Sugar #11 Oct’21

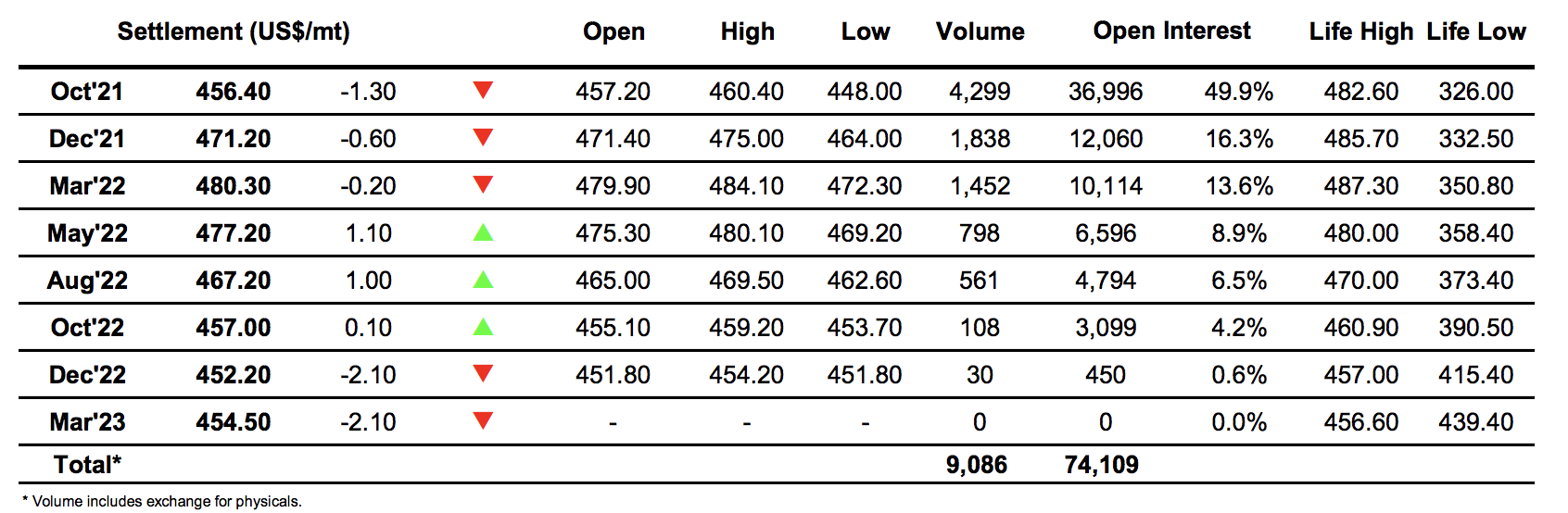

Pushing up to 18.29 on the opening the market appeared set to continue on from Friday’s strength however the gains were short-lived we soon saw Oct’21 fall back through unchanged levels to trigger some long liquidation. There was a lack of any significant scale buying initially and the decline gathered pace through 18c with a very brief pause seen before a second wave of selling sent the price to 17.77. There was a little more buying emerging as traders looked to take advantage of a 40 point lower market and this allowed things to stabilise for a while before gradually picking back up with a steady climb back to opening levels against some short covering combined with fresh buying interest amongst those keen to follow the momentum generated by Brazilian frosts and the still surging coffee market. The early afternoon saw a period of relative calm though it was only a matter of time until we saw a new wave of spec and algo buying start to take prices up once more as they looked to ride the wave of technical positivity and challenge the 18.49 contract high. Aggressive buying saw the range extend to almost reach this mark, but having faltered at 18.46 it was quickly followed by some long liquidation which sent prices back down into the range. The afternoon then saw prices continue to see-saw at the upper end of the range with the specs working through the final hour to leave prices poised near to the highs as the closed approached. A marginal new daily high of 18.47 was recorded ahead of the call and we seemed set to end quietly as MOC selling ensured a settlement level at 18.42. There was more to come on the post close however and a late spec sent prices into new contract high ground, triggering buy stops above 18.50 to record a new mark of 18.64 (some 22 points above settlement) going out.

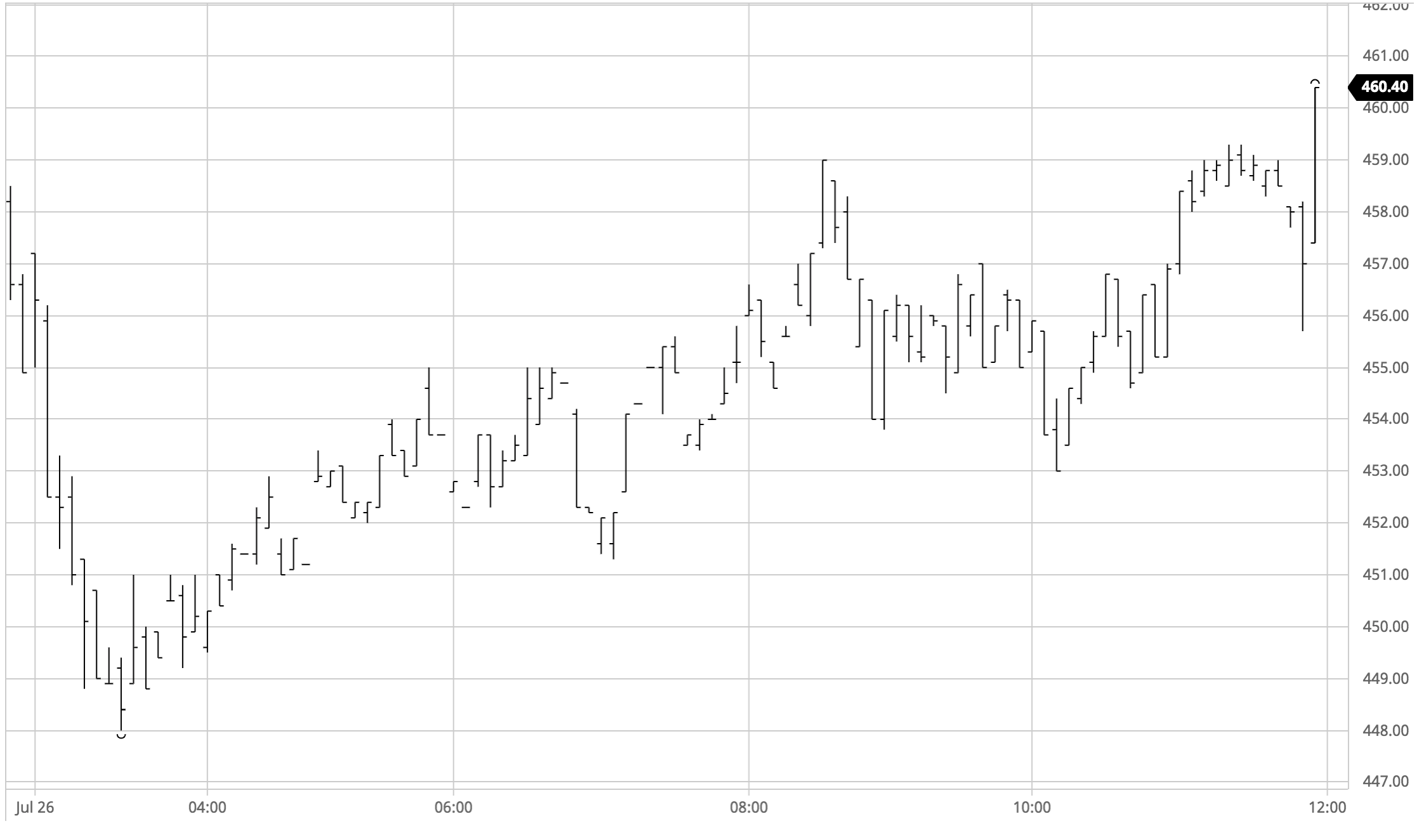

Sugar #5 Oct’21

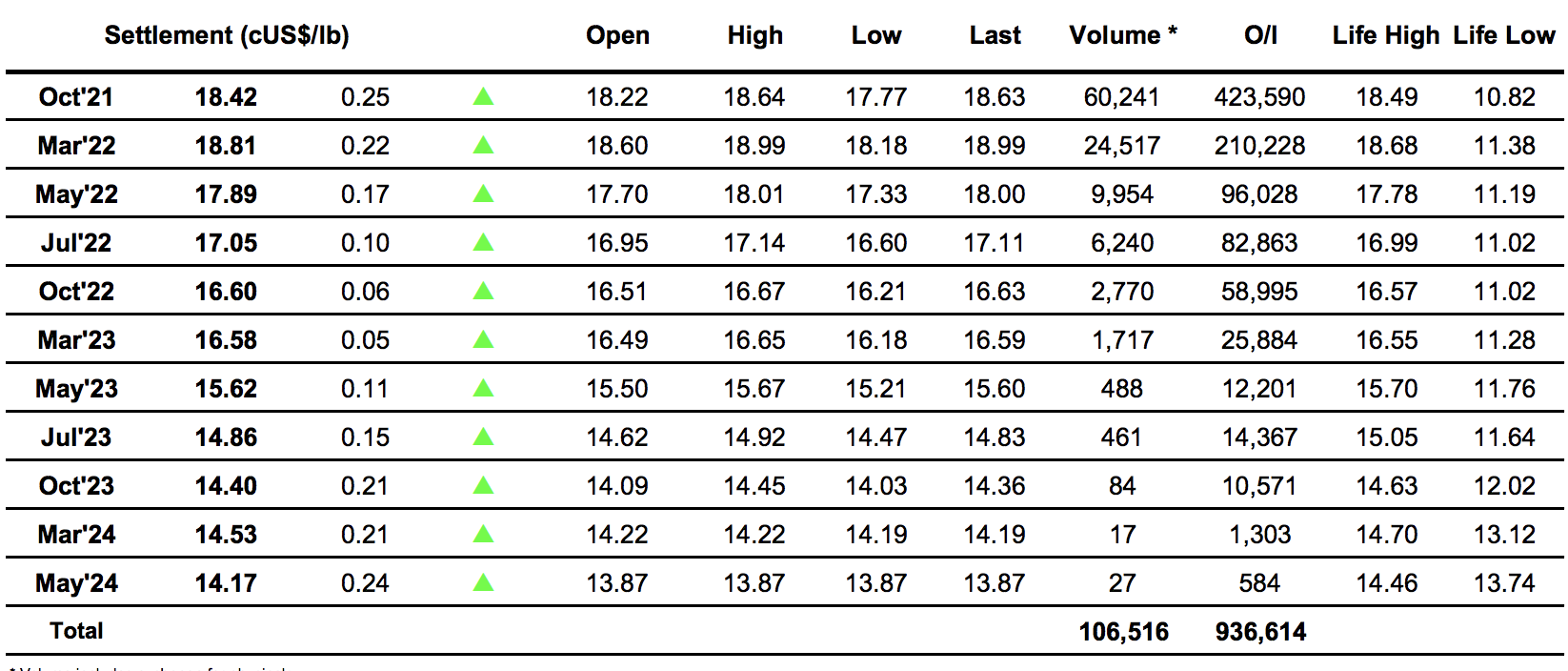

There was immediate pressure upon the market this morning having opened against a backdrop of declining No.11 values and with very limited buying in place the early momentum sent Oct’21 all the way back to $448.00 before a little buying began to creep back in to stabilise things. Such was the aggressive nature of the initial selling that the nearby white premiums continued their recent haemorrhaging with the flat price fall leading Oct/Oct’21 beneath $52 almost before there was opportunity to blink. In keeping with the recent pattern the $440’s bought more buying to the fore which provided the basis from which to begin climbing back upward and by the end of the morning the price was reaching back into the mid $450’s, a relative recovery with the white premium value still struggling and placing us well behind the No.11 once again. It was not just the premium struggling with spread pressure seeing Oct/Dec’21 traded to a new low at -$16.40 while Dec’21/Mar’22 also lost ground, extending down to t-$10.30. Moving through into the afternoon the flat price continued its recovery and reached $459.00 however it was purely based upon the drag factor of increasing raws values and in relative terms we lost more ground with the Oct/Oct’21 touching in at a new low of $50.00. The final hour saw prices pulled higher once again and having settled at $456.40 new highs were recorded on the post close with Oct’21 trading to $460.40 last.

· Another day of toil for the white premiums ended with values near to daily lows, with settlement for Oct/Oct’21 at $50.30, March/March’22 at $65.60 and May/May’22 at $82.80.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract