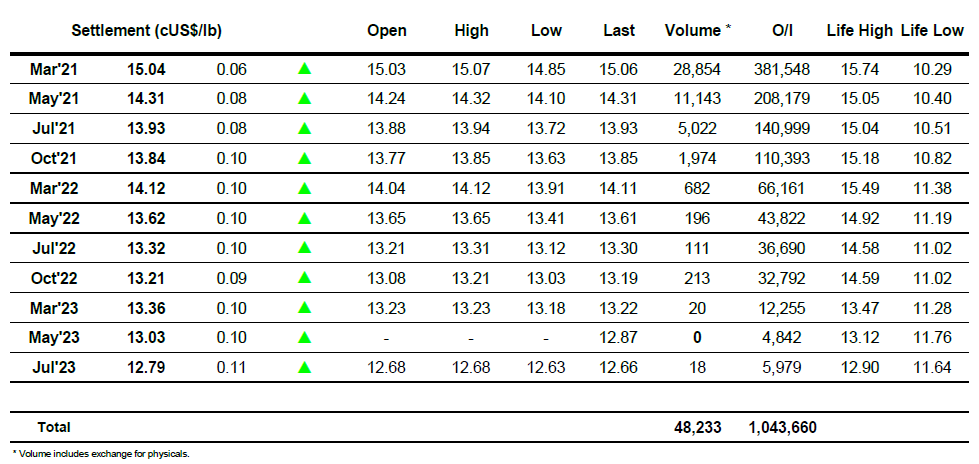

Sugar #11 Mar ’21

Having flirted with the 15c area over the past couple of sessions we found some early buying to set off on a positive note, trading up to 15.07 where we remained for a couple of hours before slipping quickly back to unchanged levels. With the macro firm it felt as though the specs would continue their recent renewed buying which has likely pushed their net long back towards the 210,000 lot area, something that with just three sessions remaining until year end they will likely want to maintain, however this was not immediately the case as we fell back to 14.85 midway through the day. Buying in this area protected yesterdays 14.83 low mark and though were remained weak for some time it eventually provided the platform to spring back upwards. With USDBRL back in the 5.18 area there continued to be no activity from producers as we quietly clawed back up the range to be trading near to unchanged levels as the close approached. Almost inevitably the specs brought out some MOC buying to ensure a settlement value above 15c for the front month despite the fact that the nearby March/May’21 spread was trading lower at 0.72 points, with similar defensive action seeming likely as Thursday’s year end approaches.

ICE Futures U.S. Sugar No.11 Contract

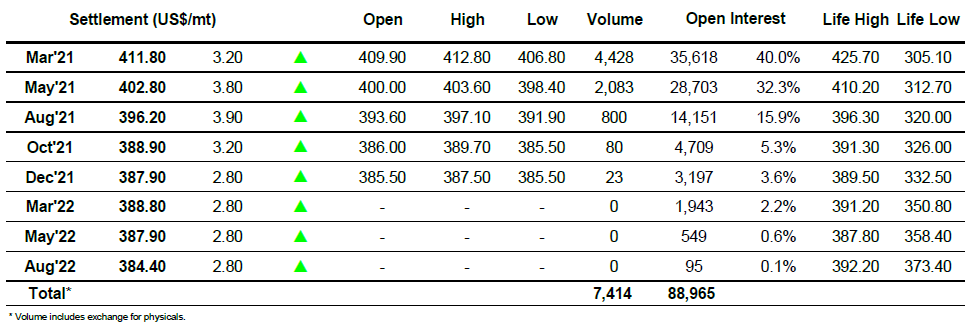

ICE Europe White Sugar Futures Contract