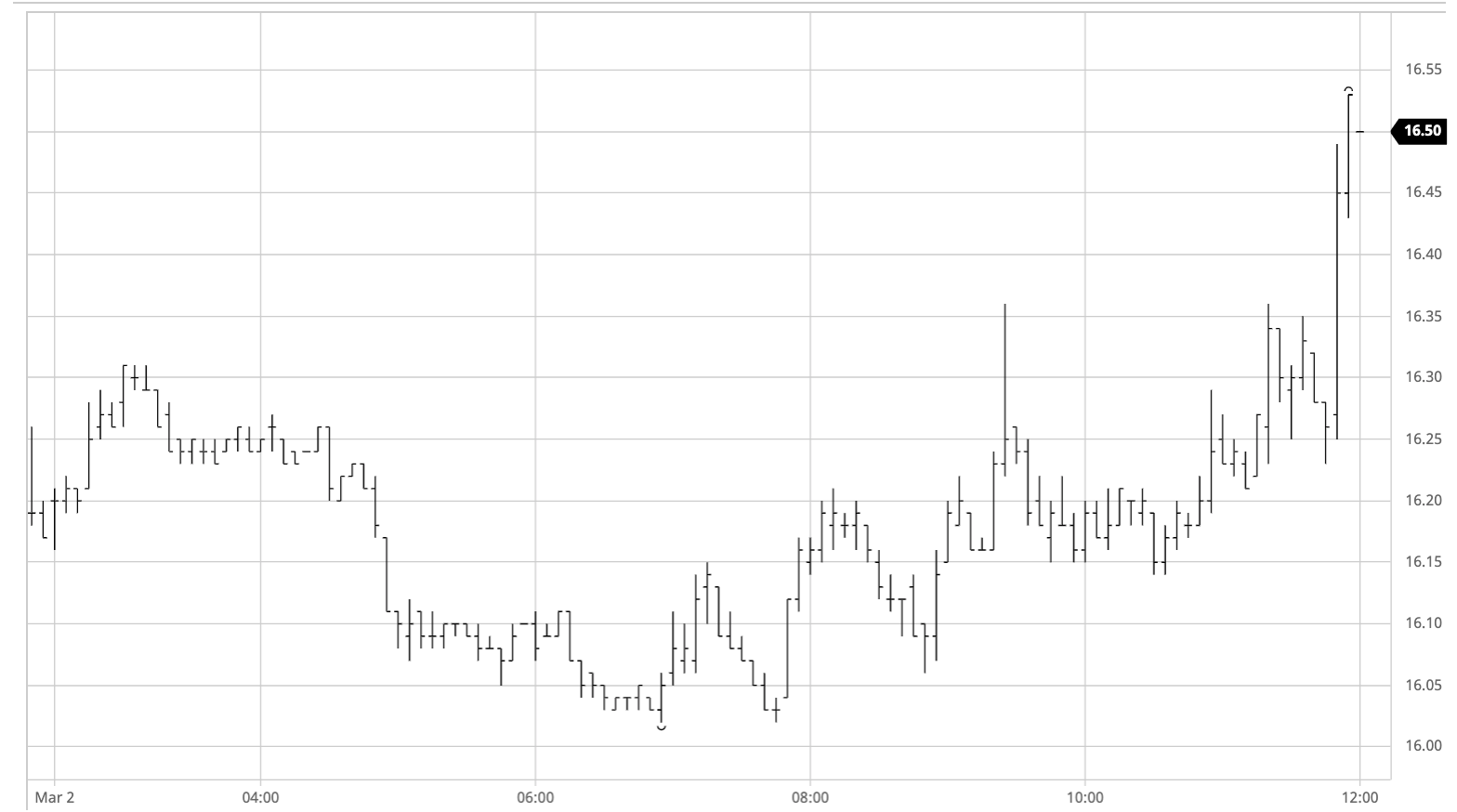

Sugar #11 May’21

There was some early buying for the market today which lifted nearby values by around 10 points initially, however the recent woes have undone some of the former confidence and we soon slipped back to be adding lower by late morning. May’21 then began to languish for a few hours but though a couple of pushes were made to test the 16c area it held firm and provided a platform from which we were able to consolidate with longs looking to provide support and halt the lower trend. Climbing back into positive ground we found buying returning to the May’21 spreads for the first time in a few days and alongside the outright support it enabled the front month to build sufficiently to be established in positive ground as we moved through the final hour. Still few would have expected what was to follow on the close as some aggressive buying sent May’21 up from 16.32 to 16.46 on the call, with the weight of volume at the higher end ensuring a firmer settlement level at 16.43. The momentum continued into the post-close with a session high recorded at 16.53 while May/Jul’21 reached a widest 0.61 points at the death. Whether this is the catalyst for a renewed push above 17c remains to be seen with the USDBRL at 5.70 likely to attract interest from the recently shy producers, however it will certainly provide heart to the longs who have broken the sequence of three successive lower days.

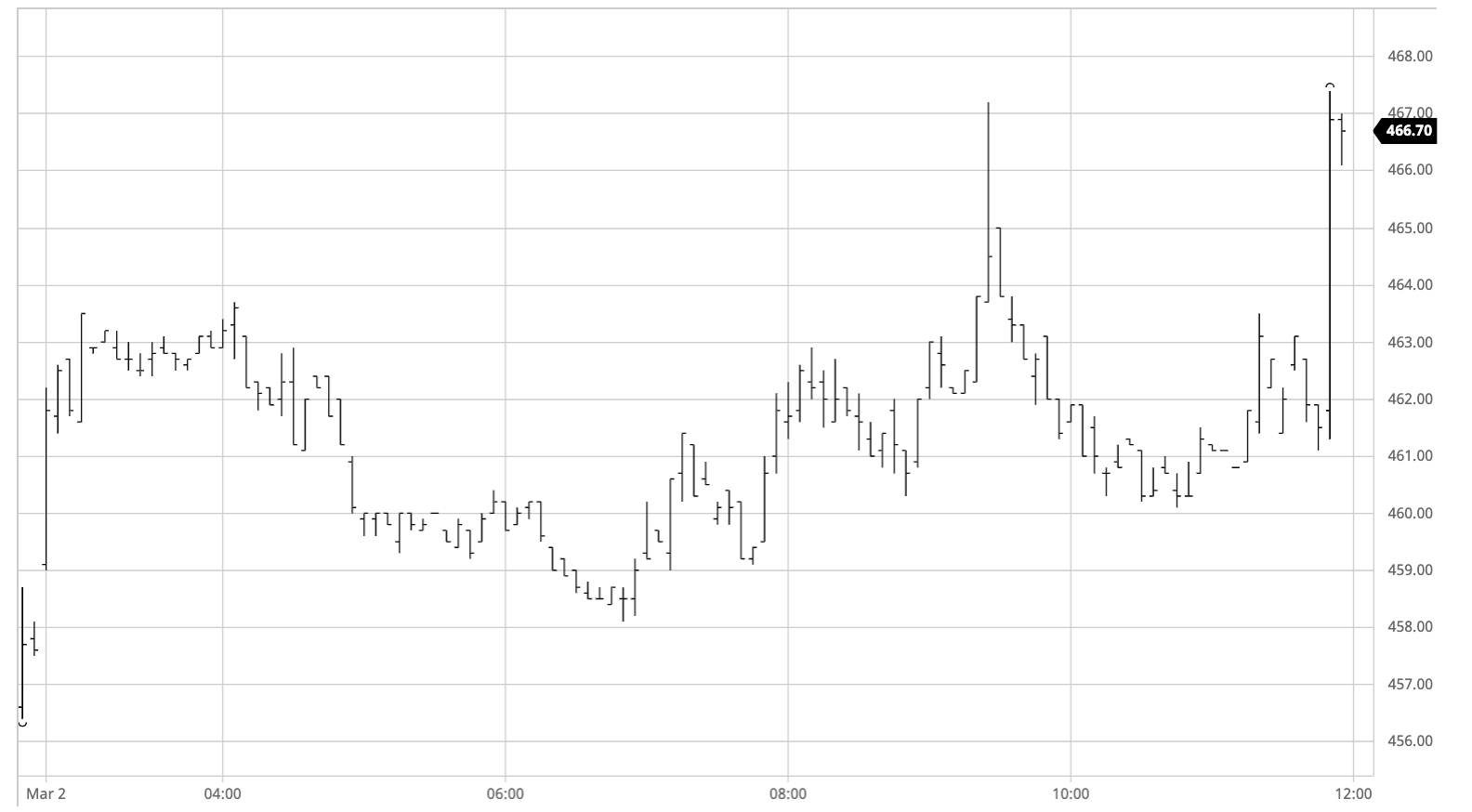

Sugar #5 May’21

The resurgence in whites values yesterday came against a backdrop of weaker raws and a neutral macro, so while unexpected it was not too much of a surprise to see buying once more thins morning in a continuation of the move. May’21 worked around $5 higher during early trading before stalling as the No.11 again dragged prices back despite a further widening of the white premiums, and by mid-session we were almost back to unchanged levels. The new found resilience that this week has brought was still there to be seen and prices soon began to climb once more to challenge the morning highs, moving upward in a series of waves. Breaking above $464 we saw a very brief spike to $467.20 as a couple of light buy stops were elected however this was soon followed by a retreat into the range and with no significant macro support it appeared as though we were destined to remain nearer to $460.00. This continued to be the case right the way into the close when from nowhere the front month shot up by some $6 to a new session high mark of $467.40 on just 300 lots of volume as longs looked to dress the close. These sharp gains were maintained on the post close with a positive settlement level registered at $465.80.

White premiums were again significantly firmer on todays moves with May/May’21 reaching a widest $106.50 intra-day, and despite easing back it remained around $104 on the close. Aug/Jul’21 was near to $101 late on while Oct/Oct’21 was moderately up at $92.50.

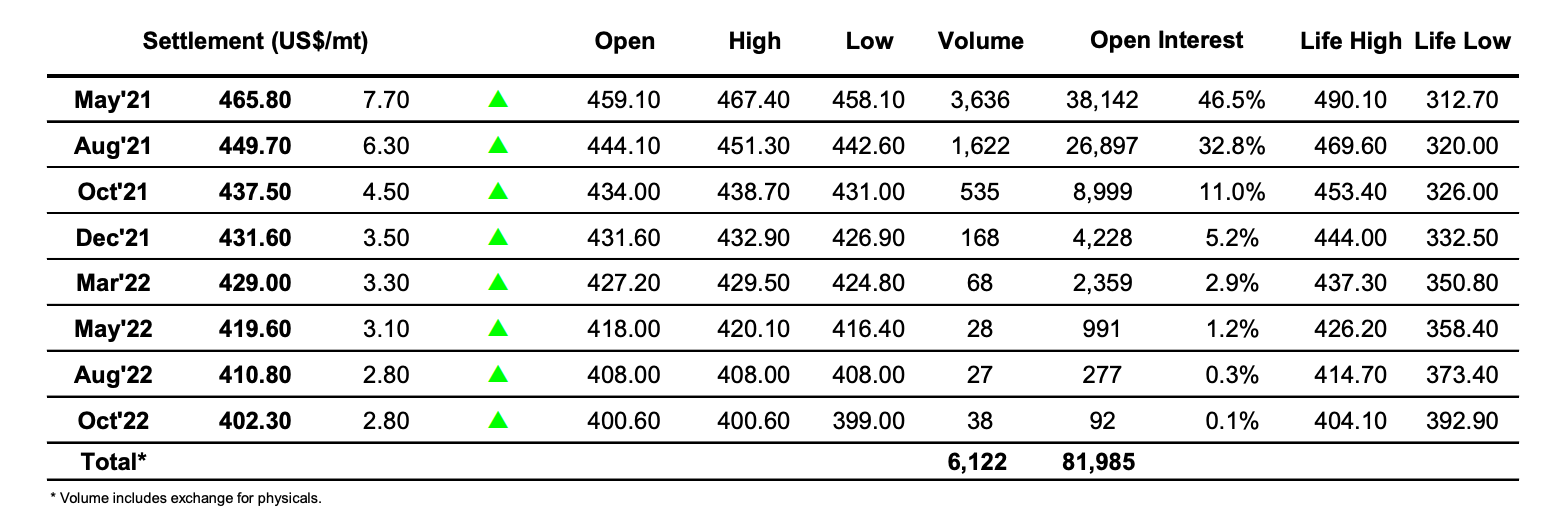

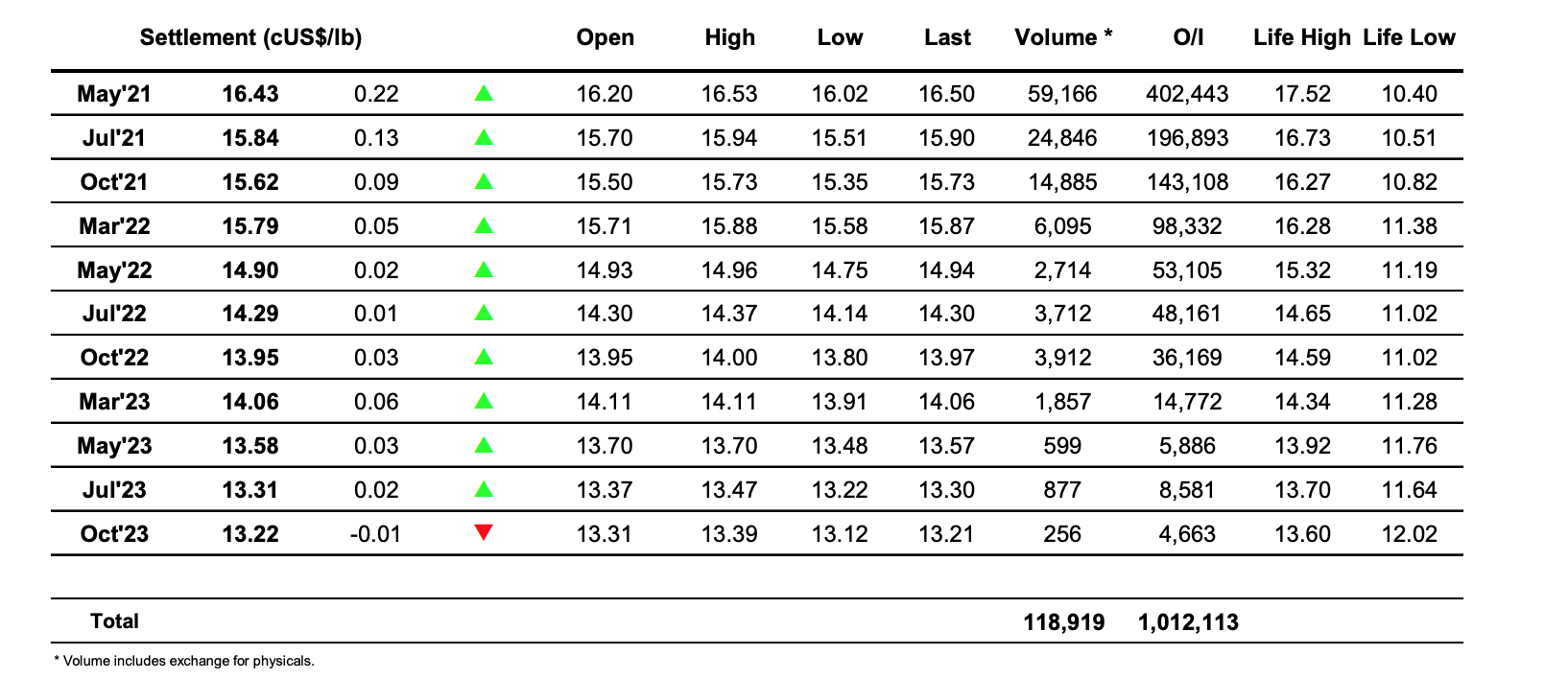

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract