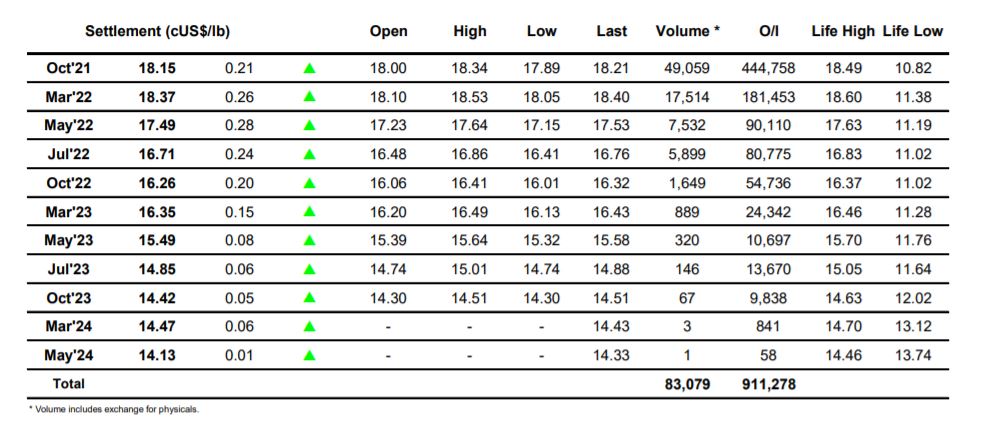

Sugar #11 Oct’21

The failure to maintain the sweeping gains recorded yesterday may have put many off of this market however the specs are currently of a positive mindset as shown through todays early action which took Oct’21 up through 18c once again and steadily on into the teens. This provided the basis to continue onward and though volume remained on the low side we were trading up into the 18.20’s by early afternoon. Of course in such circumstance where we see low volumes the market retains a vulnerability and this was seen midway through the afternoon with some long liquidation briefly sending Oct’21 back to overnight levels before an equally speedy recovery as defensive buying crept back in with longs keen to maintain the technical strength into the forthcoming 3 day weekend. This desire took us all the way to new daily highs at 18.34 with the close fast approaching, though despite the renewed strength for the flat price there was some weakness creeping back into the Oct’21/March’22 with the differential back beneath -0.20 from a morning high at -0.12. The final 15 minutes saw some end of week position squaring that sent us back to mid-range, and though Oct’21 settled positively overall at 18.15 it was less than the specs had been hoping for at the conclusion of an inside day.

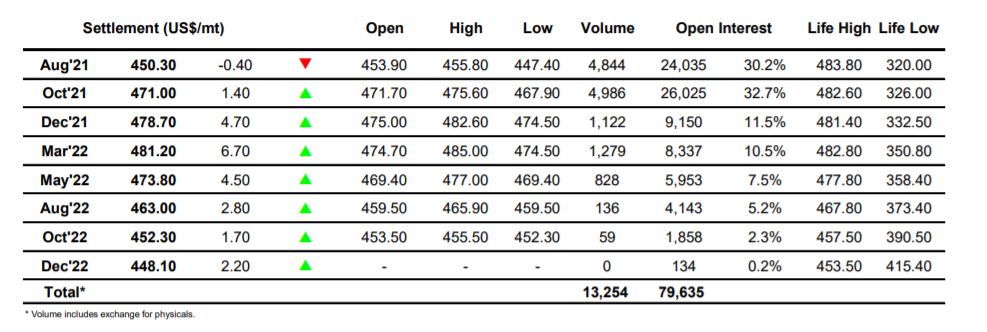

Sugar #5 Oct’21

There was buying around for the whites this morning as we shrugged off the disappointment of yesterday afternoons pullback to work back into the low $470’s for Oct’21. Volume was relatively thin outside of the Aug/Oct’21 spread and it may be for that reason that we stopped short of yesterdays highs, instead simply holding the morning gains to drift quietly along while the spread lost a little ground and traded back beneath -$20.00. There was a brief interlude to sideways pattern midway through the afternoon with a small amount of long liquidation sending the price quickly down to $467.90 before an equally sharp recovery left us back where we started and re-entering the sideways pattern once again. The final hour saw fireworks as first the market pushed to new session highs before some late position squaring sent Oct’21 all the way back down to $469.60. Settlement was established at $471 to maintain an air of positivity which will be monitored on Monday when the white hold centre stage as No.11 enjoys a market holiday.

A mixed day for the white premiums saw the front month lose ground on the late decline to leave Oct/Oct’21 settling at $70.90. Down the board we were marginally up for March/March’22 at $76.20 while May/May’22 closed at $88.20.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract