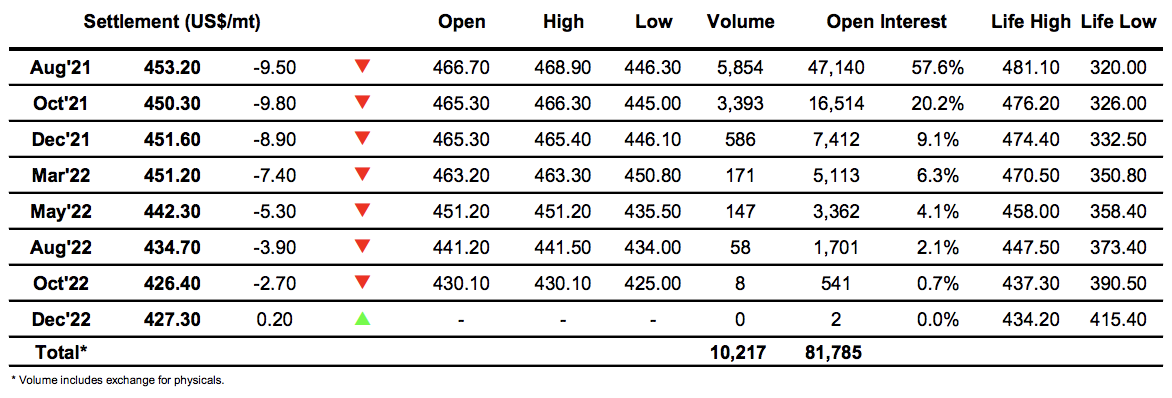

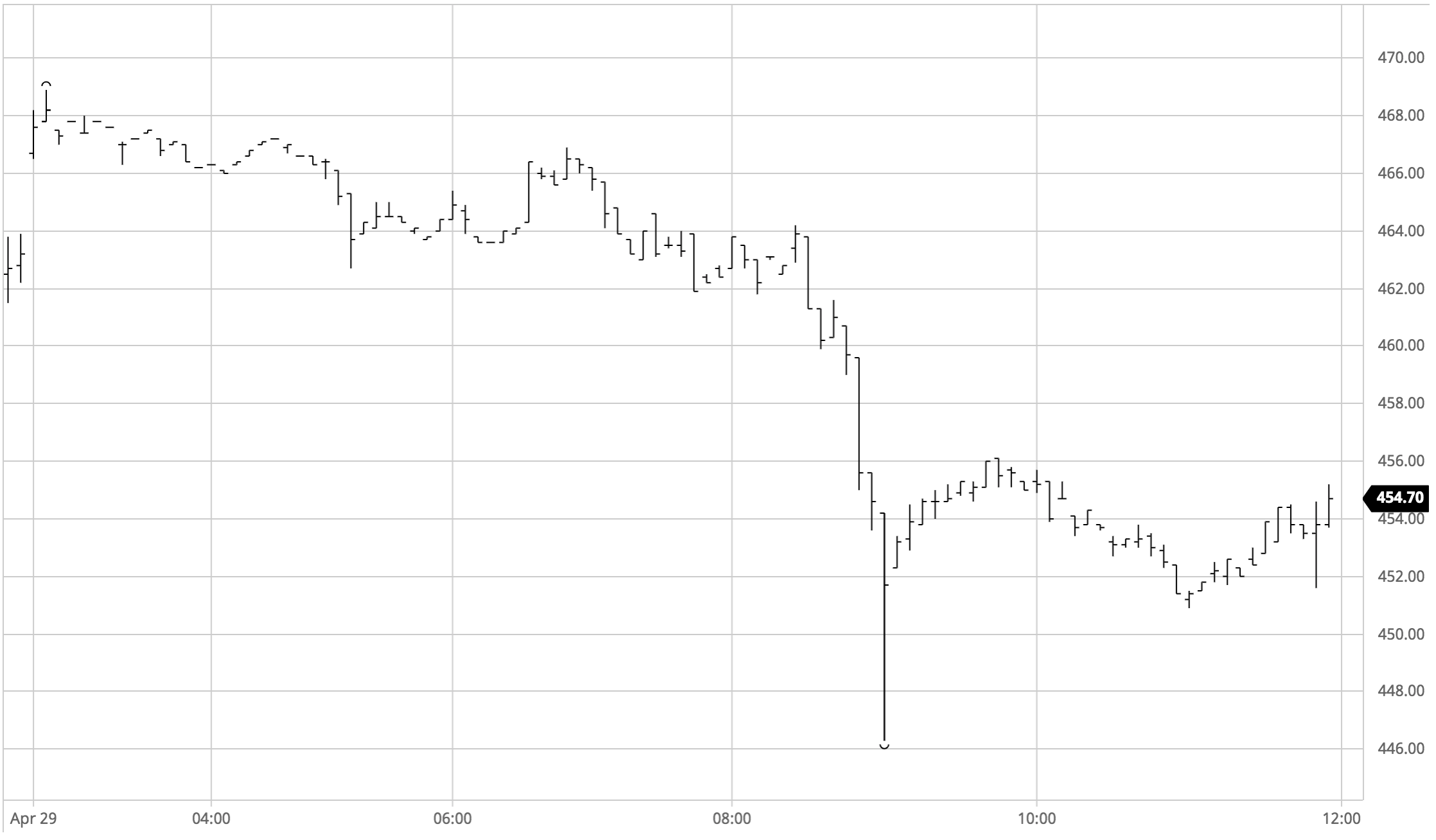

Sugar #11 Jul’21

The day began positively with Jul’21 finding early buying (maybe physical related following the pullback/maybe macro related with crude trading higher) and reaching up to 17.38 during the first 30 minutes of trading. Activity then settled with volumes reducing to minimal levels and this led to a prolonged period of consolidation between 17.16/17.36 which lasted well into the afternoon. It was a similarly quiet story for the May’21 contract which on its penultimate day of trading was relatively calm, the May/Jul’21 spread trading either side of unchanged on low volumes while an open interest figure of 17,957 lots suggests that most of the pre-expiry tidying has been done as we home in upon the delivery tonnage. Midway through the afternoon a little more selling began to emerge (long liquidation?) which sent Jul’21 back downward towards yesterday’s 17c low mark and the movement duly attracted in additional selling from algorithmic traders keen to explore any potential underlying sell stops. What followed was spectacular as a whole host of liquidation was triggered and in a continuing thin environment containing only limited scale buying Jul’21 plunged to 16.46 against around 10,000 lots before bouncing straight back to 16.80 as short covering poured in. Activity then became rather more calm and the market edged back upward to flirt with the 17c handle once again but having fallen short we eased back into the 16.70’s. There remain many spec longs who are understandably determined to try and defend against a continued decline and buying over the final hour pulled Julk’21 back up a touch to settle at 16.93, still a disappointing performance which raises further questions as to the sustainability of the upside but certainly not as bad as could have been given the circumstances.

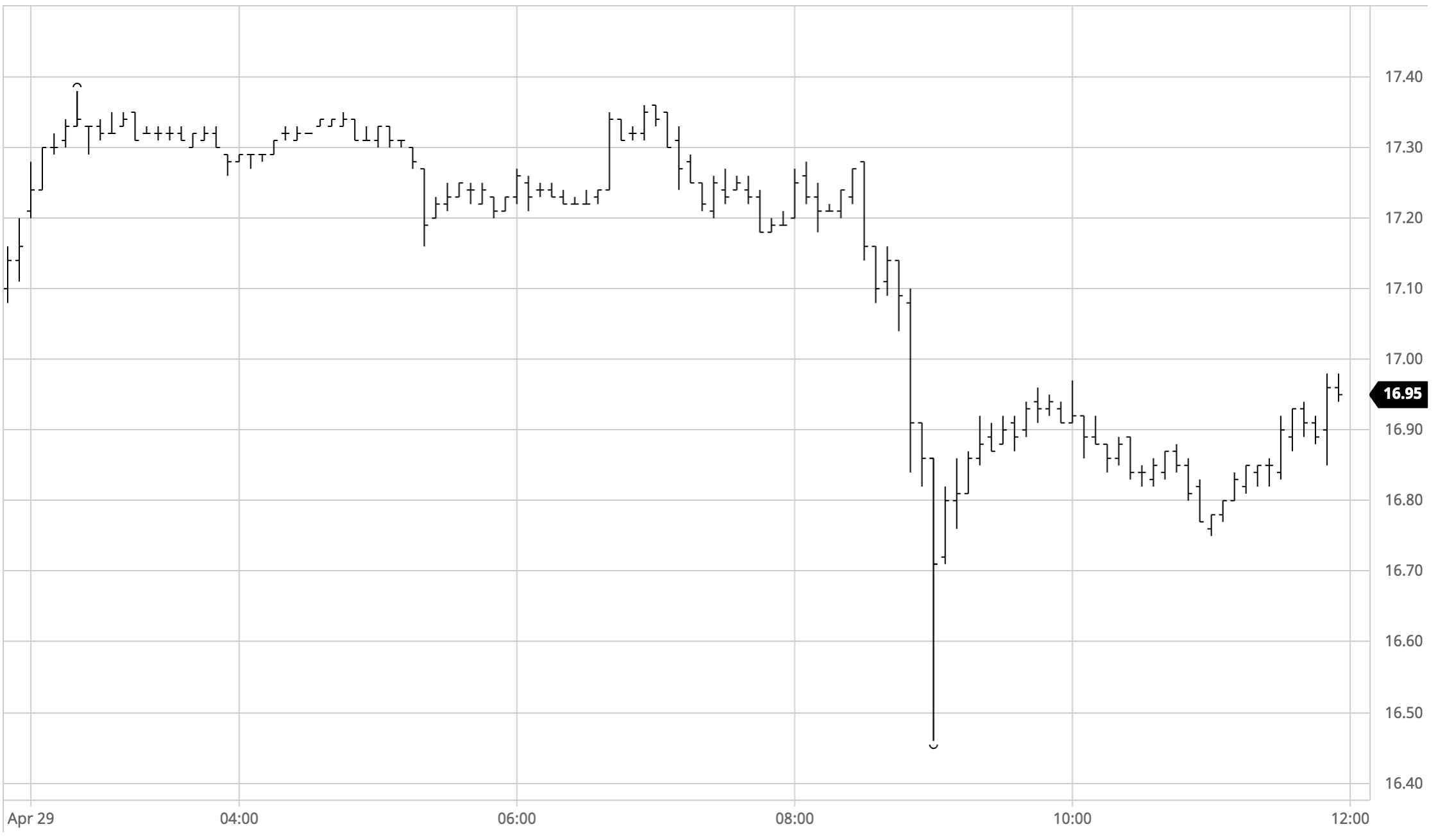

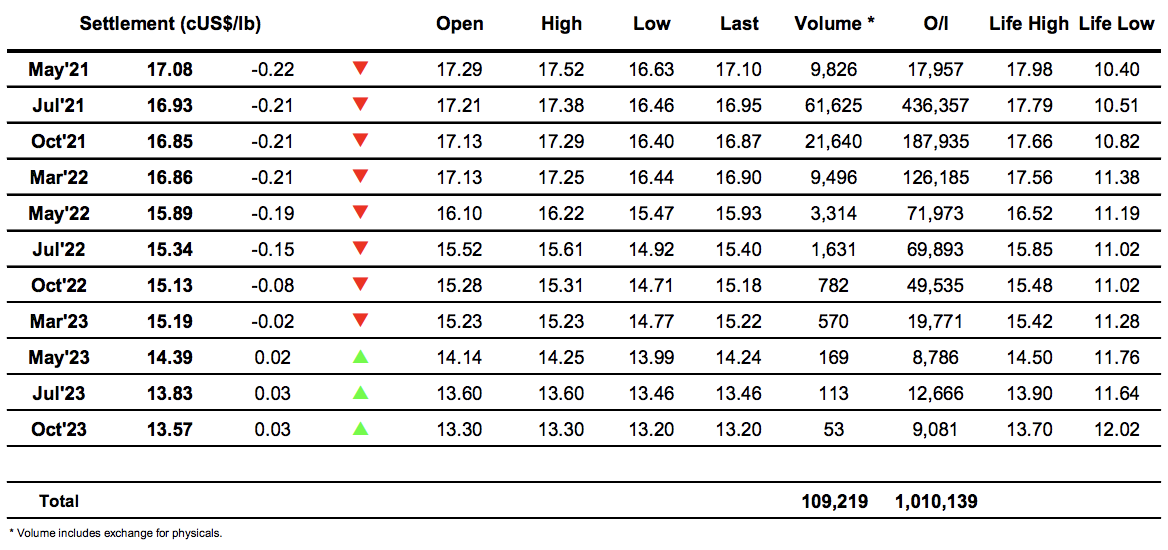

Sugar #5 Aug’21

The market has been something of a rollercoaster so far this week and that situation looked set to continue this morning as called higher we started the day with Aug’21 trading up to $468.90. Volume soon fell away and we settled into a sideways pattern, and it seemed that many traders were holding back from committing beyond necessary hedging with recent sessions showing us that there is little depth to either side of the market and so increasing the potential volatility. Though we eased back from the morning highs there was contentment to consolidate and we continued broadly sideways for several hours, holding either side of unchanged levels during the early afternoon in calm conditions that were no doubt welcomed by many. Everything then changed in an instant as a push beneath $460 to explore underlying support triggered off liquidation and sell stops which served to underline the previously mentioned illiquidity and volatility with Aug’21 plunging by some $13 to a low of $446.30 on fewer than 1,000 lots before pulling straight back above $450 as buyers reacted to the move. Spreads were weaker once again with Aug/Jul’21 reaching a narrowest $0.50 before returning back to the $1.50 area late on while the flat price meandered along in the lower $450’s as longs looked to defend against any additional losses though the market lagged behind the No.11 with white premium values losing significant ground late in the day. Aug’21 settled at $453.20, concluding a difficult session which has seen the work of almost two weeks undone in less than 48 hours.

· As mentioned the white premium values were weaker with Aug/Jul’21 ending right on its lows at $80.00. Similar weakness down the board saw Oct/Oct’21 setting around $79.00 while March/March’22 closed at $79.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract