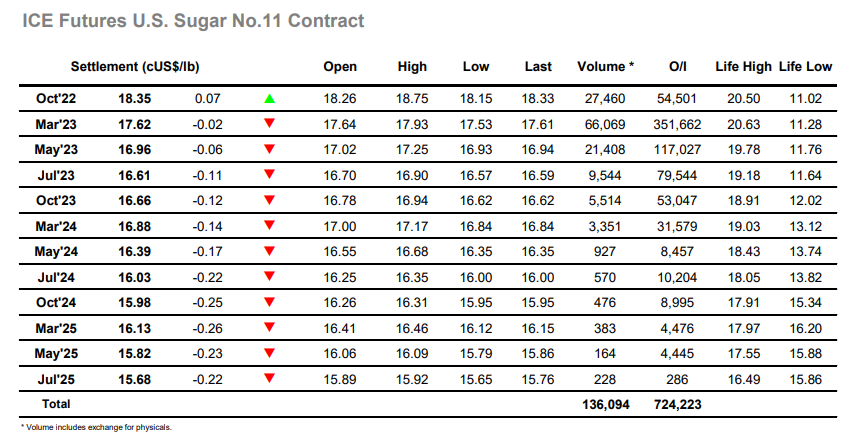

Then week got underway with marginally lower prices showing down the board, however it was not long before the soon to expire Oct’22 found buying to conti8nue its recent strong showing, working upward and further increasing the Oct’22 spread premiums. Selling was limited which enabled the rally to take place on low volumes, March’22 reaching back to 17.86 within the first 90 minutes of trading while Oct’22 surged even further ahead despite a backdrop of generally lower macro values. By late morning Oct’22 had surged even further ahead, taking Oct’22/March’23 to 0.80 points, though the lack of end user interest in following the market higher led prices to have a correction ahead of the Americas day getting underway. This dip was soon gathered back up with the spread reaching a new contract high at 0.88 points, however it continued to feel as the Oct’22 was doing all the heavy lifting with March’23 stalling well short of 18.00 and remaining confined by recent parameters. The USD was strong once again which sent the USDBRL to 5.40 as the afternoon progressed, though this didn’t draw any notable pricing interest to the market, particularly with the flat price now retreating on the same USD influence. The retreat lasted all the way through into the close, leaving prices to end the day little changed, Oct’22 +7 at 18.35 / March’23 -2 at 17.62, leaving the spread still firm at 0.73 points but the market generally still subdued.

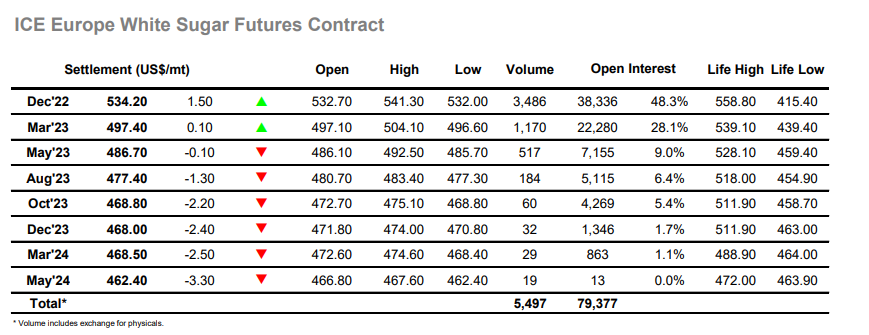

Initial trades near to unchanged were soon forgotten as Dec’22 started to trend higher once again, gathering pace through the morning with the continued spec long holding sending the price to $541.00. There was a ripple effect down the board with 2023 positions pulling upward but to a lesser degree, emphasised by Dec’22/March’23 highs at $38.40, a $3 gain on Fridays closing value. Though some consumer involvement was noted it continues to be specs who are dominating the whites at the present time, the lack of resting orders within the range allowing a sharp correction to mid-range before some fresh buying emerged to pick things back up again and return to session highs. Producer interest has been limited for some time, but some selling interest did emerge during the afternoon to limit any additional gains, eventually leading to some more day trader liquidation and a small retracement. This retreat gathered pace during the final hour to leave Dec’22 closing only mildly firmer at $534.20, USD strength hitting commodity markets across the board during the later afternoon, a factor likely to continue limiting upside potential for the time being.