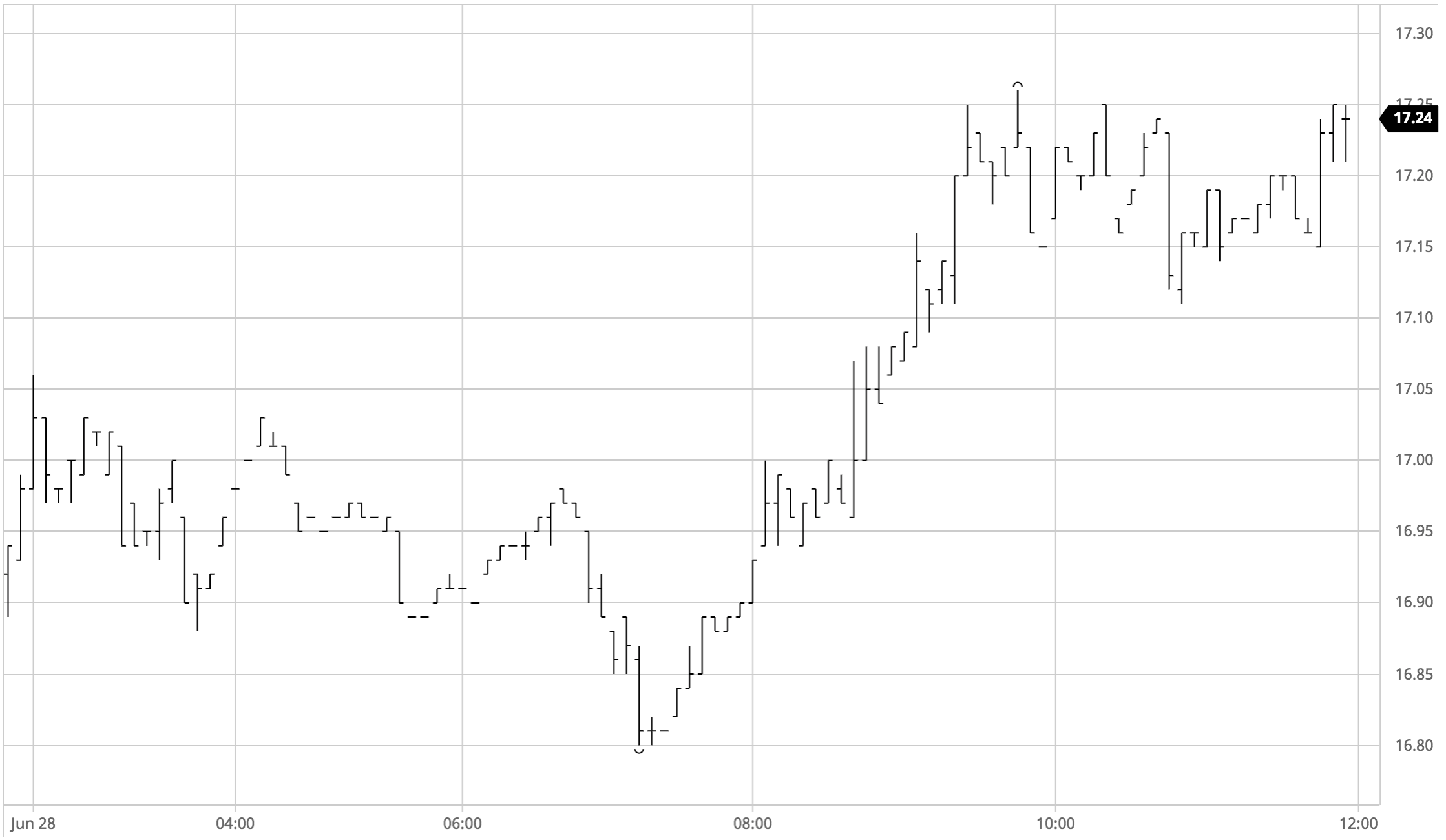

Sugar #11 Oct’21

The new week commenced quietly with Oct’21 holding a narrow range which centred around the upper 17.30’s. Friday’s COT report had shown a sharp reduction of some 35,000 lots for the spec long to now stand at 184,912 lots, not surprising given the fall in values and with last weeks recovery we are likely to still on be in the 200k range which potentially provides further headroom should these specs look to re-enter in the near future. Despite this potential when the narrow morning band broke it was initially to the downside as some moderate selling sent Oct’21 briefly down to 17.16, though the dip was quickly picked back up by some defensive support. With the Ags sector performing reasonably well and our own technical picture now looking more positive the specs capitalised on the recovery and continued to push steadily upward, bringing in some increasingly sizable volume above 17.40 to maintain the momentum on to the 17.60 area. Progress became rather more tricky from this point onward with some more sizable selling starting to be uncovered as we approach the congestion which extends up to 17.94, though at no point did we show any sign of the buyers losing heart and so the gains were comfortably maintained. New highs were recorded on the post close following a positive settlement value of 17.61 with the expectation that there will be a continuation of the momentum for the near term with testing of the overhead resistance.

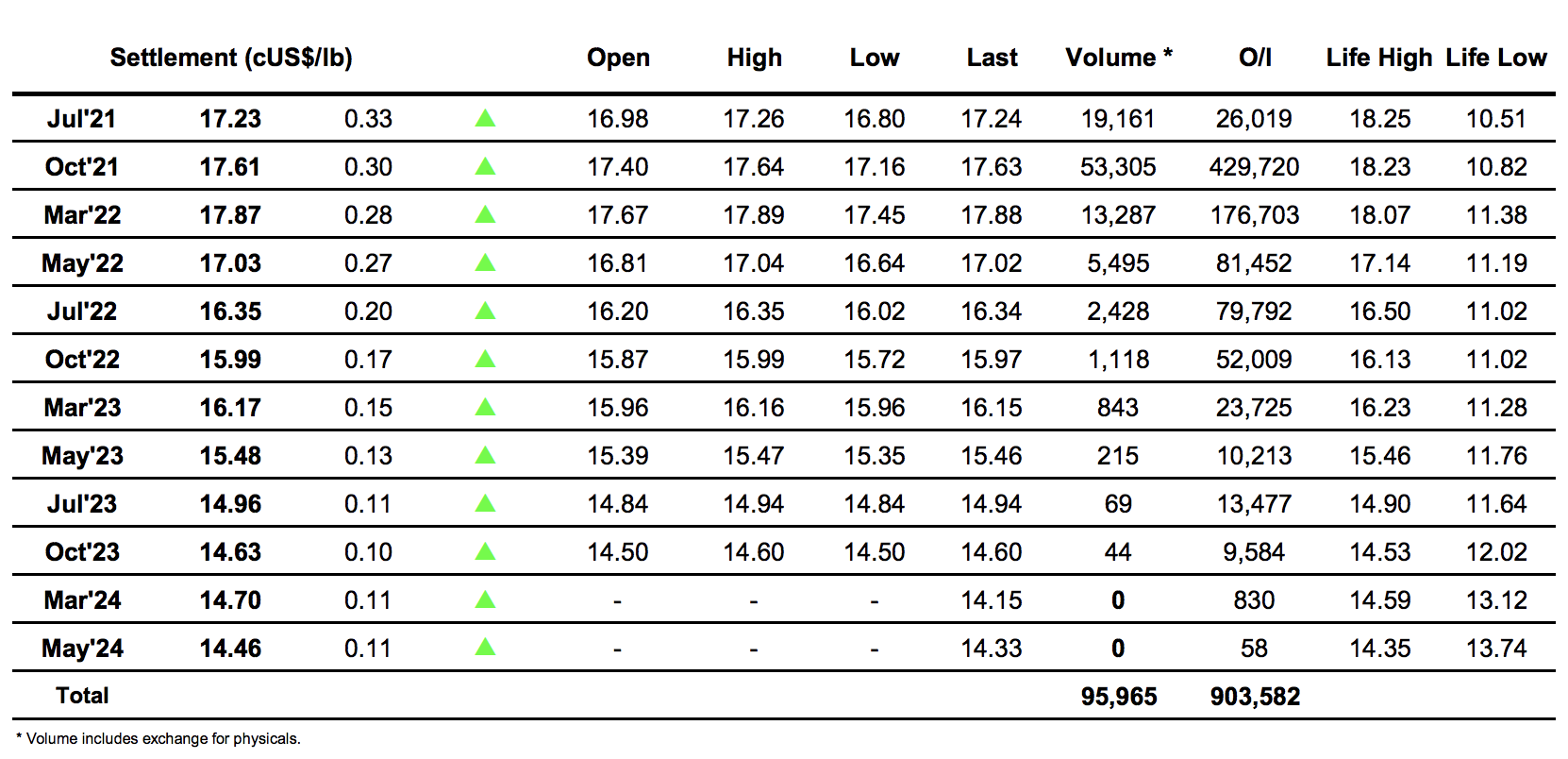

· Jul’21 expires this Wednesday and the latest OI figure of 26,019 lots and a Jul/Oct’21 spread at -0.38 points is suggesting a moderate tonnage only will be tendered.

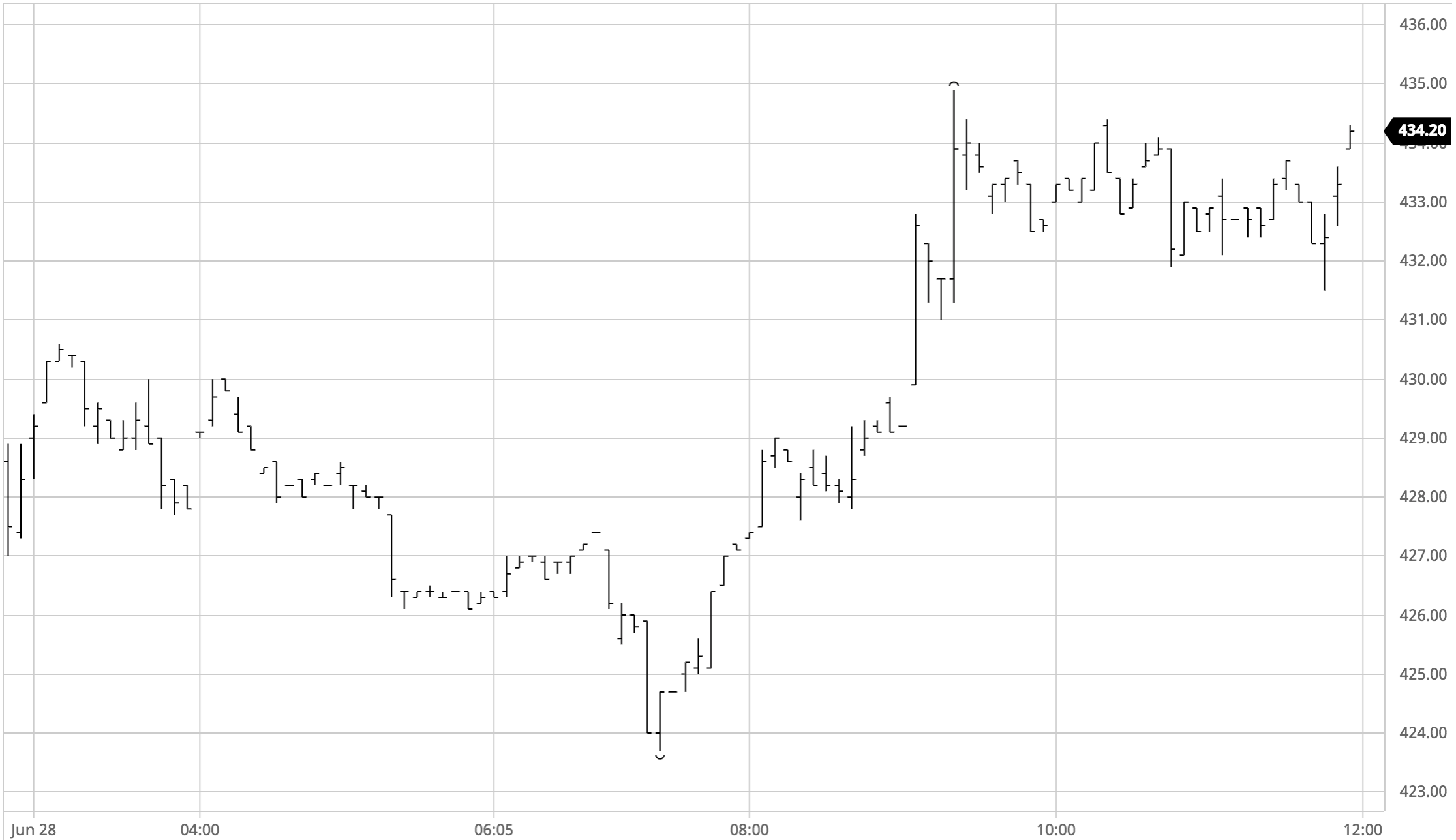

Sugar #5 Aug’21

The new week began with some light buying to take Aug’21 up briefly above $430.00 though on very quiet volumes we soon settled into a range and ticked along calmly between $426 and $428. The calm came to an end as some mid-session pressure was applied and this took us to a session low at $423.70 though short covering kicked in soon afterwards and we pulled back into the morning range. The specs have been rather more animated in recent days and this was apparent with a surge of buying now emerging that just two hours after recording the lows saw Aug’21 surging to $434.90. This push was in keeping with the wider improvement in commodity values while also maintaining the recent resurgence from the double bottom down in the $416 area. Despite the flat price recovery there was to be no resurgence for the Aug’21 spreads as they made further new lows, and by late afternoon Aug/Oct’21 had slipped down to -$21.50. The flat price remained constant at the upper end of the range throughout the final couple of hours with a positive settlement value of $433.30 providing a sign that the rally is not over yet.

· Another day of mixed fortunes for the white premiums saw the soon to expire Aug/Jul’21 lose further ground against Aug weakness while the Oct/Oct’21 was marginally up. Closing values showed Aug/Jul’21 at $53.50, Oct/Oct’21 at $66.00 and March/March’22 at $71.50.

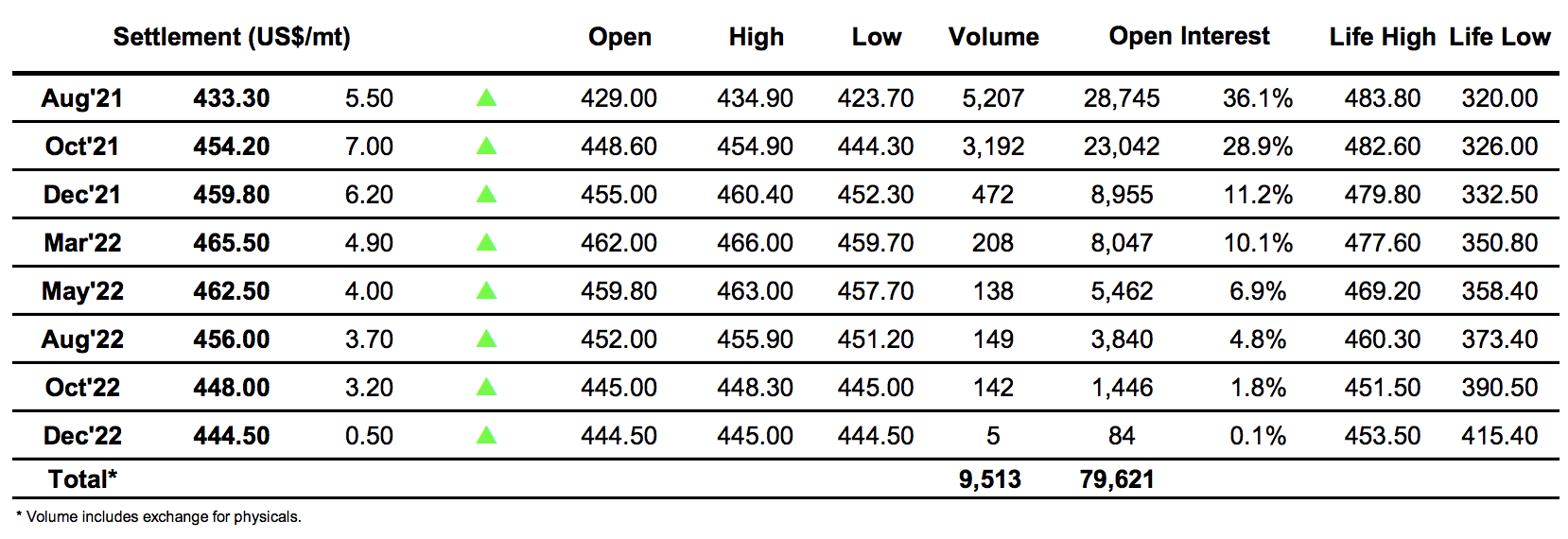

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract