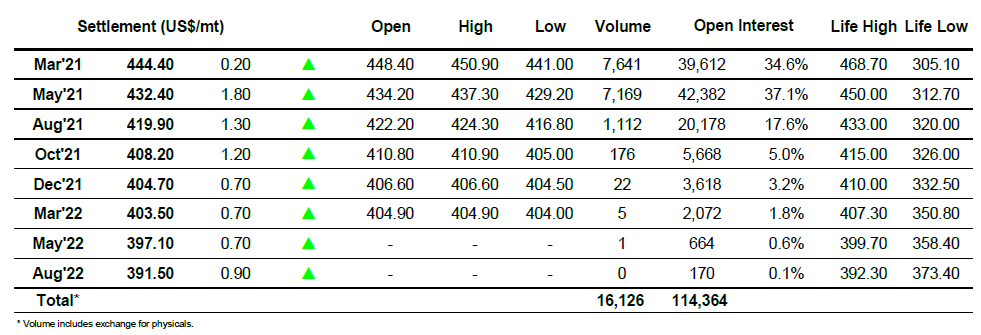

Sugar #11 Mar ’21

Strong early buying sent March’21 immediately upwards to 15.97 and though the pace of increase soon slowed there remained a desire from the specs to push the long side which led us through 16c where we consolidated for the rest of the morning. In a limited selling environment despite the BRL opening a little weaker, we saw a sharp push to a session high 16.19 very early in the afternoon however it proved to be a mere spike and values settled down to sit in front of 16c again as soon as it was concluded. The continuing challenge for the market remains the lack of buying in place once the specs stand back, a situation which explains the afternoon decline all the way back down to 15.66 before finding support from consumers placed ahead of yesterdays 15.62 low mark. Spreads meanwhile fared relatively well following recent struggles and despite the failure of the flat price to maintain the earlier gains March/May’21 was holding slightly firmer at 0.72 points while May/July’21 was at 0.45 points later in the afternoon. The malaise at the lower end of the range was only broken by some late buying (either short covering or defensive window dressing) which pushed March’21 back to 15.84, and while this ensured a positive settlement price of 15.80 the failure to hold above 16c again may encourage a fresh test of the recent lows for the near term.

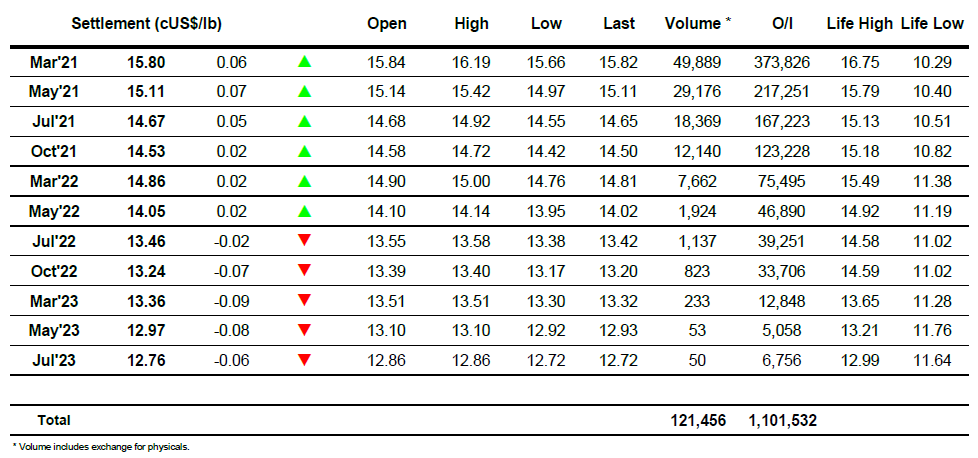

Sugar #5 Mar ’21

With the No.11 already trading higher we followed suit by gapping upwards and spending the morning holding comfortably between $448 and $450. Though we were maintaining gains there was only light volume being seen for the outright’s with an exceptionally large proportion of the activity being from the March/May’21 spread as rolling accelerates ahead of next month’s expiry. The driving force of this rolling was the fund sector with their selling impacting the differential quite considerably with a narrowest trade recorded at $9.20 before prices picked back up again later on in the afternoon to consolidate near to $12. With the spread under pressure it was not surprising that flat price values slipped back downwards, working through something of a vacuum to be back at $443 midway through the afternoon. A little more consumer pricing emerged at the lower levels, some of which was filled in as prices edged to a session low $441.00 before stabilising during the final two hours. The close saw some defensive buying which pushed March’21 to $445 though settlement was a mere 0.20c higher at $444.40.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract