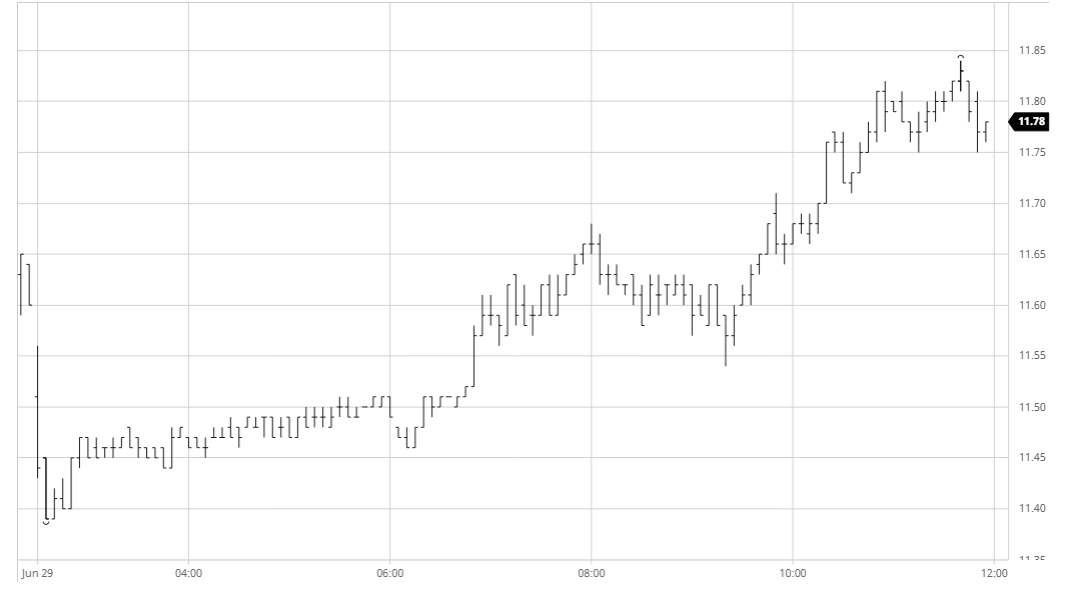

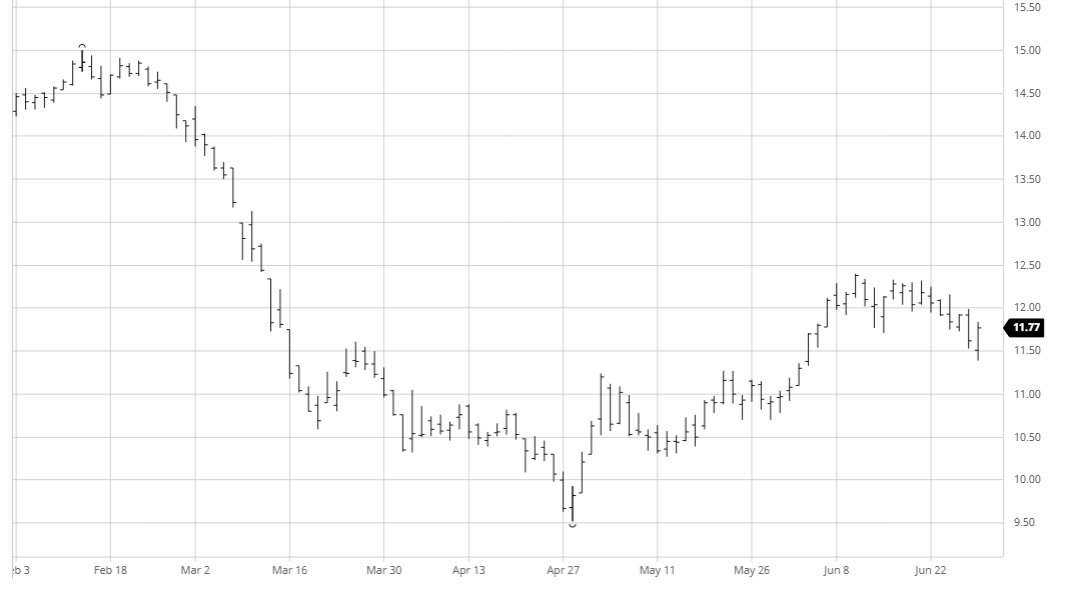

A weak technical conclusion on Friday combined with the COT news that as at last Tuesday the net spec position had increased to 58,272 lots long to leave prices called lower at the start of the new week. Some long liquidation has no doubt already been undertaken by the specs at the end of last week, and while the reported number is by no means huge, the fact that a good deal of these long will have been accumulated at higher levels has the potential to lead to fresh liquidation, particularly if the macro remains vulnerable. Following the early losses it was a morning of quiet consolidation with many traders content to wait and see where the increased afternoon volume would lead, and when the time came it seemed that the answer was upwards. Prices initially rallied up to erase the morning losses however a second more concerted rally was to follow which took prices onwards to a series of new session highs, culminating at 11.84 prior to some late book squaring. This uptick came in line with a broad recovery across most of the commodity sector and firmer equities which continue to defy wider concerns regarding the ongoing spread of covid-19, perhaps illustrating that concerns over the specs desire to hold longs are going to be purely centred around the macro picture. Settlement level was a little away from the highs at 11.77, representing a solid performance and decent turnaround following Fridays weakness. Maybe the fall was a false break and we will see a return to range bound trading.

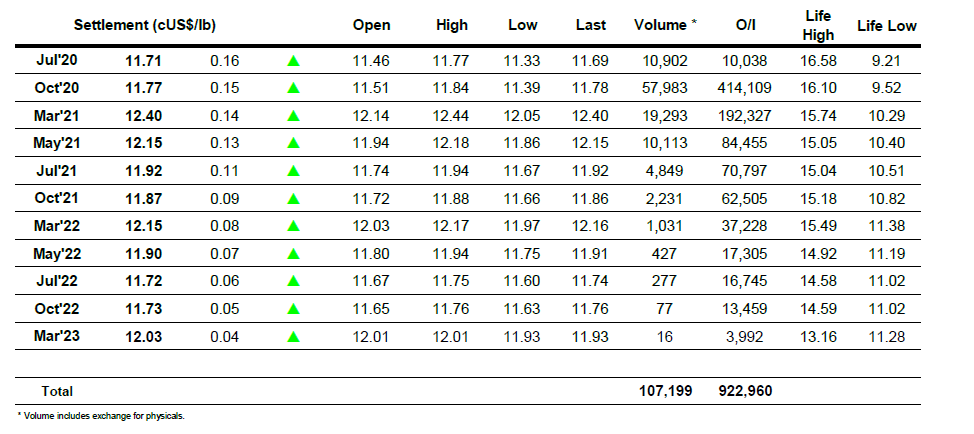

Looking ahead towards tomorrow’s Jul’20 expiry open interest has fallen significantly to 10,038 lots as at Fridays close, suggesting that we will see a relatively small tender when all is said and done. Today’s Jul’20 volume of 10,902 lots could well lead to a further reduction in this figure tomorrow.

SB Oct- Sugar No.11

SB Oct- Sugar No.11

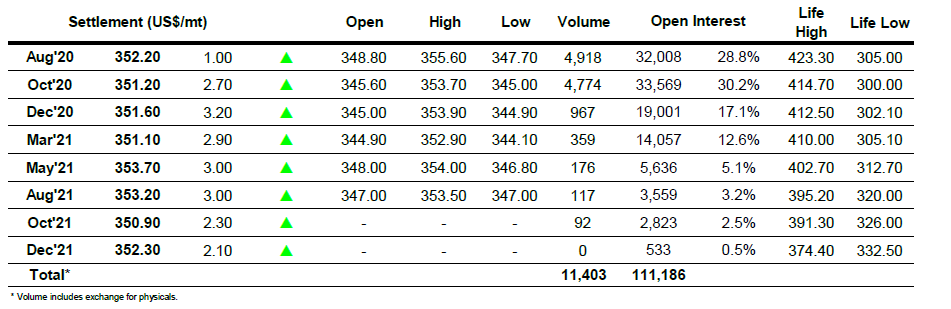

ICE Europe White Sugar Futures Contract