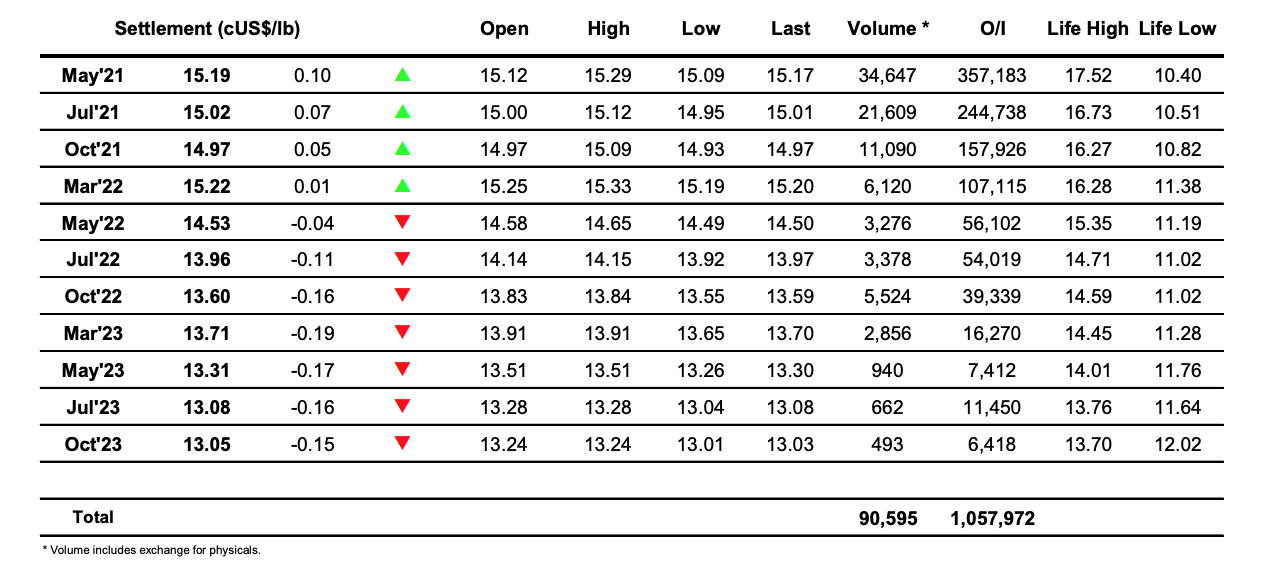

Sugar #11 May’21

The day began with a positive move, the lower levels having brought out some hedge lifting against physicals which combined with a firmer macro environment to send May’21 up to 15.29. With the initial wave of buying having concluded we eased back into the range for a while and in the calm environment volumes fell to minimal levels ahead of the US morning. AN upturn in spec activity from the Americas hauled values back to the morning highs as they looked to try and piggyback the firmer energy sector, though with crude merely recouping yesterday’s losses and the broader sentiment continuing to be negative this had limited potential and we again topped out at 15.29. Inevitably the failure to move upward led to some long liquidation That saw May’21 down to the 15.10 are during the latter part of the day, action which also brought the May/Jul’21 spread back in to 0.13 points from a morning high at 0.20 points. A mixed close saw May’21 somewhat appropriately settle precisely in the centre of the days range at 15.19, bringing a rather non-descript session to a conclusion though providing a negative leaning to the weekly charts.

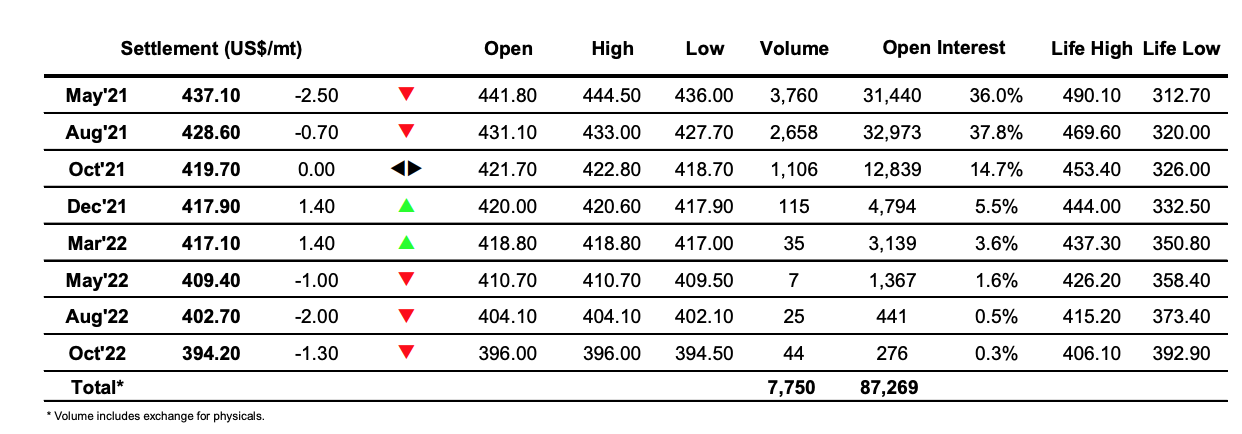

Sugar #5 May’21

Despite having closed negatively last night the market was called higher against a macro recovery and duly followed this lead in rallying all the way up to $444.50 during the first 40 minutes of the session. Theis early strength saw the whites once again leading the charge away from No.11 to widen the May’21 white premium back to $107.50, although such gains proved to be short-lived and we returned toward overnight values with the flat price easing back towards the $440 area. Calmer trading then ensued as the market entered more of a sideways pattern either side of $440, though increasingly the path became downward particularly given the pressure being applied to the May/Aug’21 spread which was attracting selling into $8.50. The pressure only increased during the final couple of hours with a nudge down to $436.00 and although some short covering followed we continued at the lower end through until the close with May’21 settling at $437.10 and Aug’21 at $428.60, a quiet end to the day though with the negative market bias maintained.

In the face of the falling market the white premiums end back at the lower end of recent ranges, ending the week at $102.25 for May/May’21, $97.50 for Aug/Jul’21 and $89.75 in Oct/Oct’21.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract