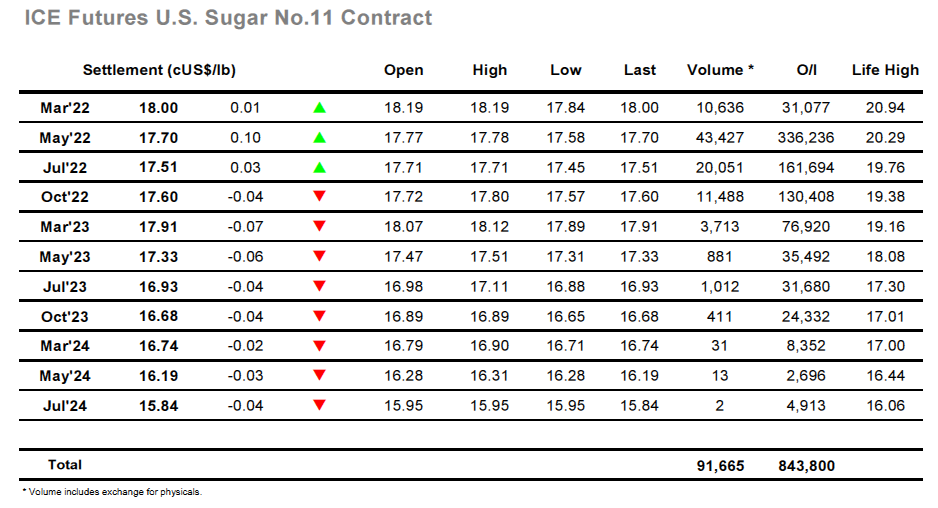

Sugar #11 May’22

Ahead of this morning’s opening there was a positive macro picture developing with the grains and energy sectors recording gains due to war being waged by Russia on Ukraine, but though this provoked some initial buying that led to May’22 touching 17.78 the gains were soon eroded to leave prices sitting back at unchanged levels. For many weeks now there has been strong support in the vicinity of 17.50 and this remains true as a long calm period of consolidation ensued within a tight range, sugar still happy to exist away from the macro and do its own thing. The market saw a small increase in activity midway through the afternoon as a few of the specs stepped forward to push May’22 back up toward the opening highs in search of a reaction, but with nothing forthcoming the inevitable long liquidation followed to leave the price back in the 17.60’s as if nothing had happened. Prices continued in the 17.60’s as we moved through into the final hour and though there was some month end buying which took the price back up a few ticks during the closing stages it merely served to ensure a settlement level at 17.70 to conclude an inside day.

March’22 spent its final day trading lower with the last of the pre-expiry positioning sending the March/May’22 spread in to 0.22 points before expiring at 0.30 points. We are hearing that 26,350 lots (1,338,646t) will be tendered with many origins expected to be nominated. Formal details will be published tomorrow.

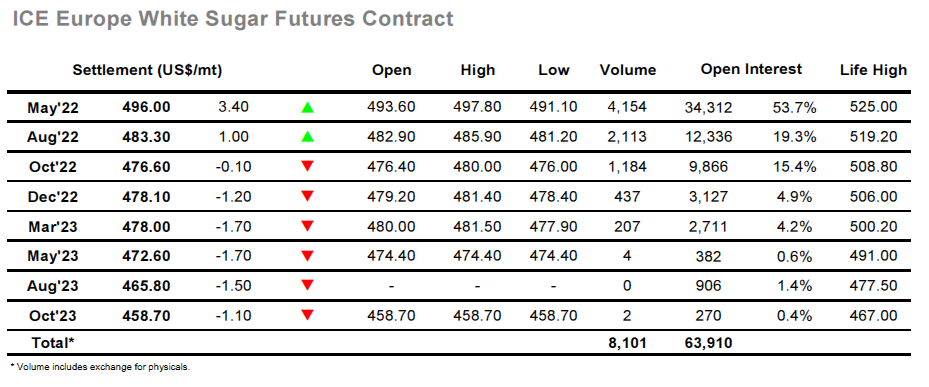

Sugar #5 May’22

The weekend has seen a continuation of the conflict in Ukraine however sugar was showing no signs of being influenced by this and the wider macro activity with a calm start seeing May’22 trading within a couple of dollars of unchanged through the first hour. A small slip down to $491.10 ran into some scale support which left the market to continue meandering quietly along within the tight range for a few hours more on low volumes. Despite the tight range the white premium values were holding firmly once again, though the lack of volume outside of the May’22 contract meant that only small volumes were changing hands. With the wider macro (led by energy and grains) remaining positive some moderate buying began to emerge and pushed May’22 up through the opening highs to reach $496.60 however with only very small specs involved the momentum was soon lost and so prices slipped back into the range once again. The market calmed considerably during the final couple of hours to sit at the centre of the range until some late fireworks saw the price pushed sharply up to new daily highs on less than 1,000 lots of volume. With No.11 disinterested this widened the May’22 white premium out to $107 with May’22 concluding the month at $496.00.