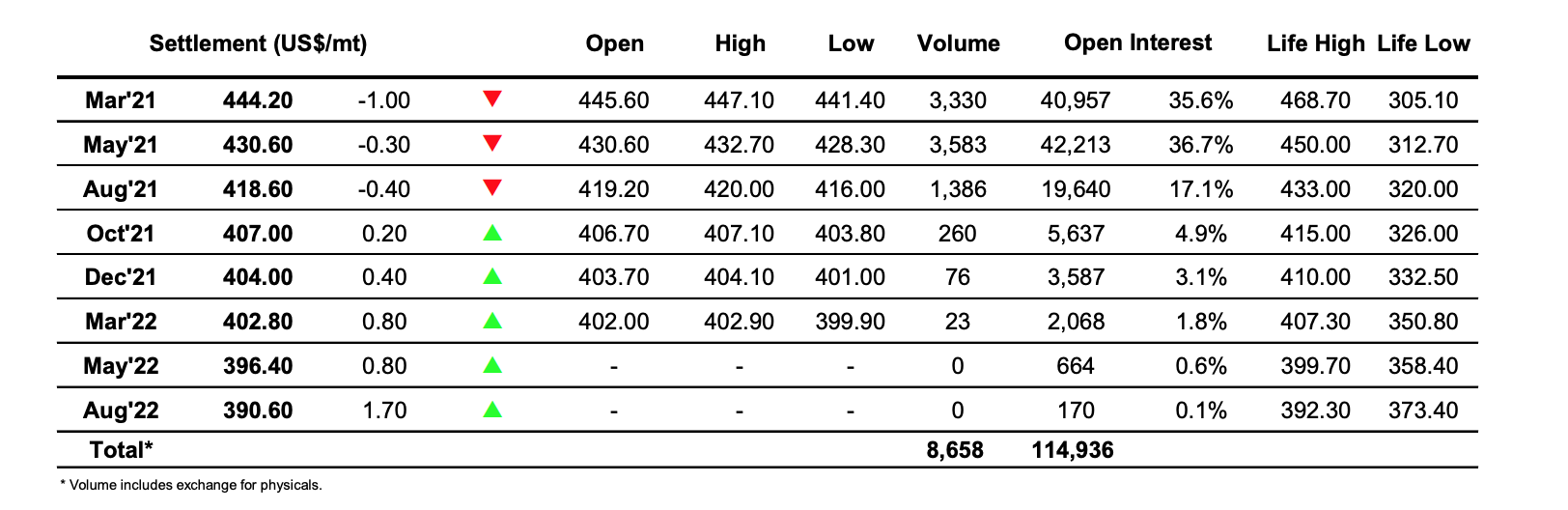

Sugar #11 Mar ’21

The ongoing decline from last week’s 16.75 high mark continued this morning as initial light gains were pared by selling which triggered a couple of small sell stops on route to a new low for the current move at 15.62. Scale buying then enabled values to stabilise before picking up over the latter part of the morning to trade back into the 15.80’s against some light spec activity with most other potential participants remaining rooted to the sidelines. A particularly dull afternoon then unfolded with values see-sawing around within the confines of the relatively narrow morning range without ever really threatening to break outside as day jobbers and algo’s generated the movement. Spread values did show some brief positivity as we played the higher end of this range with March/May’21 printing up slightly to 0.74 points an May/Jul’21 reaching 0.45 points however these were the only spreads seeing any volume of substance and given the recent losses the small gains may merely be against some short covering with the market now at the lower end of the 2021 range. Producer selling has been thin on the ground over the last week or so and with the BRL finding some strength for the first time in a few days and bringing the USDBRL back to 5.35, the likelihood of any noteworthy pricing from South America in the near term becomes even lower. We remained mid-range heading into the close and despite some late buying March’21 ended a dull session by settling unchanged at 15.74

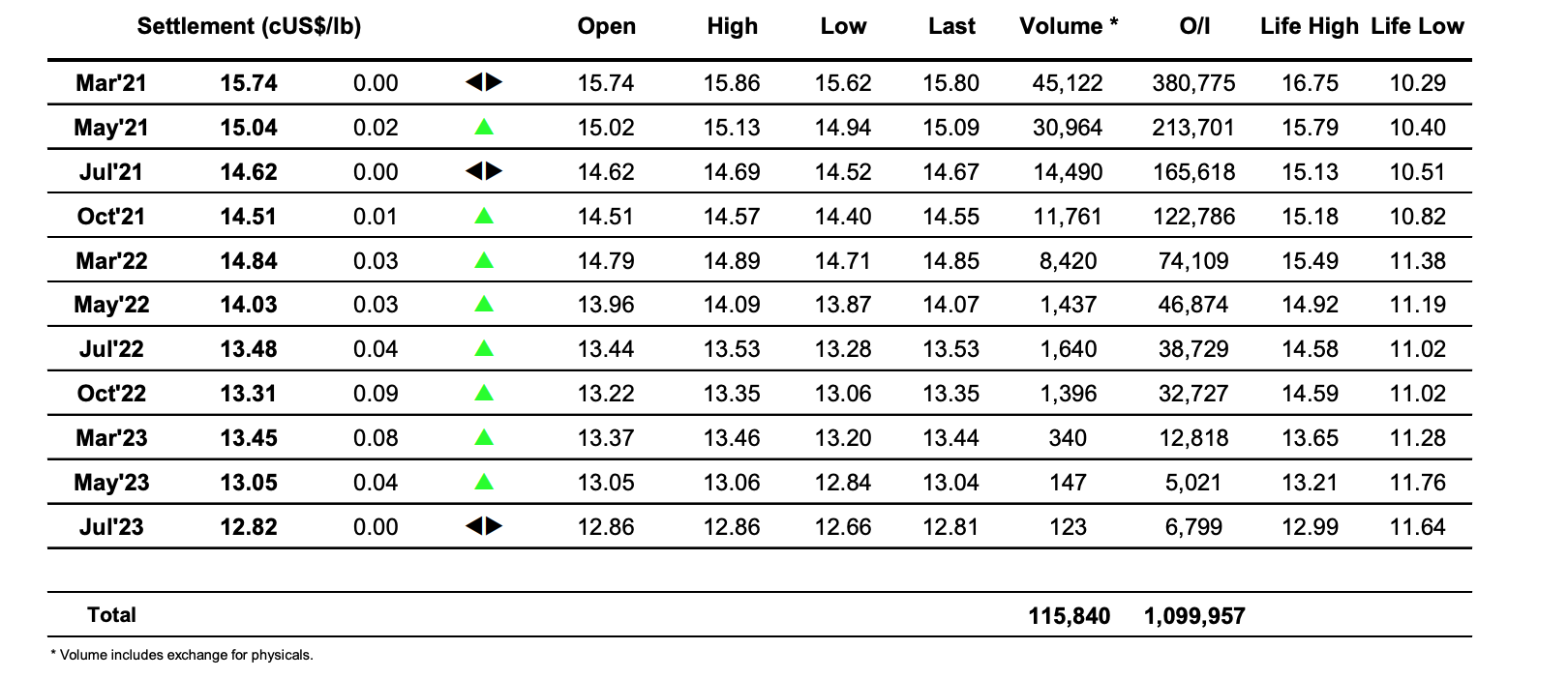

Sugar #5 Mar ’21

Initial selling sent prices immediately lower this morning with March’21 trading down to $442.60 before finding some light support. Quiet consolidation followed but did not last for too long before we found light buying which endeavoured to push values back higher once more, reaching a high mark of $447.20 by the end of the morning. The problem remains that there is no significant desire from the trade or consumers to join the push higher without fresh news currently and when the spec led moves end there is nothing behind it which leads to mid-session dips such as seen today as we traded back to a session low $441.40 soon after having recorded this high. In a thin trading environment the afternoon then saw further light spec activity whip values around the days range with another couple of small failed rallies, with more than 50% of the days volume being generated by the March/May’21 spread which continues to try and consolidate between $13 and $14 following recent losses. Activity remained quiet as we headed into the close with March’21 ending a dollar lower at $444.20 before pushing a little higher on the post close as some late book squaring occurred to finish things off.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract