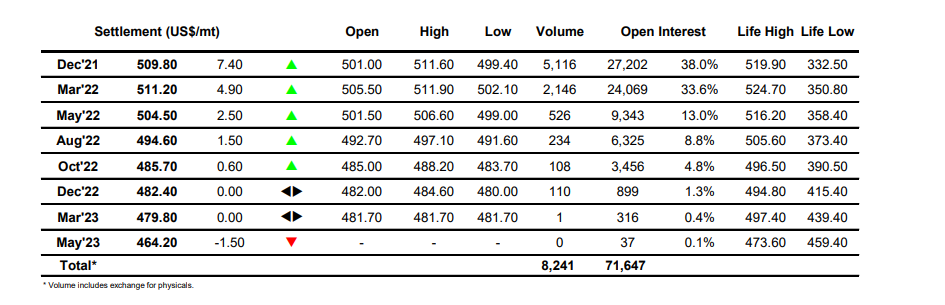

Sugar #11 Mar’22

Recent struggle has eroded confidence in the market and we started today negatively with a slide of some 20 points during the first hour before encountering some support from trade/consumers ahead of 19.50. This led to a period of stabilisation however toward the end of the morning we extended to a new daily low 19.45 as exploratory selling looked to test for stops beneath last weeks 19.49 mark, with some swift covering following close behind when the move failed to yield any success. This acted to draw a little more covering out and having reached steadily back to unchanged levels a more aggressive push higher emerged that significantly extended the upside to 19.91. Alongside the flat price move there was also significant extension for the March’22 and May’22 spreads emphasising the thin liquidity present in the market at this time, March/Jul’22 reaching to 1.27 points which was a gain of 30 ticks from its morning low. Alongside we also saw some recovery for the Oct’21 which traded up to 19.05 while the Oct’21/March’22 moved back to -0.80 points as spread buying pushed the price on thin liquidity with the Oct’21 OI reduction to 20,932 lots showing that most traders have now exited the front month. The macro was acting in contrast to our own rally and so as spec buying eased the market drifted back a little from the highs, though remaining above overnight levels. Almost inevitably there was spec buying for the close as those that had been pushing earlier looked to maintain momentum though there remains a long way to go to escape the broad range which most likely will continue.

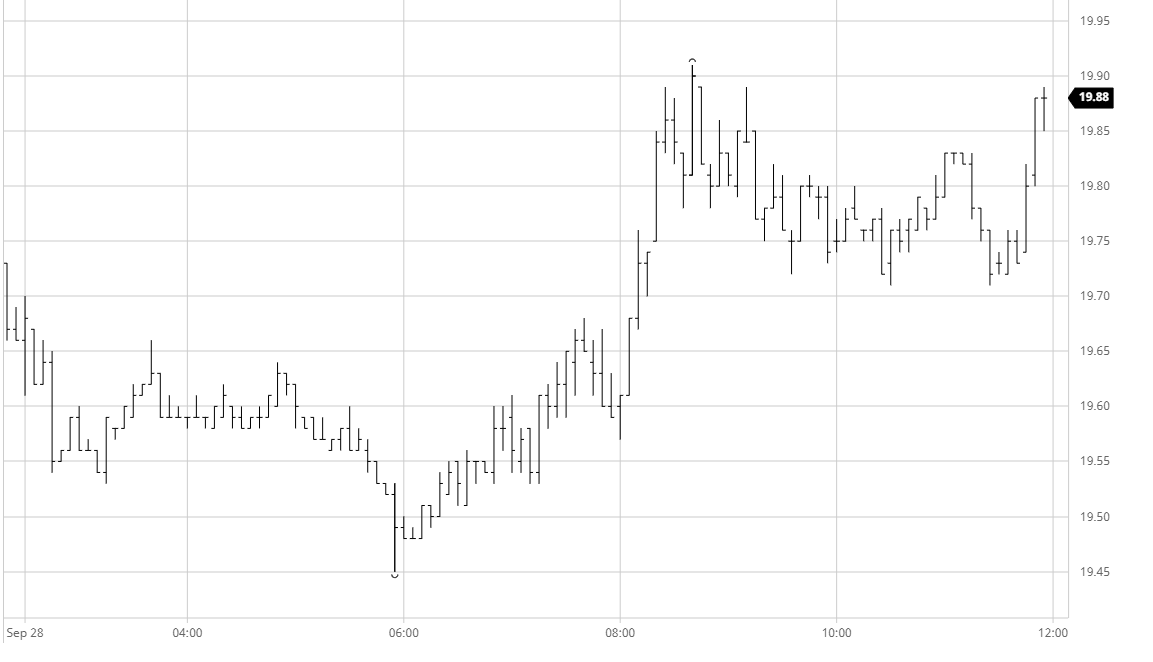

Sugar #5 Dec22

The day began with the market on the backfoot, not overly surprising given the fall in values over the past couple of sessions and in quiet conditions Dec’21 eased to record a low of $499.40, though there was no psychological impact from the break of $500. The morning was a complete non-event as prices edged along quietly within a couple of dollars of the lows and wit the macro showing a little more negativity than of late there was little indication that the situation would change. But change it did as the US morning saw some buying emerge into the No.11 leading our price levels to pull higher on the coattails. It was clear that spec and day traders were involved by the sheer impact upon the front month with Dec’21 moving upward to $511.60 while the Dec’21/March’22 spread shrugged off its recent struggles to make a daily high at -$0.10. Down the board things were a little more orderly, reflected in the white premiums where March/March’22 was stable at around $73 to maintain its morning gains but lacking the impetus to kick on. From mid afternoon the price action cooled a little and we consolidated the $507/$508 area for a couple of hours which ultimately provided a platform to push on again on the close. Dec’21 settled at $509.80 to reverse the recent decline though the pattern of rangebound trading over recent weeks suggests we have a long way to go before this is considered anything other than another short term swing.

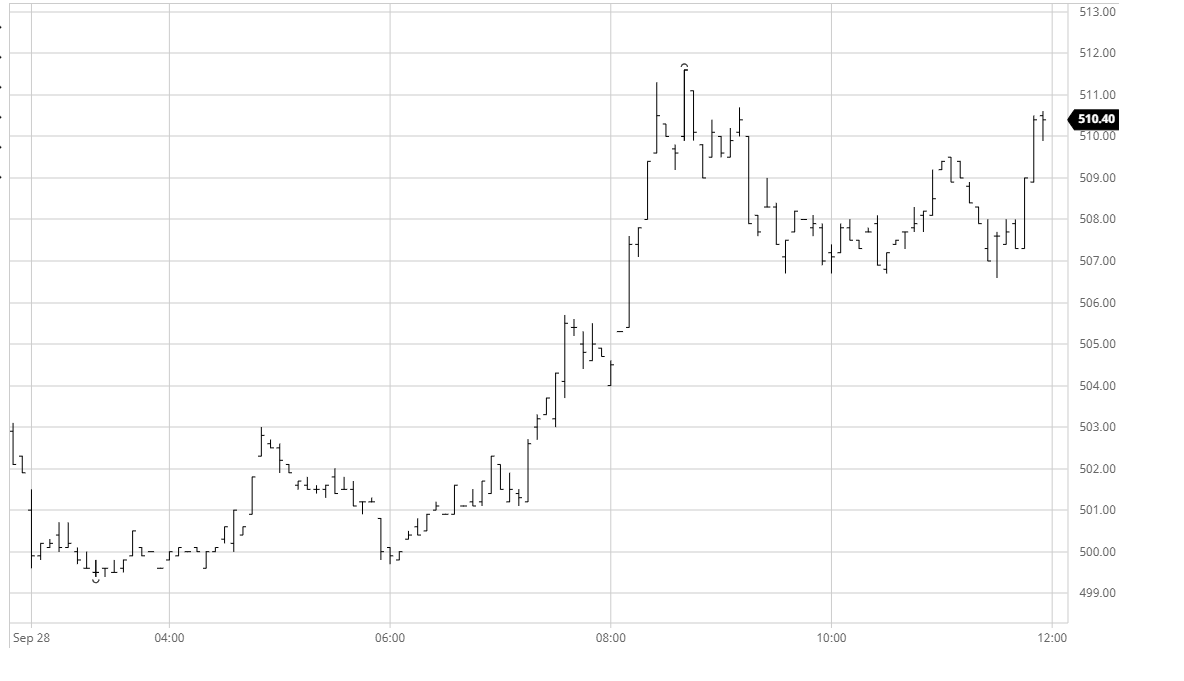

ICE Futures U.S. Sugar No.11 Contract

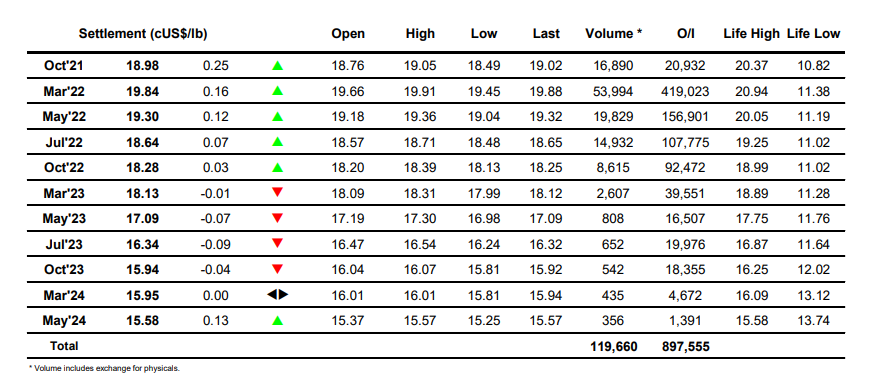

ICE Europe Whites Sugar Futures Contract