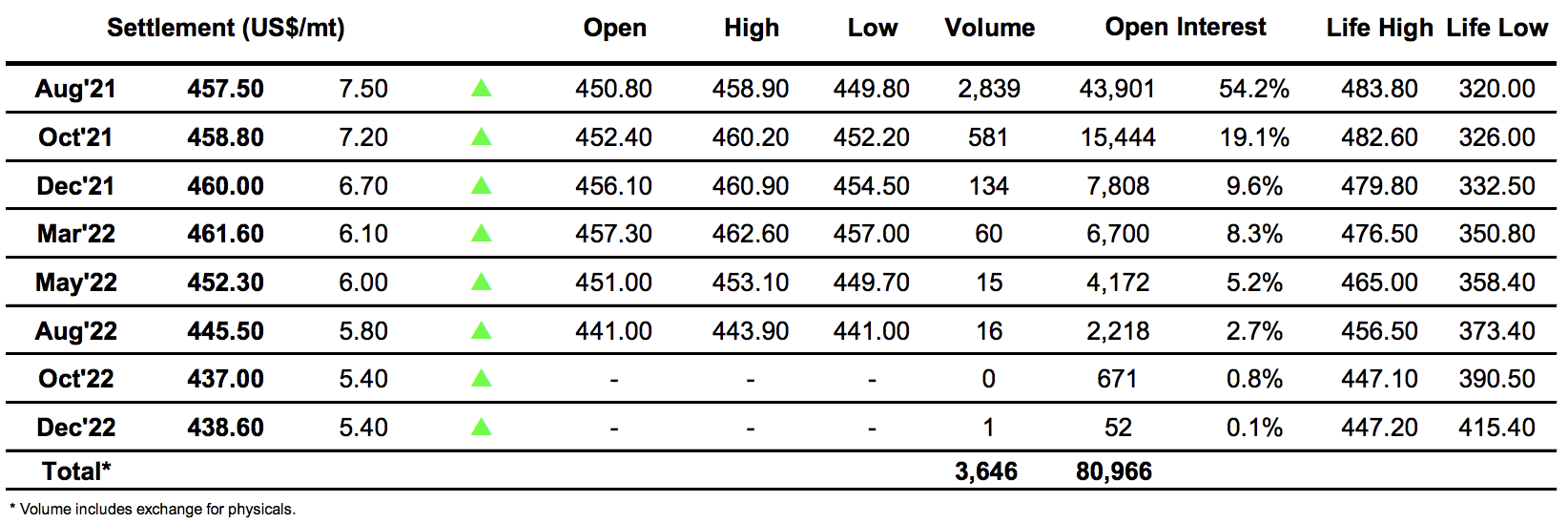

Sugar #11 Jul’21

Despite recording a weak close yesterday we found buying from the get-go which allowed Jul’21 to edge higher over the course of the morning to once more find itself situated right around 17c. This provided a nice platform for the start of the US day and spec buying duly followed soon afterward which extended the rally to 17.20 while at the same time bringing some solid buying to the Jul/Oct’21 spread with the differential reaching to -0.06 points in its best showing for some time. The movement was in contrast to a generally flat macro picture but though progress halted the longs showed more determination than some recent efforts with a period spent holding 17.10 rather than the more usual pattern of washout liquidation. Failing to find any additional upward traction the market eventually succumbed to some position squaring which sent the price back to what is becoming its spiritual home around 17c. We continued here quietly until the final 10 minutes when some aggressive buying pushed prices back to the highs in the hope that it can be the catalyst to finally break the current broad range and increase the volatility once more as we move nearer to next months fund roll and Jul’21 expiry.

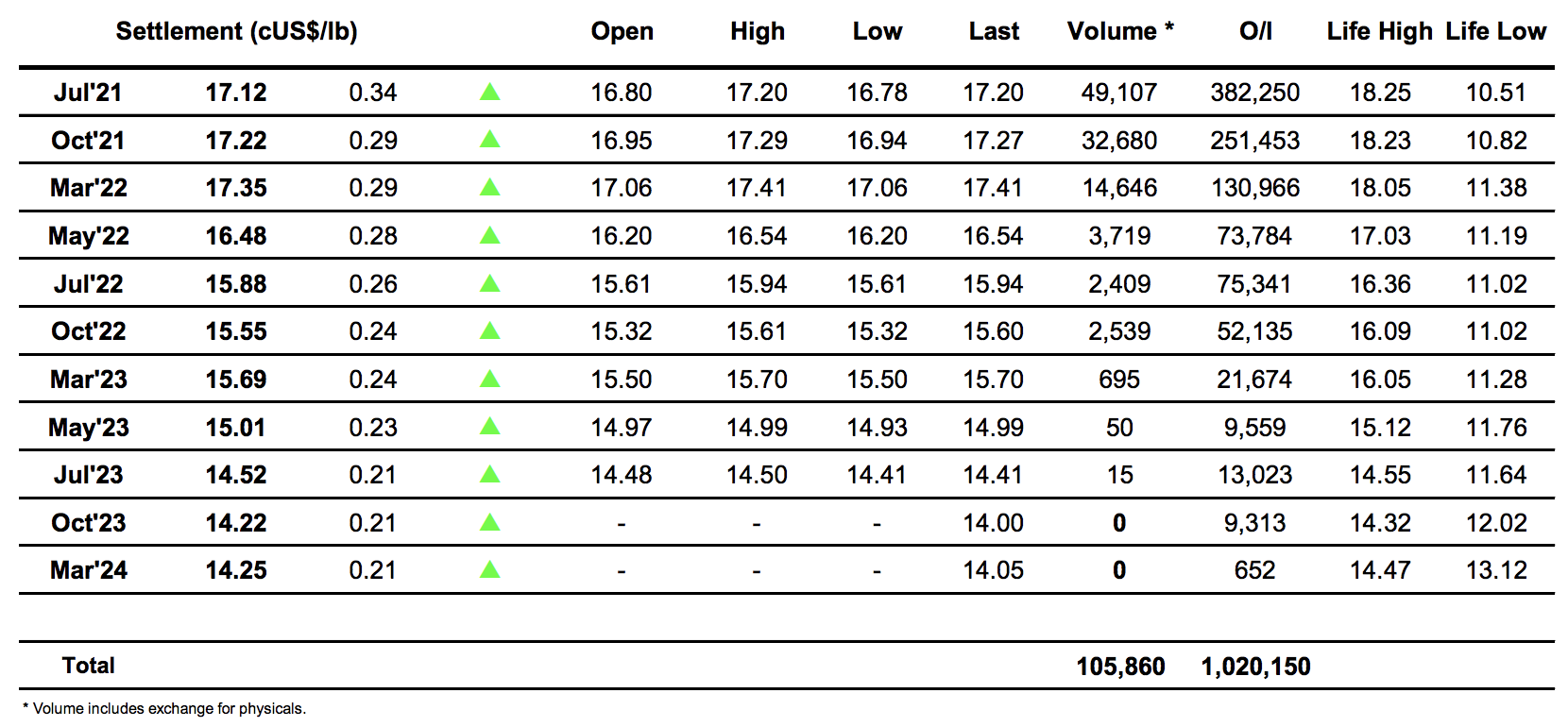

Sugar #5 Aug’21

A quiet opening either side of unchanged levels gathered some light support and the early part of the session was spent holding a couple of dollars above settlement levels. The lack of any firm direction in the last couple of weeks continues to confuse and is increasingly leading participants to stand aside from the market with today’s action proving similarly hard to fathom as prices continued to edge upward despite the nature of yesterday’s failure. Having built a small platform in the $453 area the early afternoon saw a sharp push upward quickly extend Aug’21 to $458.70 before faltering as the spec buying eased having again found some light resistance ahead of the $460 area. The afternoon played out within the confines of the range and remained featureless until the final 10 minutes. Here we saw specs look to dress the price upward and they successfully ensured an Aug’21 settlement level at $457.50, though there will be plenty more work to do if this time we are to build something more sustainable and not simply continue within the same old range.

· Closing white premium values continue in the same area, ending for Aug/Jul’21 at $80.00, Oct/Oct’21 at $79.20 and March/March’22 at $79.10.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract