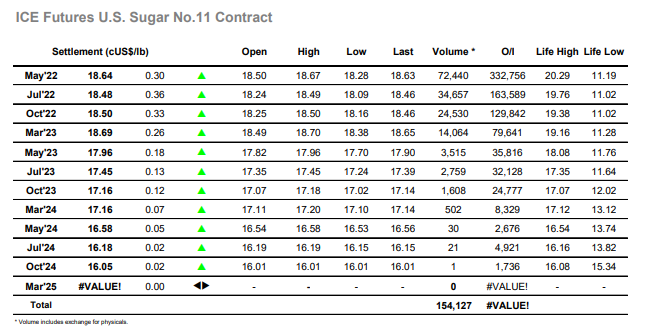

Sugar #11 May’22

There continues to be a lot of strength for the grains and energy sectors, and this encouraged some early spec buying to the No.11 today regardless of the lack of correlation to the wider macro in recent times and the more bearish fundamentals being seen. The gains extended to 18.59 for May’22 before stalling against an assortment of producer scale selling and while there was no immediate desire for the longs to close back out the loss of momentum led prices downward and sparked some day trader liquidation on the way back to unchanged. Rather than end the positivity this merely served to be a blip with some fresh buying emerging from US based specs during the early afternoon, however it lacked in size and led to an afternoon of ebbs and flows as the faster moving entities swung positions around. In contrast to the flat price gains the day saw the May/Jul’22 struggle to maintain above 0.20 points with selling pushing it to a 0.15 low at one stage, a concerning action reflective of the more bearish fundamental view being held by many in the trade currently. The flat price surged ahead to new highs during the final hour and marked another strong closing value for May’22 at 18.64, technically positive buy relying on the specs to continue buying if we are to continue upward with scale selling continuing above from producers.

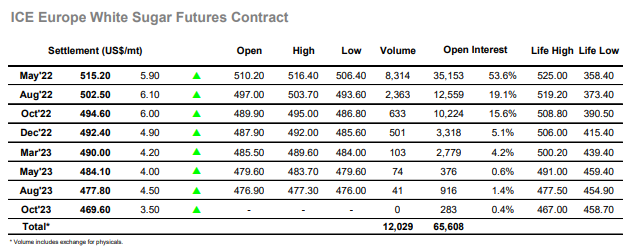

Sugar #5 May’22

May’22 jumped by around $3 on the opening in reaction to No.11 values however the buying soon dried up which left May’22 slipping back down and into debit with the early afternoon seeing a low at $506.40. There was selling appearing for the white premiums with refiners keen to take advantage of the recent surge in values, and this contributed to the May’22 struggles where the premium value was back around $102. With no significant selling above the market moved sharply away from the lows on limited volume and this action provided the impetus from which prices could rebuild over the course of the afternoon, seeing some swings along the way to making 3-month highs and further improving the technical picture. Session highs were recorded as we moved onto the close, a positive action which ensured a strong settlement level of $515.20, while the premiums were also rediscovering some strength with May/May’22 trading back above $104. With such a worrying situation in Ukraine still dominating the wider macro the technical positivity may be called into question if only the situation could improve, however one thing which does seem certain is that increased volatility is set to remain for the time being.