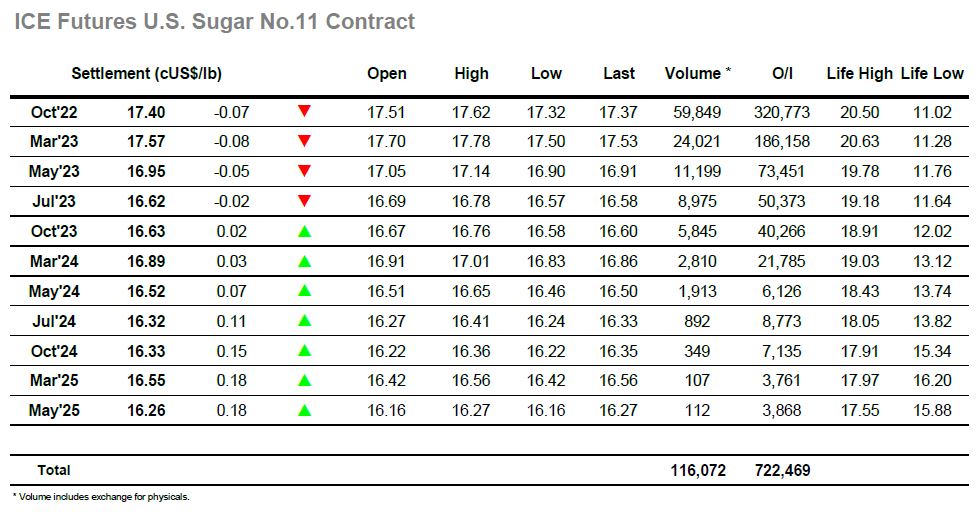

The market attracted some offtake related buying again this morning however progress was far calmer than seen 24 hours ago with a quietly positive morning topping out at 17.62. This did at least provide a base from which the market could potentially try and build, however the specs have other ideas at present with the start of the US-day signalling a change of fortunes as we were sold down to new session lows. It was only in the upper 17.30’s that the market found better support from increased consumer pricing ahead of yesterdays 17.35 mark, however this too broke with new yearly lows registered at 17.32 as the latest UNICA numbers were released. These showed that for the first half of July there was cane production of 46.35mmt / Sugar production at 2.976mmt / Mix at 47.07% / ATR 143.19 kg/t. Clearly the headline of increased production encouraged the initial kick to new lows however there was no follow-on interest and given the crop remains behind last year as is well known the general feeling was clearly more neutral with prices continuing sideways for the next hour. A spike higher followed against some spec short covering but once that petered out prices returned down to spend the final stages at the lower end of the range and settle at 17.40. Following so many negative days the market is at least showing signs of stabilising with questions being raised as to how short the specs may be prepared to go. This gives rise to the possibility of some corrective action though there has been little hint that the funds are interested in following macro gains and so such moves may have limited upside unless trade/consumer entities find reason to push.

There was buying around for the opening again today with the lower levels continuing to bring out some physical activity and this pushed Oct’22 up to the lower teens before prices faded with the cover taken. Despite a second consecutive day or broadly positive macro movement there seemed little interest in joining the herd with prices sitting broadly sideways, a rally to a high at $515.30 again failing to generate any momentum despite helping the nearby Oct/Oct’22 premium widen out to $128.50. Generally, the afternoon provides some greater interest / volume however today was no such day as activity remained minimal across the board, with any price swings remaining comfortably inside the morning parameters. With the market continuing to struggle to pull clear of the lows the closing stages played out to the bottom of the range with Oct’22 settling at $510.20. This represented a second consecutive inside day and will provide encouragement to buyers that the market can begin to build a bottom from which to try and recover, though at the present time it remains difficult to see who other than the specs may push the market significantly higher.