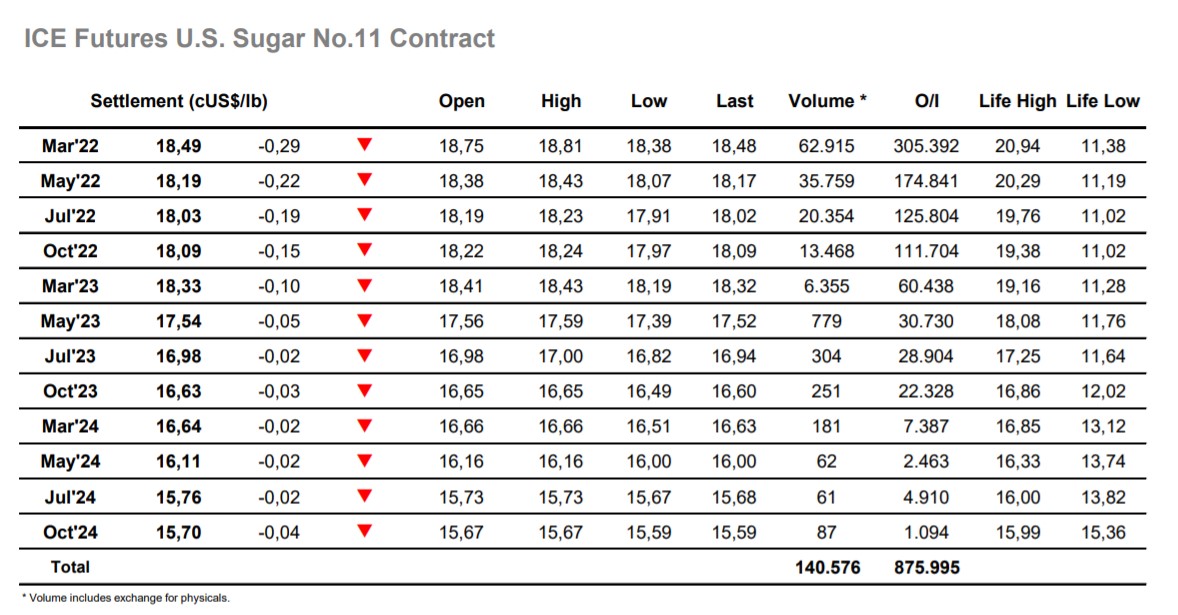

Sugar 11 Mar’22

Initial selling sent March’22 down into the 18.60’s however with no real spec activity showing and the macro picture showing marginally higher things soon calmed and values looked to consolidate within a few points of last night’s settlement values. The situation was unchanged until the Americas came online at which stage the market took an unexpected turn as it broke away from an improving macro environment to slide down to new session lows. The decline continued for more than two hours with some decent support filled in ahead of Monday’s 18.51 mark on route to registering daily lows at 18.38, a move which also saw spreads coming under pressure with March/May’22 trading back to 0.29 points, 0.13 points below yesterday’s monthly high. A short covering led move took the price back towards 18.50 where the price remained throughout the final couple of hours, with buying filtering in as some within the trade looked to accumulate longs believing that these levels represent a value opportunity toward the lower end of the range. The macro continued to throw up a conundrum with Brent crude working above $90 per barrel on continuing uncertainty over the Ukraine situation however for today at least there was no inclination for sugar to follow this lead with a calm close seeing settlement at 18.49.

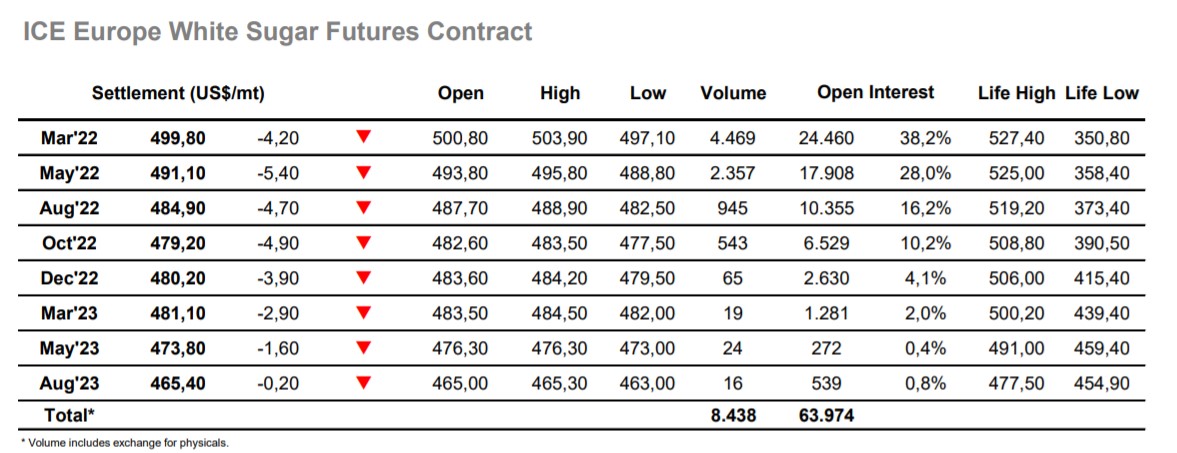

Sugar #5 Mar’22

Values dipped during early trading however with limited activity from both sides of the market the situation soon levelled out to spend the morning holding a narrow bad centred around $503.00. With no fresh news and uncertainty remaining over the geopolitical situation in the Ukraine we saw values further decline as we moved into the afternoon, March’22 softening steadily to a low at $497.10 despite contrarian movement for the March/May’22 spread which was trading a touch higher at $8. It was difficult to gauge the motivation for the decline with the macro generally positive but despite this factor we found it difficult to pull back away from the lows, a short-covering bounce back to $500 proving short lived as another look at the lows followed. Prices did not descend beyond existing parameters and the final stages saw another short covering bounce which enabled the latest in a series of quiet sessions to conclude at $499.80.