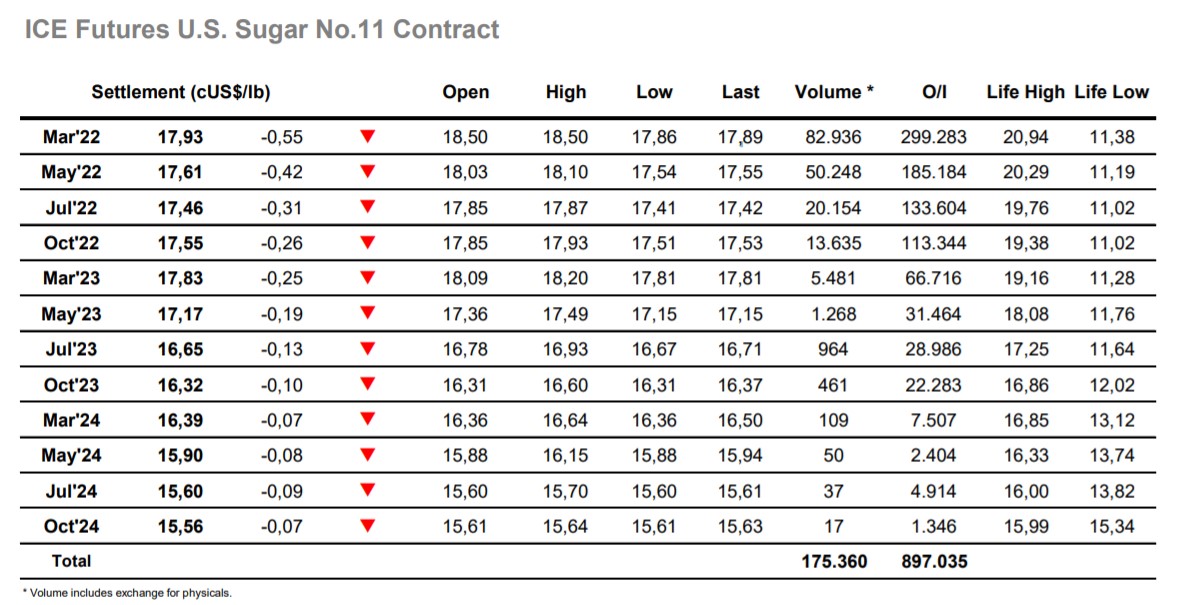

Sugar #11 Mar’22

An unchanged opening soon gave way to moderate losses and the March’22 contract eased back to 18.30 with limited buying on show to continue the recovery made yesterday. Light interest did then emerge, possibly buoyed by a generally firm macro showing and through the late morning and into early afternoon prices clawed their way back up to the 18.50 area where the start of some scale selling tempered progress. This still placed sugar at the bottom end of the macro and possibly raised hopes amongst day traders that prices could look to follow higher during the afternoon, however it was not to be as events too a sudden change. Fund selling sent March’22 slipping to the morning lows and as prices fell through 18.30 so stops were triggered to leave the market staring in the face of 18c once again. Spreads too were suffering with March/May’22 handing back recent gains to find itself near to 0.30pts, with bigger losses seen against the middle and back months. There was no sign that this contrarian action would be reversed as sugar sat alone at the bottom of the commodity lists that were still mostly green, and further selling (liquidation) sent March’22 all the way back to 17.86 by the end of the session. Settlement at 17.93 asks technical questions with the January low of 17.60 now back in view and much will depend upon the desire of funds to further liquidate or turn short with scale buying expected at each point lower as consumers continue to take advantage.

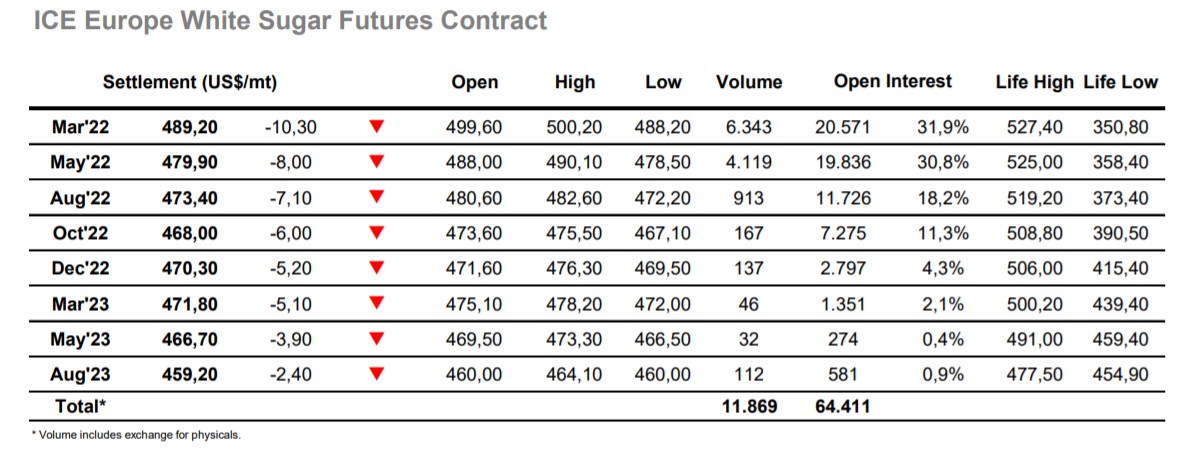

Sugar #5 Mar’22

The strong gains made for the market yesterday provided some belief for longs that we may be trying to stabilise and despite slightly lower values this morning the market was proving to be calmer than of late in finding support within the upper $490’s. This led things quietly into the afternoon and with the macro performing solidly it appeared that an uneventful session was set to play out. Of course, sugar has been no such thing recently and so it again proved as spec selling reared its head to push quickly back down through the $490’s, aided by the limited number of resting orders as we gave back all of yesterday’s gains. Consume interest began to emerge as we worked beneath $492.00 but it was purely confined to scales and as such the market showed no sign of mounting a swift recovery. Spreads too were experiencing losses though nothing too severe as March/May’22 held just beneath $10, while for the white premiums things were fairly stable with the heavy losses for No.11 seeing March/March’22 back around $95. The final stages saw further new daily lows recorded as we printed beneath Monday’s $489.10 mark to record the lowest levels since 11th January. A weak settlement was made at $489.20, and we move to tomorrow appearing vulnerable having resumed the downtrend once more.