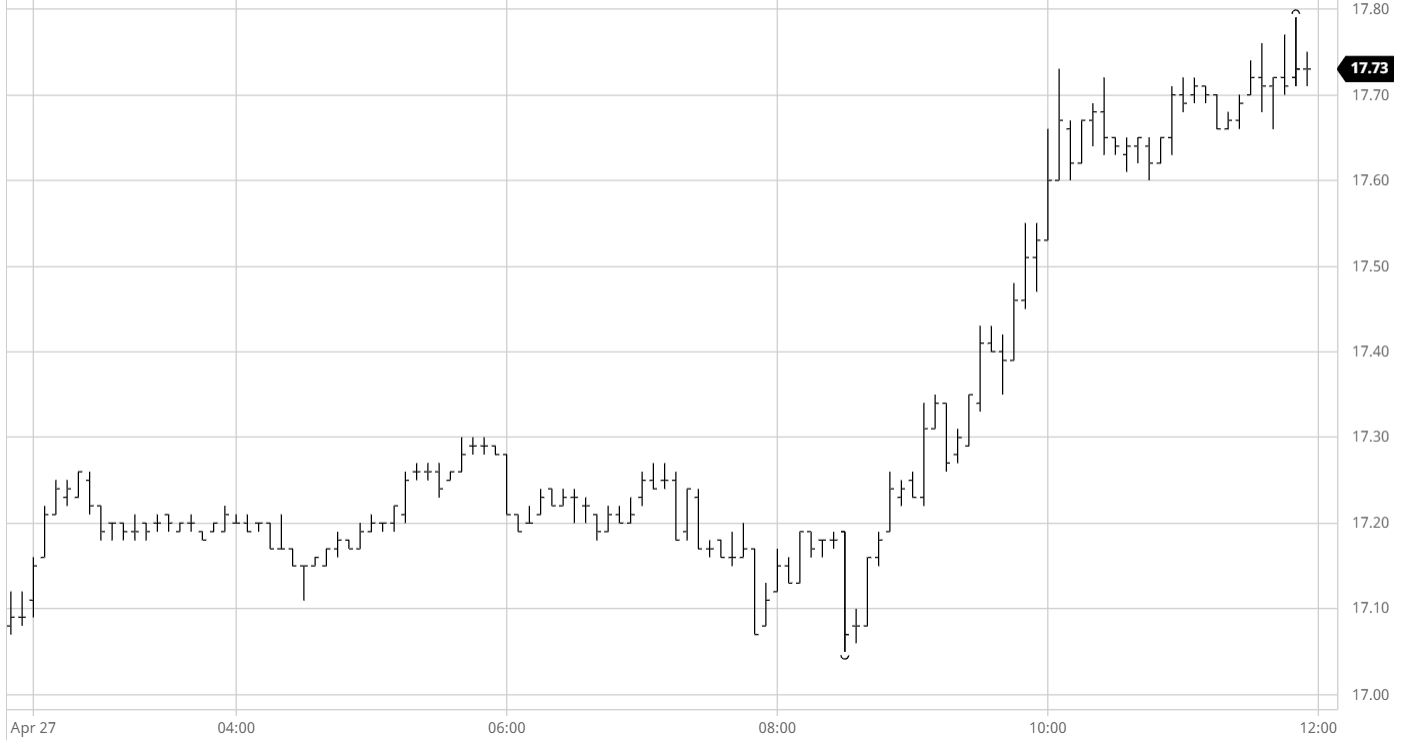

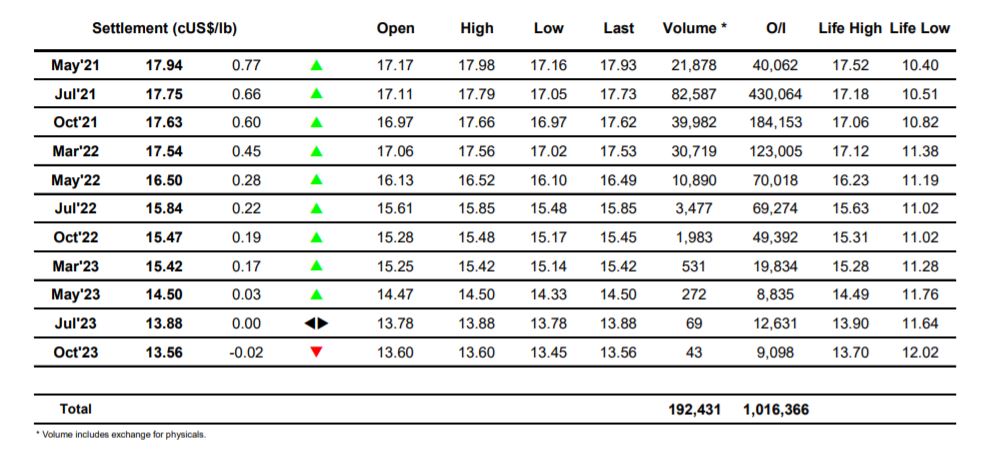

Sugar #11 Jul’21

Buying from the opening bell (mouse click) placed the market immediately into positive ground this morning, sending Jul’21 up to 17.26 in quick time before pausing as the lack of sizable spec activity left us to consolidate. Given this represents the latest in a seemingly endless series of new contract highs the hours that followed were slower than may have been expected as despite the lack of spec volumes during the morning there also remains a dearth of overhead producer selling which may have tempted some to try and push further ahead. Aside from a nudge to 17.28 late in the morning we had been confined to the range for some six hours when more meaningful finally appeared to take things ahead. The increase in volume coincided with the announcement of the latest set of UNICA figures which showed a sugar production of 0.624m tons, representing a reduction of 35.8% compared against the same period last year, though whether this was the sold reason for the aggressive push is open to debate given the prevailing technical picture and also the recent pattern of strong pushes primarily gathering pace midway through the afternoon. Either way the market had strong momentum and Jul’21 was led up to 17.73 over the course of the next hour while the soon to expire May’21 contract fared better still as May/Jul’21 spread buying out to 0.20 points saw it push to 17.92. The relentless pace was quite understandably not maintained and a period was spent holding just beneath the highs with the longs content to sit and wait for the next move given the healthy complexion showing. We extended to new highs during the final hour as specs and trade bulls looked to take things out positively, Jul’21 settling just 4 points shy of its high at 17.75. With Friday being the May’21 expiry we are showing remarkable similarity to the bullish surge that preceded the March’21 expiry a couple of months ago, we wait with anticipation to see whether on this occasion the stories of lower Brazilian crops will mean a differing outcome when Jul’21 assumes its position at the front of the board.

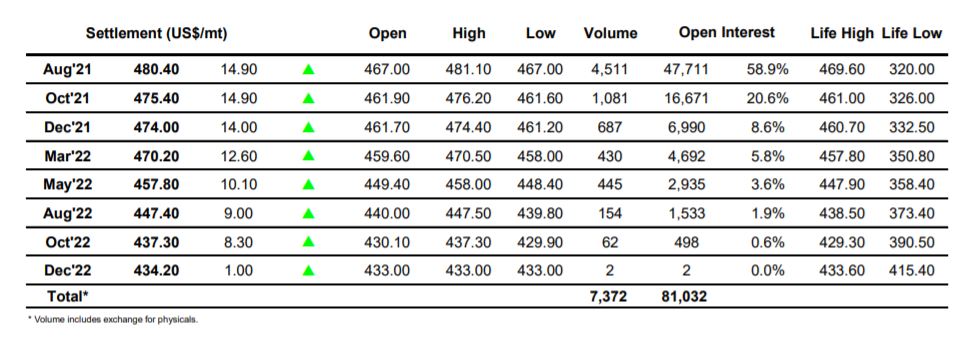

Sugar #5 Aug’21

No.11 strength encouraged immediate buying to the market and gapping higher on the opening we saw an instant push upward to the former Aug’21 contract high mark at $469.60. A pause followed but it was just that as following many days of muted disappointment the market pushed on through to reach $471.50 by the end of the morning. Strength was not just confined to the outright with the white premiums breaking their recent lower cycle as Aug/Jul’21 worked back up into the low $90’s although nearby spreads were still finding it tough to break clear with the movement relatively uniform across the front three prompts. The early afternoon failed to yield much interest with the specs seemingly holding back despite the immense positivity of the technical picture and as so often has been the case we did not see them showing their hand until the final three hours of the day. When they did it was with a flourish the Aug’21 pushed on from its consolidation point in the upper $460’s to extend by some $10 all the way to $478.70, though still the spreads remained disinterested while white premiums gave back some of their gains due to the more vigorous specs activity being seen for the No.11. The move continued through the later part of the day at an understandably slower pace of increase, and by the close we had pushed all the way to $481.10 with settlement only just beneath at $480.40. Another incredibly strong performance which leaves the technical picture looking positive though with short term indicators increasingly overbought we watch with interest to see just how much further we can continue.

·White premium values ended the day little changed to slightly higher having seen some swings to both directions along the way – Aug/Jul’21 closing at $89.00, Oct/Oct’21 ending at $86.75 and Mar/Mar’22 at $83.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract