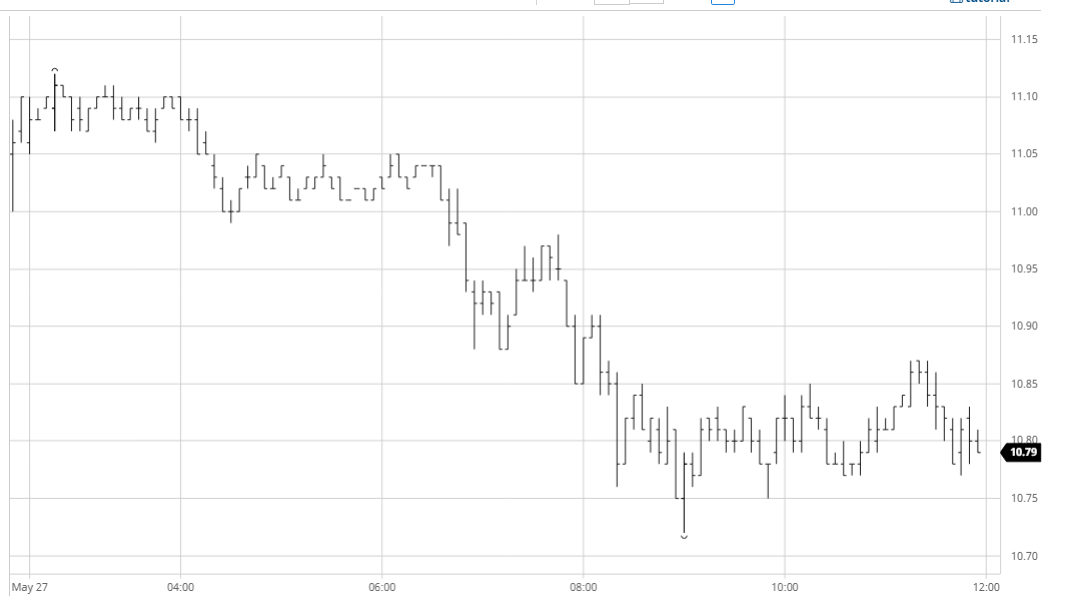

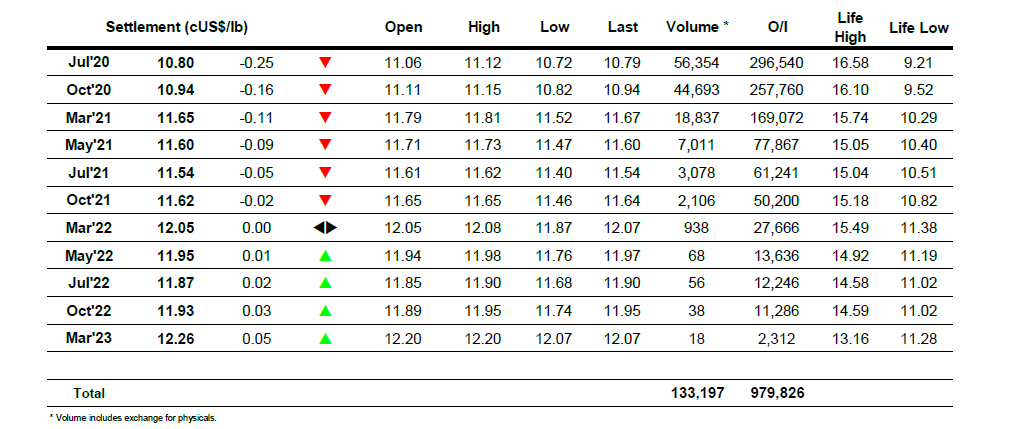

The day commenced slowly with prices trading marginally higher, a combination of the relatively flat macro and no significant fresh news suggesting that a quiet day would follow. Spot values remained above 11c through into the early afternoon, however with the macro now beginning to slide and lacking any other direction we started to drift a little lower once more, slipping to a low of 10.72 over the next couple of hours. USDBRL was a little firmer at 5.30 while the recent driver crude was now trading lower, however in reality there was only light spec volume and while these factors may have contributed to the decline it felt as though the general apathy of buyers was more significant. Indeed the bulk of volume was being seen in the spreads where Jul/Oct’20 was under particular pressure with the recent move to a premium seemingly a distant memory with traders encouraged to sell again while the Brazilian ports continue to operate smoothly, the sentiment of which was adding to the pressure on the spot month. Values continued at the lower end of the range throughout the remainder of the session and although Jul’20 showed signs of trying to lift as we moved into the final hour the buying soon faltered in the face continuing spread selling, Jul/Oct weakening further to end the day at -0.14.

No.11 Futures

ICE Futures U.S. Sugar No.11 Contract

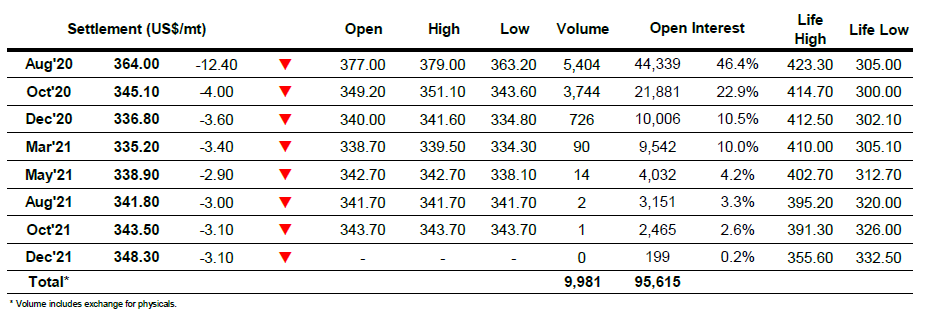

ICE Europe White Sugar Futures Contract