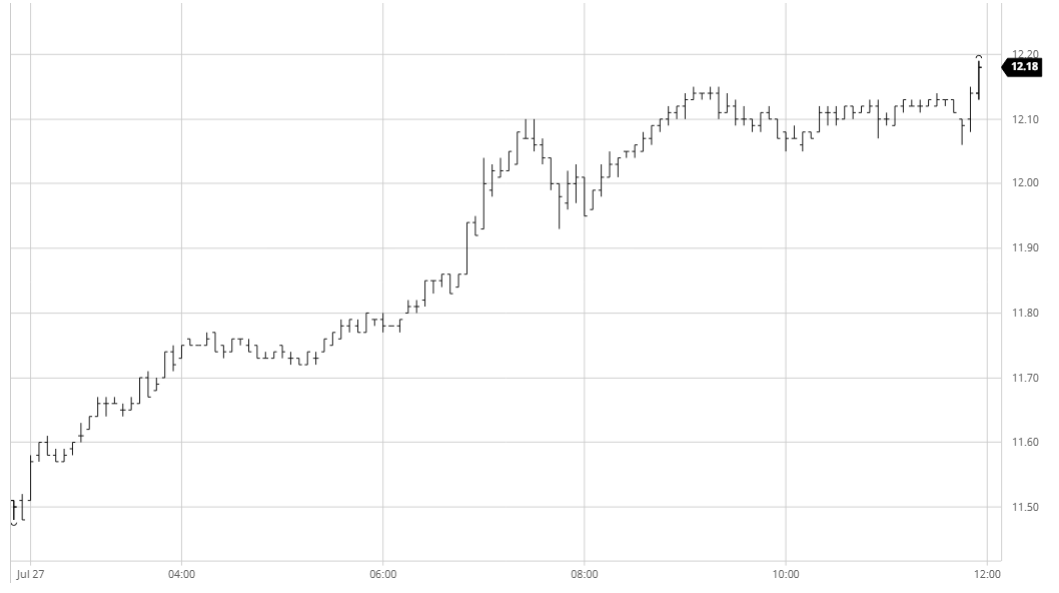

There was buying seen for the opening this morning which quickly pushed Oct’20 up above 11.60, marking a positive start in sharp contrast to the decline seen on Friday afternoon. The continuing stability of the fund position (last week’s COT showed a small increase back to 81,322 lots) shows that there is no significant desire from the specs to liquidate at present and the market climbed further over the morning to the 11.75 area. A good deal of the early buying was emerging into the spreads, taking Oct/March to -0.63 points as the morning progressed. Brokers were talking up the possibility of increased Chinese imports and a potential reduction in the size of the next Thai crop and this added to the upward momentum which accelerated as the US based specs came online, sending Oct’20 through the 2 week high at 11.97 to trigger a few buy stops. It was not just the outrights that were flying as the spreads also marked further gains, Oct/March reached -0.57 points while the lack of buying down the board saw the Oct’20/Oct’21 spread widen by a mighty 37 ticks to reach -0.08 points. Maintaining such strong early gains is always a challenge however following a brief decline back beneath 12c the market reasserted itself and traded up to 12.15 although progress was now starting to become tougher as producer selling began to emerge. This meant that the final three hours were all played out in a tight range between 12.05/12.15 (although post close activity pushed to a new high 12.19) with specs content to hold the market in front of the overhead selling. Oct’20 settlement was a very strong 12.12, still within the broad 11.30/12.30 band that has prevailed for many weeks however technically well poised to mount a fresh challenge of the overhead 12.25/12.40 resistance area basis the first month continuation and Oct’20 charts.

SB Oct – Sugar No.11

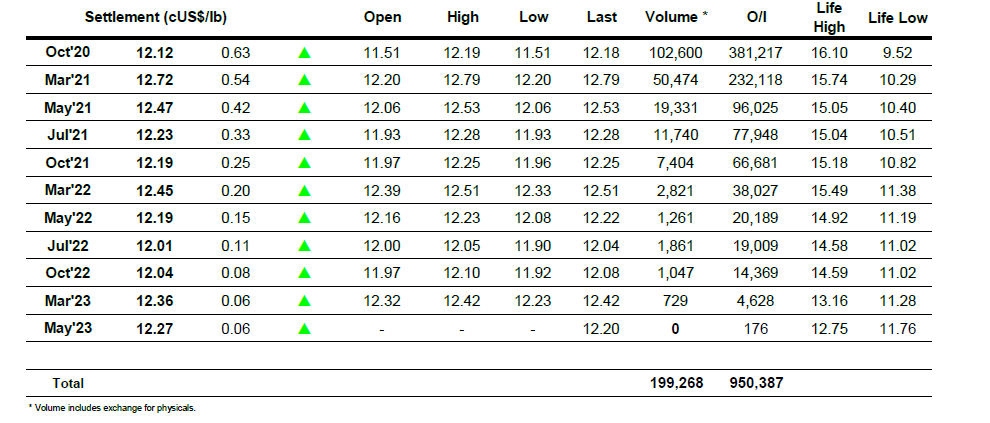

ICE Futures U.S. Sugar No.11 Contract

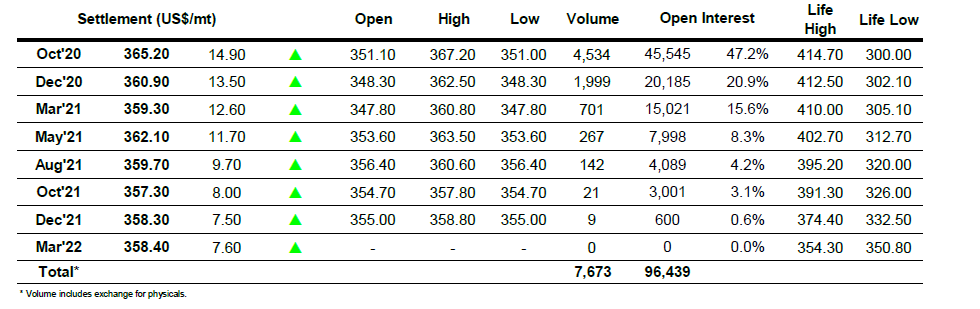

ICE Europe White Sugar Futures Contract