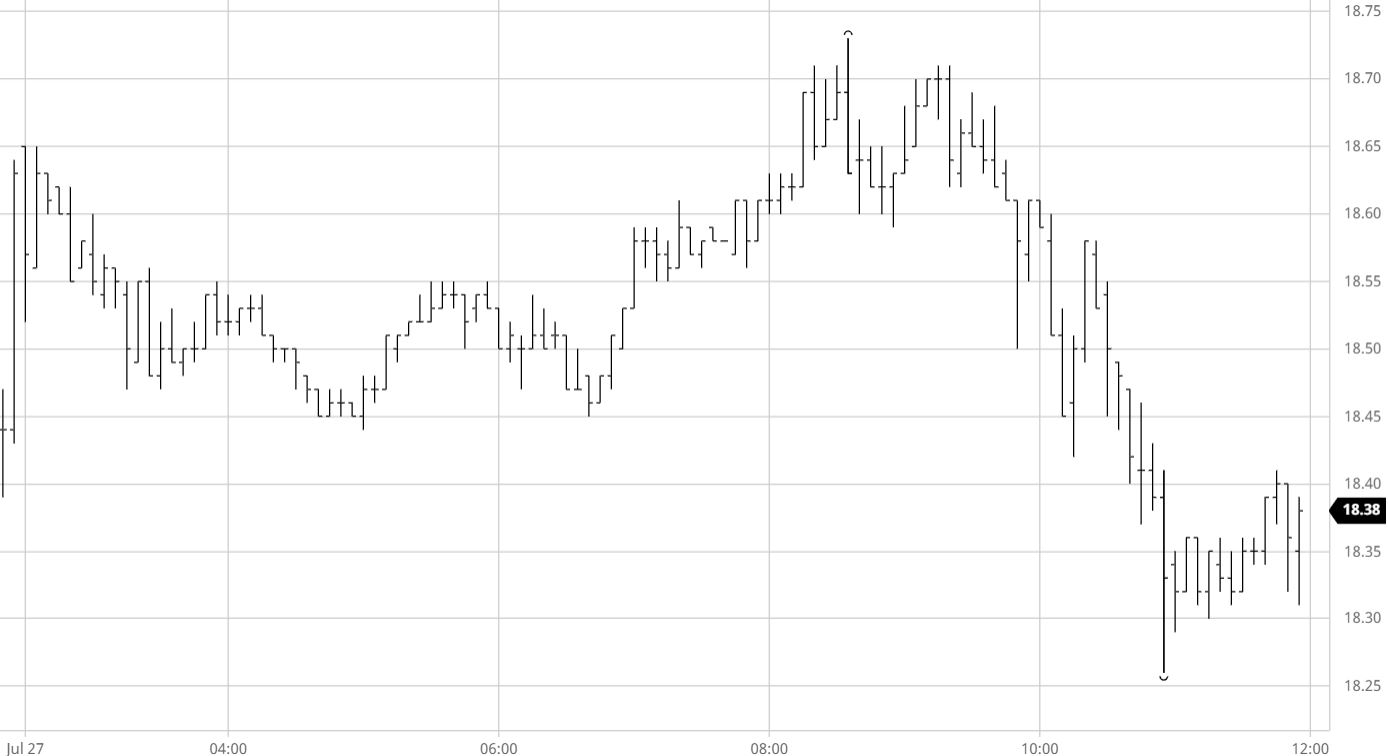

Sugar #11 Oct’21

There was opening buying which printed Oct’21 immediately to a new contract high of 18.65 though no buy stops were triggered and the price soon dropped back to consolidate in the 18.50 area. The morning was then relatively calm with an extended period spent nudging sideways though with a low of 18.45 it was apparent that the market was being set for the next look higher to try and explore beyond 18.65 with the yearly 1st month continuation high at 18.94 providing the next target. The arrival of US based specs encouraged in some gentle buying to nudge values back towards the morning high and provided the platform to push beyond soon afterwards with an upside extension only reaching to 18.73 with buy stops absent and the volume flowing in being lower than may have been anticipated. There was a small pullback prior to the announcement of the latest UNICA figures which showed for 1st half July a crush of 45.65m tonnes, with 2.940m tonnes of sugar produced and a sugar split at 47.10%, numbers which were a little below the same period in 2020 but largely in line with expectations. A little more buying emerged following this news but the price stalled short of 18.73, signalling a few of the specs to lighten the load a little and reduce some recent longs with the market now more than 150 points above last Tuesday’s lows. Having paused at unchanged the decline saw a second round of liquidation which sent the price down as far as 18.26 with consolidation then taking over as the selling eased. Heading in towards the close we were holding just 10 points above the lows and MOC selling then emerged to leave prices settling in the red at 18.35, by no means a negative conclusion but one that shows that without the momentum of coffee that has been tracked recently the market might again cap out in front of 19c.

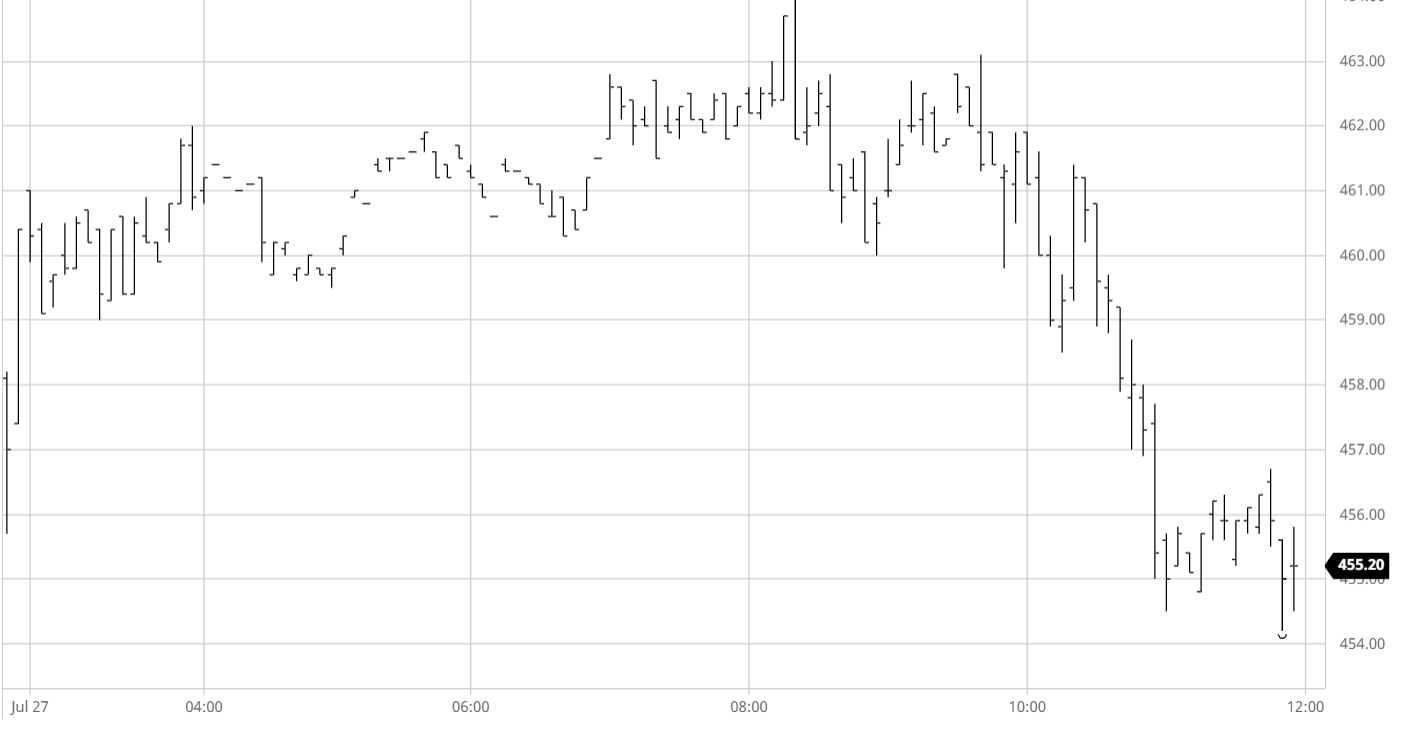

Sugar #5 Oct’21

Oct’21 commenced positively in a continuation of last night’s post close activity and although the price eased slightly to $459.00 soon afterwards we remained firmly in positive ground. With the early flourish of activity concluded we settled into a sideways pattern throughout the rest of the morning on very low volume, a familiar situation though at least on this occasion giving a platform from which the market could continue to try and recover. With Us based specs having provided the bulk of recent momentum an afternoon push to continue the recent No.11 strength was anticipated and when it arrived we duly followed upward to a session high $464.00, and in the process saw some sign of recovery for the Oct/Oct’21 white premium to $53, a modest effort but one which shows that there are finally signs of some trade support emerging. Having attempted to consolidate the lower $460’s the final couple of hours proved rather disappointing and once more underlined the frailties of the whites at the current time. Against a very thin environment Oct’21 slipped back beneath $455 while the white premium gave up its hard won gains to be back in the vicinity of $50. Prices remained near to session lows heading out with Oct’21 settling at $454.70 and while this is in no way critical the whites continue to send out negative signals with the feeling remaining that should the macro and No.11 pull back it would take very little to place the lower $440’s support area back into the spotlight.

White premiums lost their early gains and ended the day back around recent lows with Oct/Oct’21 at $50.20, March/March’22 at $66.00 and May/May’22 at $83.80.

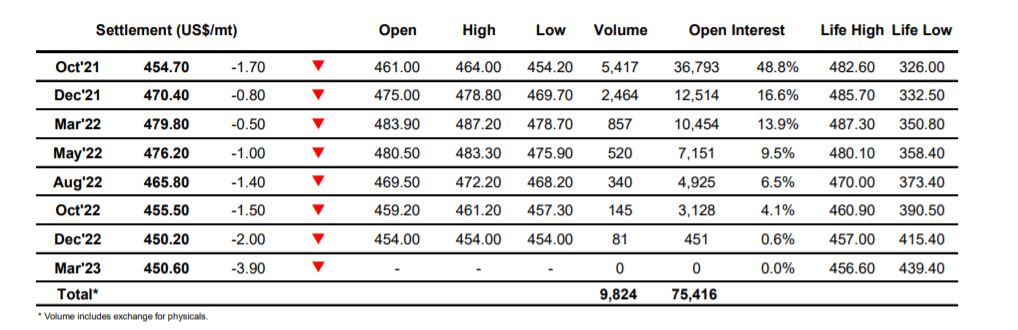

ICE Futures U.S. Sugar No.11 Contract

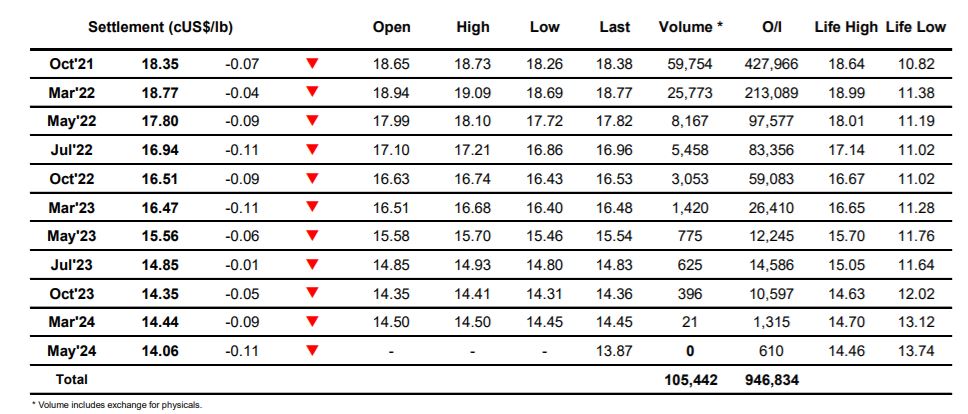

ICE Europe Whites Sugar Futures Contract