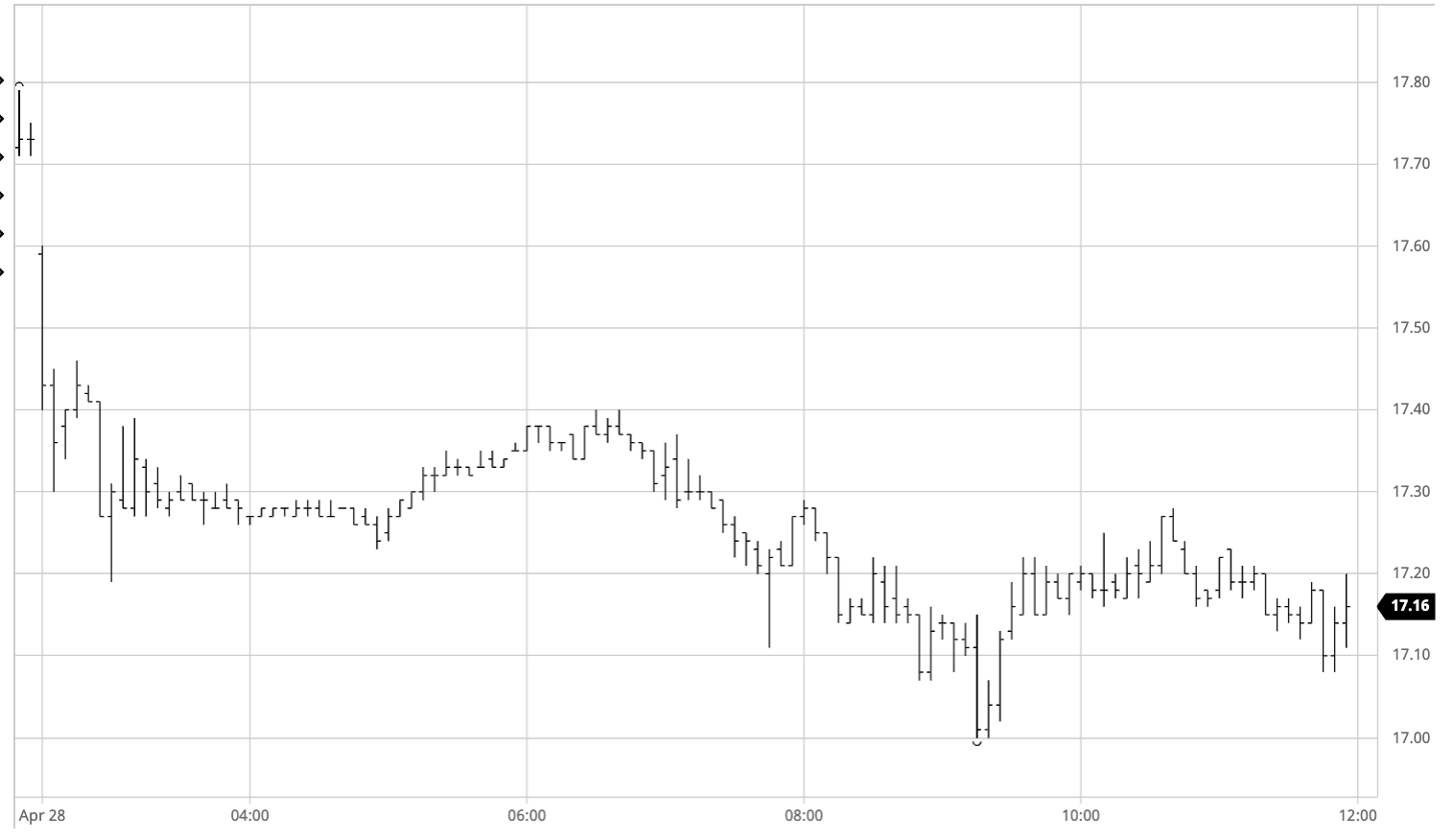

Sugar #11 Jul’21

Yesterday’s surging performance placed the technical picture into heavily overbought territory but with so little selling on show and the funds driving upward it has taken a brave person to stand in the way for fear of further upside extension. While some unwinding of this upside extension that has seen prices rally buy 300 points during the month of April was to be expected it started in spectacular fashion as initial selling sent Jul’21 all the way down to 17.30 in the opening minutes with a second wave of selling seeing the price fall to 17.19 soon afterwards. With only a few thousand lots having traded on the decline there will undoubtedly have been some spec longs looking nervously over their shoulder and for several hours we saw the market try to dig in and work its way back upwards until having failed to pass back beyond 17.40 a little more selling started to appear. Working lower once again we saw further lightening of the load from some of the recently added longs while day traders and algo’s were afforded the opportunity to take advantage of the volatility in playing the short side. By mid afternoon the decline had led below yesterday’s 17.05 low with Jul’21 touching at 17c, though understandably defensive support appeared from longs to defend against the possibility that a 16c handle would add to psychological weakness and quickly pull prices back up into the teens. Through all of this movement we saw nearby spreads trading a little lower with May/Ju’21 into 0.13 points and Jul/Oct’21 back to 0.07 points, only modest losses but in keeping with similarly modest gains seen as the market rallied. Quieter trading during the later part of the afternoon saw values hold a tight band toward the bottom end of the days range with Jul’21 settling at 17.14 to partially unwind the extremely overbought picture while raising questions as to the merits of the upside with the potential to further correct.

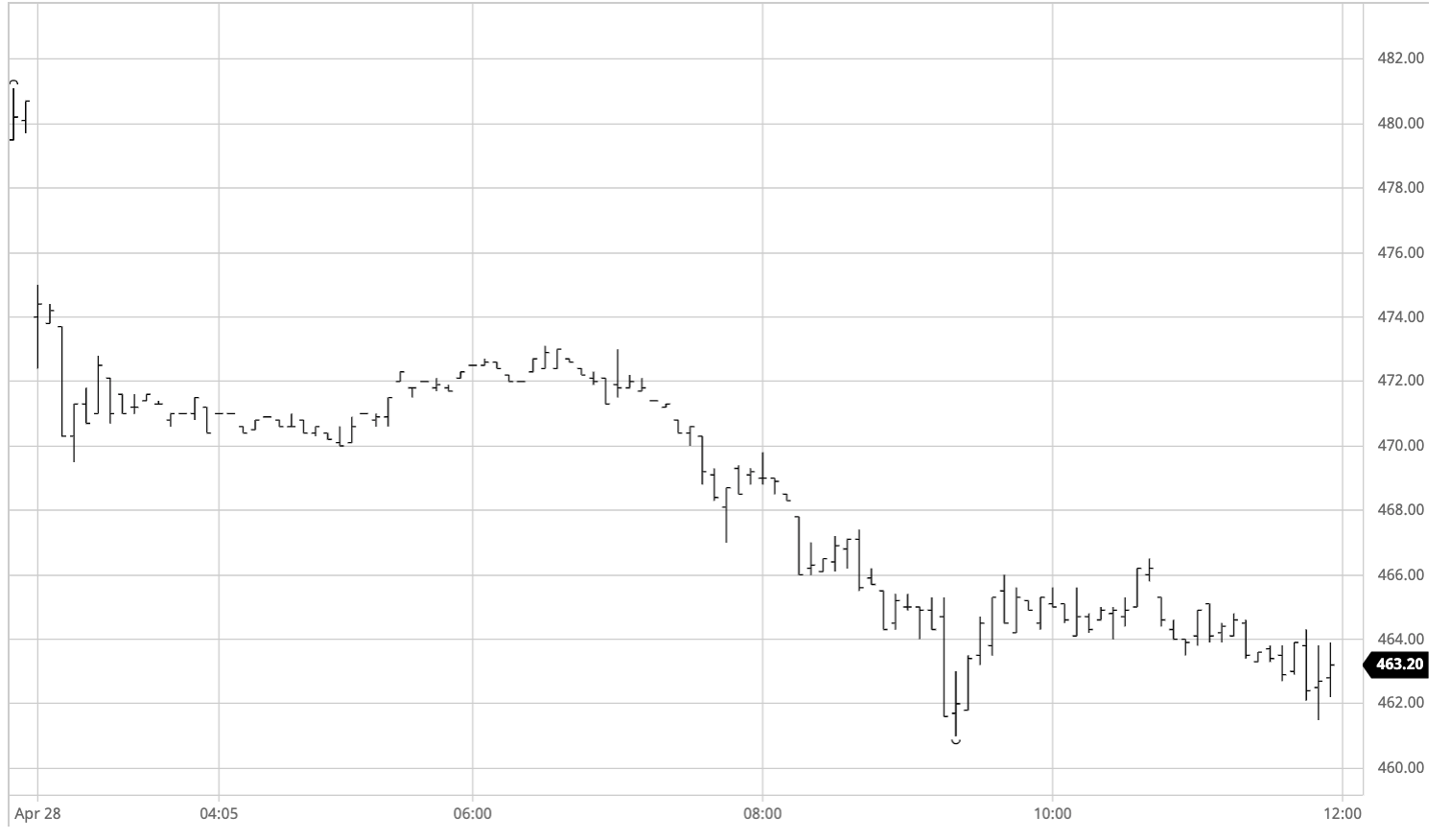

Sugar #5 Aug’21

A sharply weaker No.11 market was calling the whites to begin significantly lower and they did just that, commencing more than $5 lower at $475.00 and then extending down to $469.50 soon afterwards on total volume of only 250 lots. For several days now the whites have seen only very sparse volumes changing hands and this situation is clearly continuing with the level of consumer interest at these high levels even smaller than the light activity seen from the producers, providing little opportunity for any fresh longs to escape from their holdings. Prices then settled and the rest of the morning was spent consolidating ahead of $470 in quiet volumes, holding value fairly well with the Aug/Jul’21 white premium actually a little firmer at $90 despite the lower underlying values. Moving into the afternoon the lack of further recovery began to undermine confidence and as values declined beneath the morning lows so the level of selling increased once more to lead the price down in a series of steps to fill the gap which opened yesterday on the way to a low of $461.00. It was not just the flat price that was creaking with the Aug’21 spreads also having to absorb some pressure, placing Aug/Oct’21 in at just $2.20 and maintaining the downward trend of this differential which has been ongoing despite the recent rally for the outright prompts. At almost $20 lower the market inevitably picked up some buying interest and pulled up by a few dollars though was unable at any stage to extend back above yesterday’s $467 low mark. Most of the ground recovered was given back during the closing stages to leave Aug’21 settling negatively at $462.70 which in light of the sudden reversal raises questions as to the longer term upward potential and whether we are repeating the action seen during late February. White premium values gave away significant ground during the afternoon, to show significant losses with Aug/Jul’21 closing at $84.75, Oct/Oct’21 ending at $84.00 and Mar/Mar’22 at $82.25.

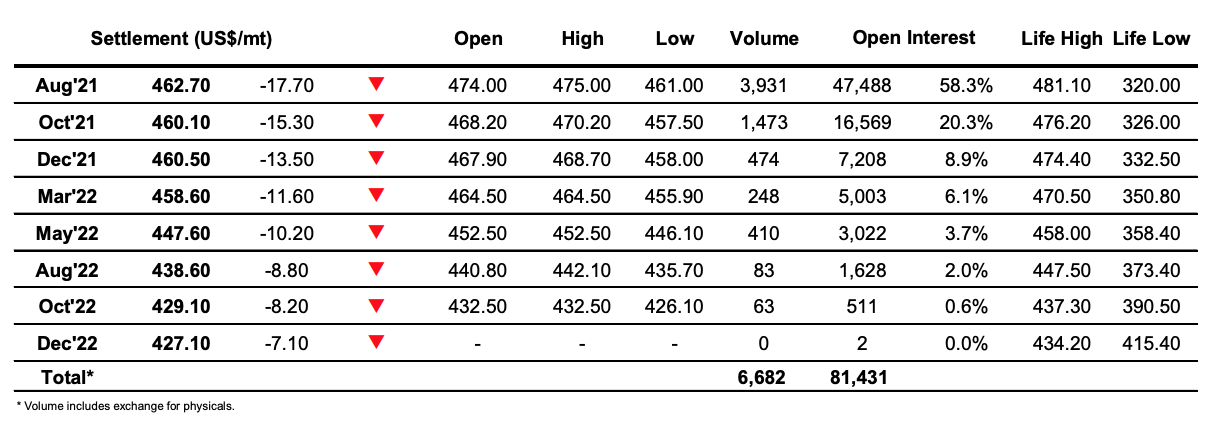

ICE Futures U.S. Sugar No.11 Contract

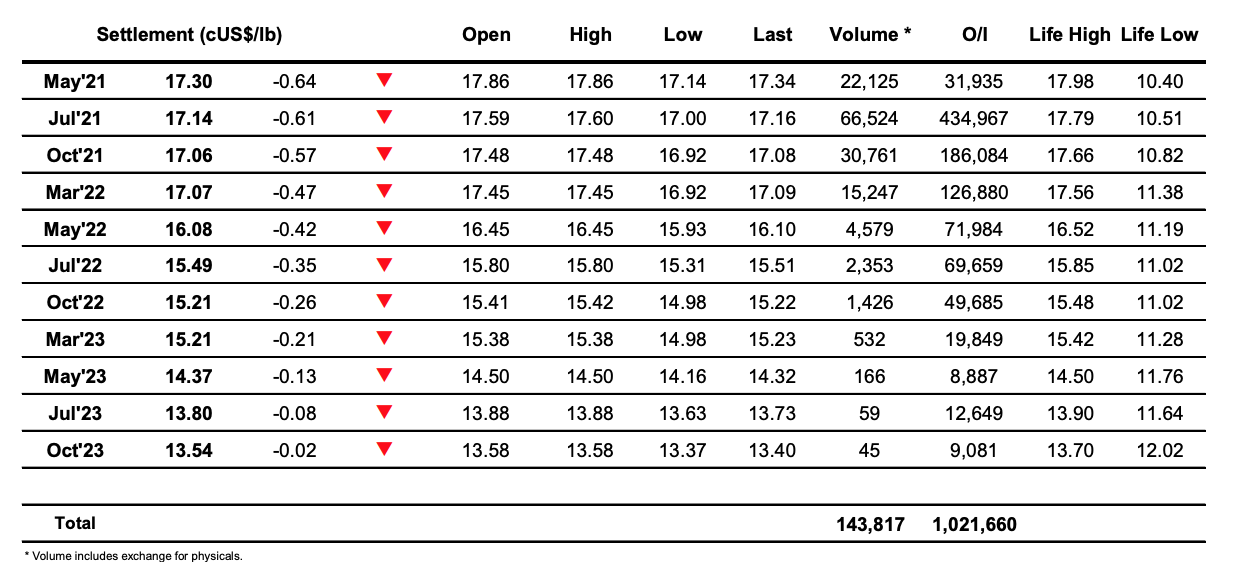

ICE Europe Whites Sugar Futures Contract