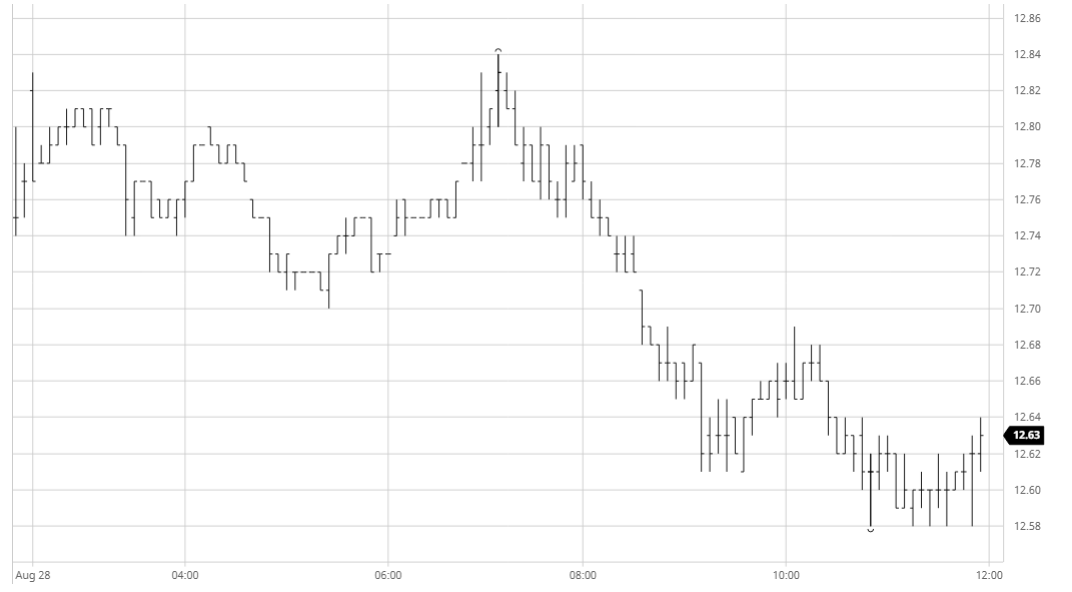

- Following on from the recovery back up from 12.50 yesterday afternoon the market initially found some buying to open higher, however once concluded activity dropped to a minimum and we again started to drift sideways. The US morning saw a brief small recovery however it was remarkably short-lived and having started to decline back toward morning lows the move gathered pace to be bringing the weekly low mark of 12.50 back into view by the final hour. A good portion of the selling on the way down was being led by the spread with Oct/March working back out to -0.64 points as a result while outright selling was seemingly limited to smaller specs and algo’s as producers remained away from the market with the recovery of the USDBRL to 5.44 impacting their potential returns. Values remained at the lower end of the range as we headed calmly into the weekend.

- Monday sees the whites market closed for the summer bank holiday. No.11 will open late at 7:30am NY / 12:30pm UK with the close at the usual time.

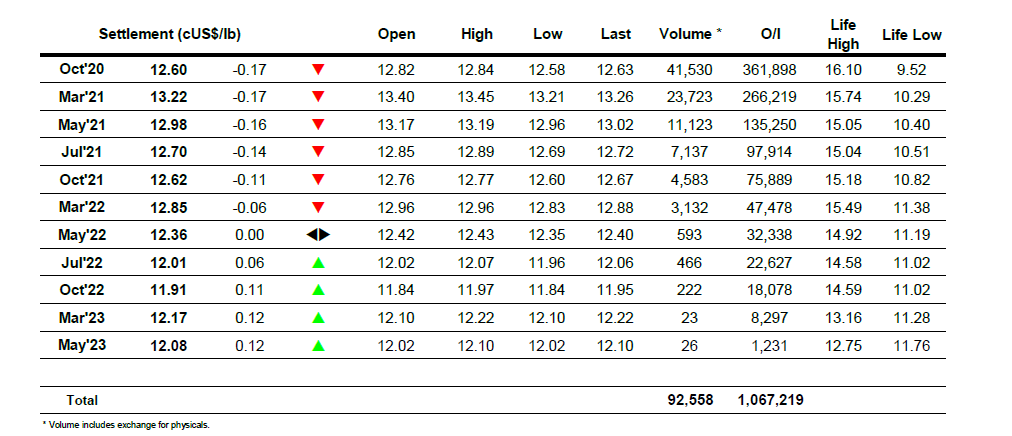

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

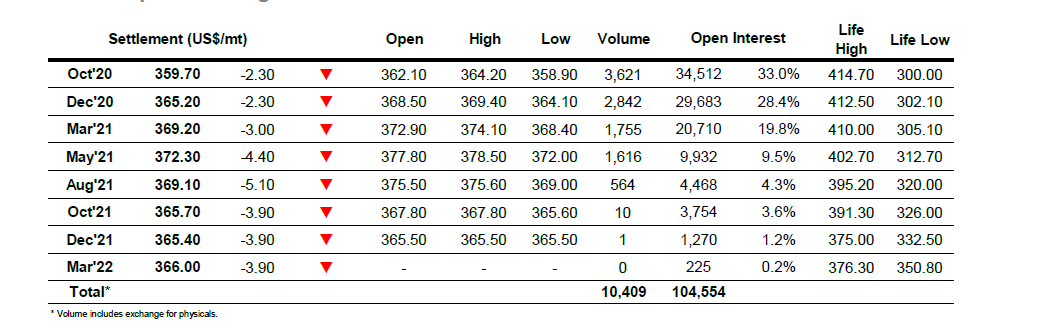

ICE Europe White Sugar Futures Contract