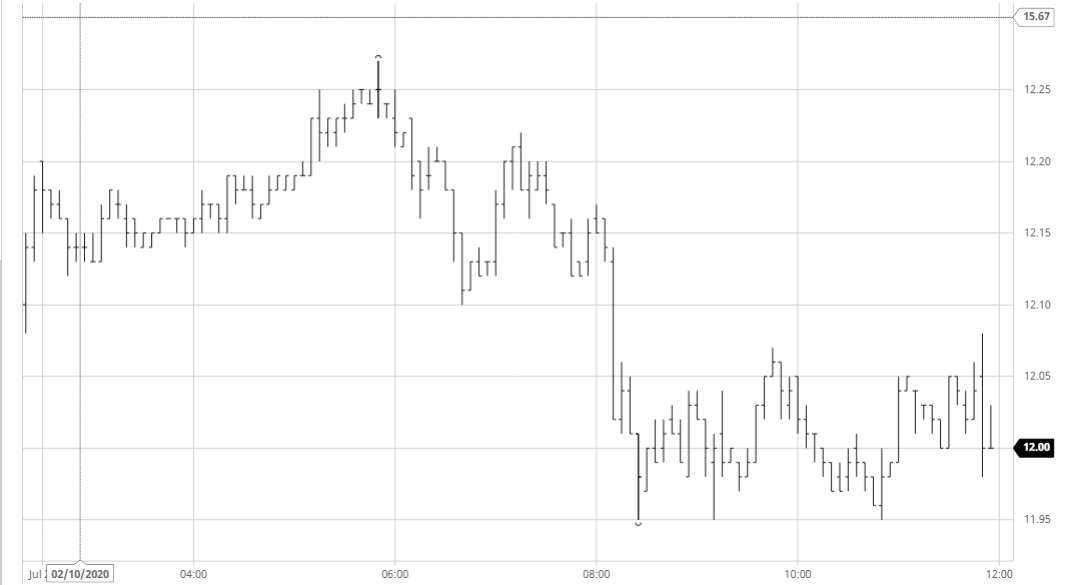

Yesterday’s strong recovery provided a good technical base to look higher once again, and buying duly appeared for the opening to take October to a first print at 12.20. Good selling was immediately uncovered in this area and the early stages were then played out in a narrow range nearer to unchanged values with longs appearing content to consolidate and build a base for an attempt at the overhead resistance. Gradually we then began to push upward once again and some strong Oct’20 call option buying (most likely spec) was noted along the way. Breaking above the earlier 12.20 high then brought a degree of additional spec buying to the fore which pushed further through the overhead scale selling to reach 12.27. Spreads meanwhile were not finding the same level of support as seen yesterday on the rally with Oct/March offered back beneath -0.60 points despite the flat price strength. A pullback ahead of the US opening proved short-lived when specs drove the price back above 12.20, however the move lacked substance and when prices slipped once again the move became more severe with long liquidation from day traders as we broke to new daily lows sending Oct’20 all the way down to 11.95. A quieter afternoon ensued with prices holding a band towards the lower end of the daily range with specs having largely retreated, although news that Pakistan has approved 300,000mt imports to maintain stocks served to underpin the market around 12c. Closing values remained in this area, Oct’20 settling at 12.01, still ensconced within the broad recent range.

SB Oct – Sugar No.11

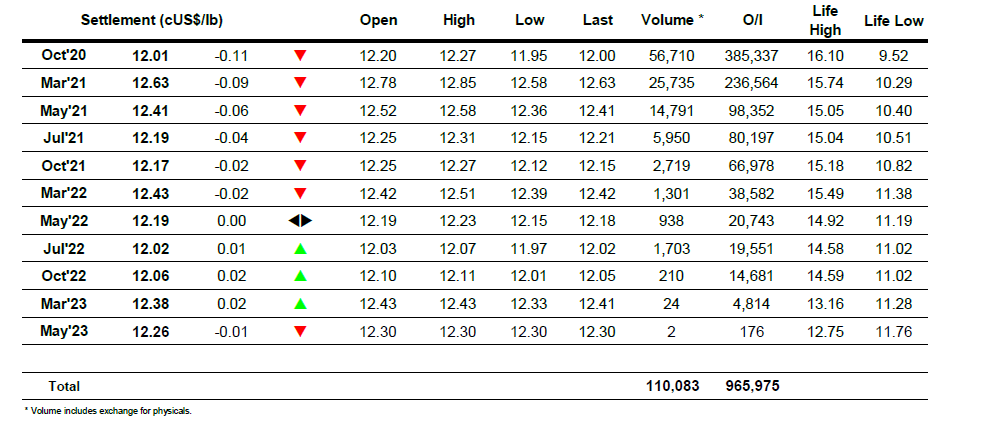

ICE Futures U.S. Sugar No.11 Contract

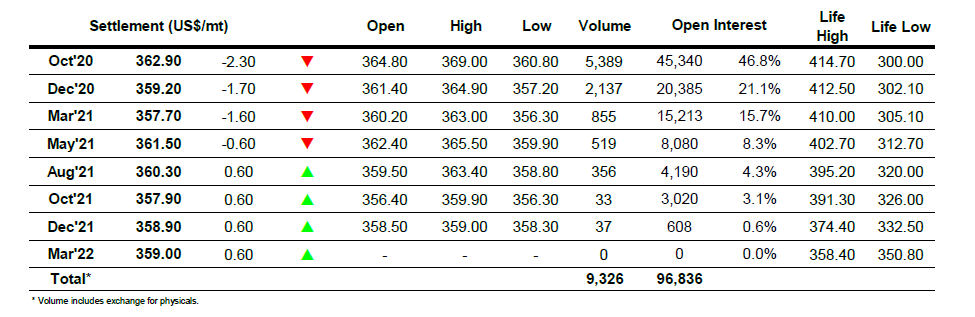

ICE Europe White Sugar Futures Contract