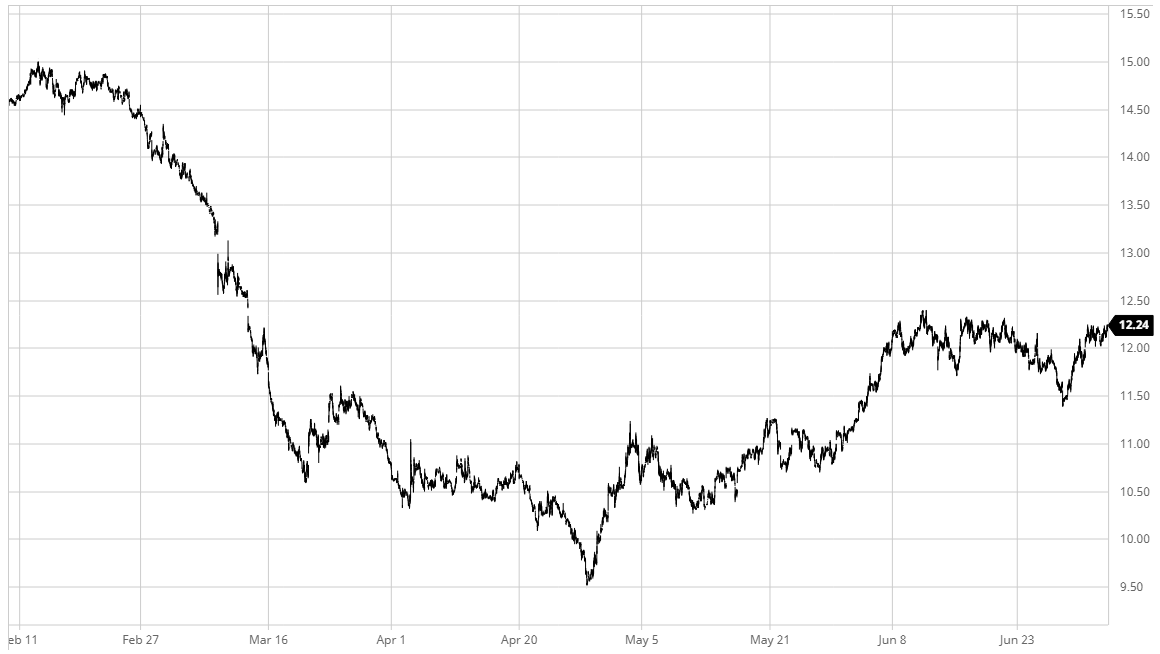

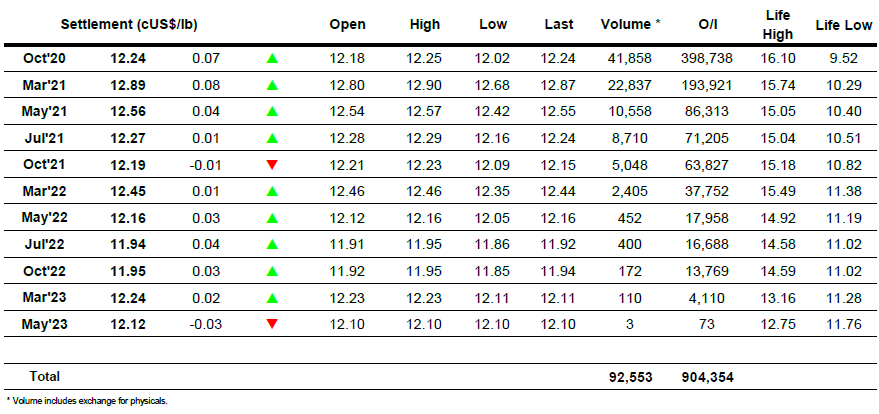

• The market picked up where it left off with early trading seeing prices nudge up slightly to trade back above 12.20 for Oct’20. Volume was very slow though and with the macro continuing to be quietly steady there was little reason for the specs to step in given their current long holding. An unexpected decline to 12.02 late in the morning broke the initial consolidation, however it seemed without merit and having held above 12c prices proceeded to work back upwards into the range. Better than expected US payrolls gave the macro a slight boost and encouraged buying that too Oct’20 to 12.24 by mid-afternoon, but on continuing light volumes we still lack the impetus to challenge the recent highs at 12.40 and instead settled back in to the range once more. Support for the closing stages took us to a marginal new session high at 12.25, matching yesterday’s mark with a positive settlement established just a point below at 12.24 as we head into the extended 3 day weekend for the US Independence day holiday.

SB Oct- Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

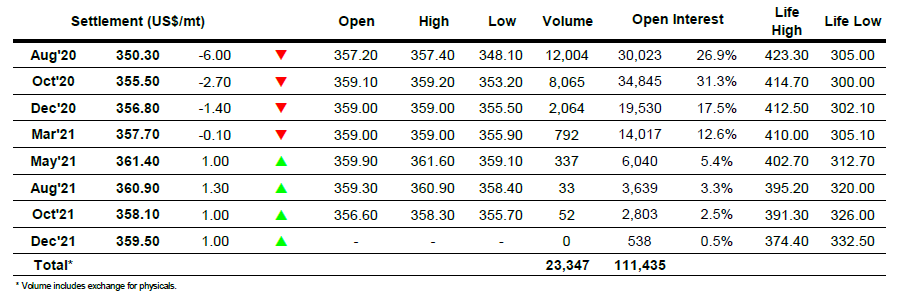

ICE Europe White Sugar Futures Contract