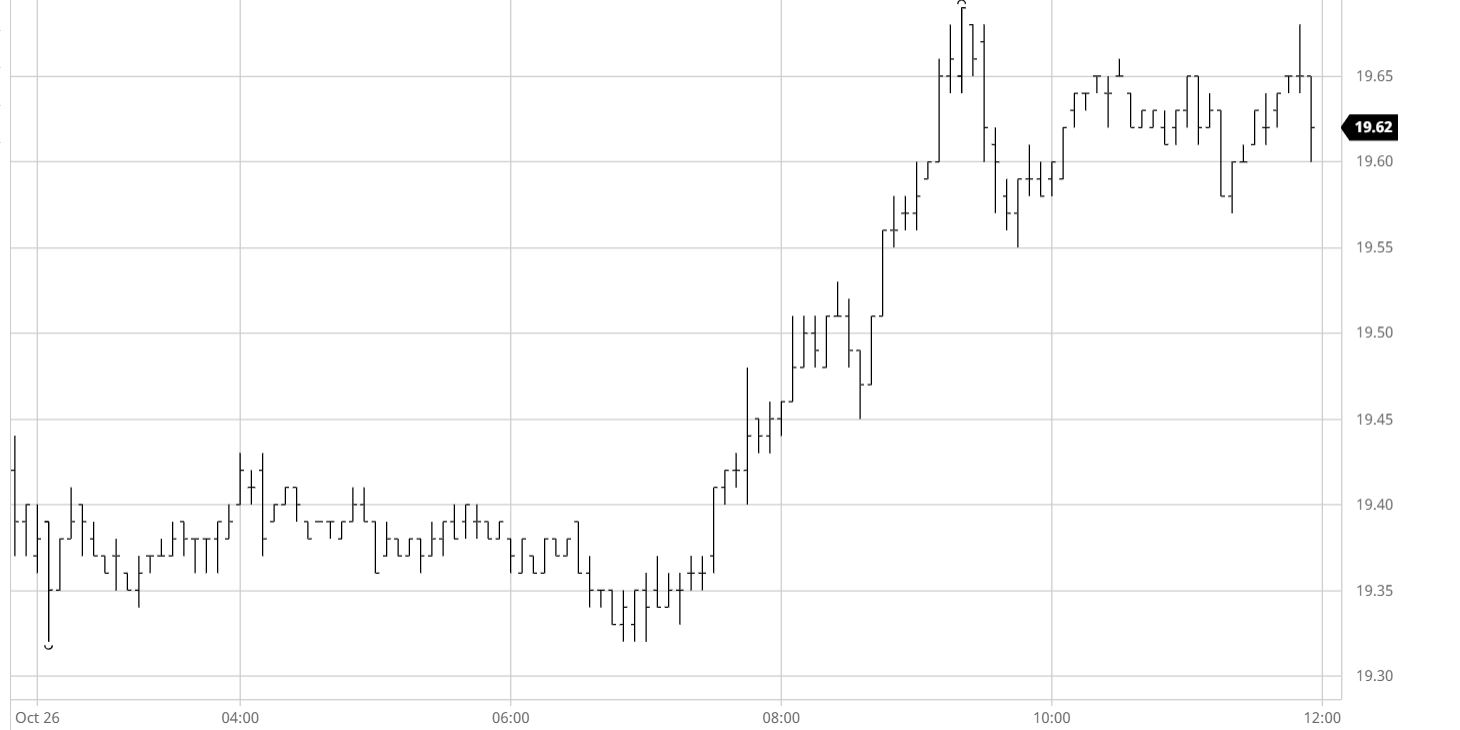

Sugar #11 Mar ’22

The morning started slow, with very little liquidity before 9am BRT and the market around the 19.40 level. By 9.30am, though, we saw a continuation of yesterday’s rebound and the fundamental traders have picked up on the buy side, which, coupled with the absence of selling pressure, took the market all the way to the 19.70s, settling at 19.62. HK remained in the +-.40 level and K/N was pushed up by 4 pts which turns our attention to the recent rains in CS Brazil and the 22/23 crop start. Finally, today we saw India saying they’ll refrain from subsidized exports given the already high world prices, which should provide some resistance in the near term.In Brazil, inflation data which came way above the estimates prompted a sling in the interest rate futures market, which now prices, against all previous expectations, a 40% probability of a 1.5% rate hike in the next COPOM meeting tomorrow. If the expected hike doesn’t happen, we might see the currency strongly depreciate in response which could bring some good pricing opportunities for the Brazilian producers and building some selling pressure on the longer tenors. On the whites side, premiums have continued to weaken on slow demand and the activity has been mostly from longer term commercials seizing the current backwardation.

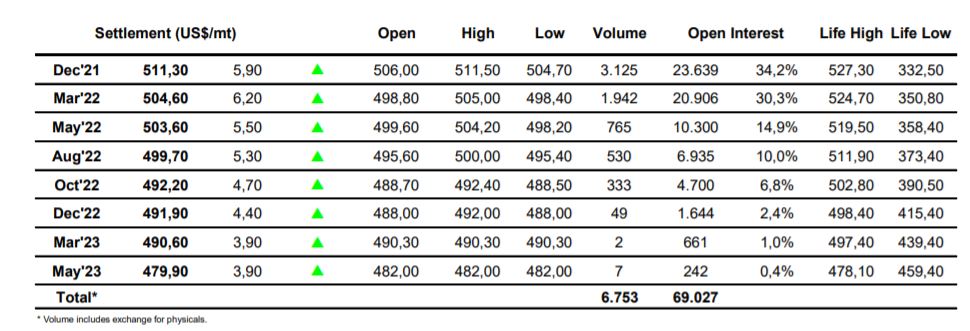

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract