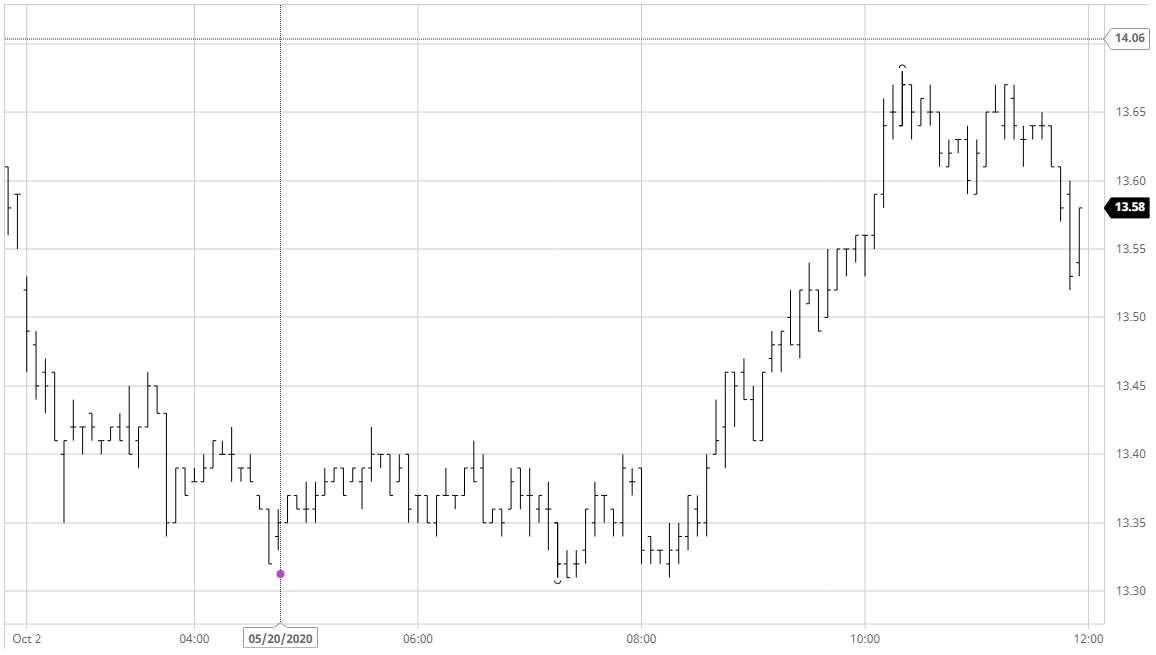

Mar 21 – Sugar No.11

The news that US president trump has tested positive for coronavirus prompted a weakening for commodities and equities this morning and with the sector already showing losses led by the energy products we quickly pulled back to 13.35 basis March’21. Volume on the decline was remarkably light as we again saw that there is only limited underlying buy interest when the specs stand back, and so it remained for several hours with prices skimming along quietly in a narrow range. A White House statement that Trump is only showing mild symptoms and is carrying out his duties prompted some risk to return to markets, pulling the wider macro up from session lows though the wider CRB remained in net deficit for the day. No.11 has been rather contrarian of late and this continued as spec/algo buying returned, seizing the opportunity to push through the relative vacuum and again search out recent highs in the quest to continue the technical push. March’21 climbed back to 13.68 before pausing within a few points of the highs and remained in this same area until the final 15 minutes when in contrast to recent days we saw prices ease back as some pre-weekend position squaring took place. With the macro so important to the specs hopes of continuing upwards eyes will surely remained focused upon Trump and the US in the coming days with fundamental factors put to one side.

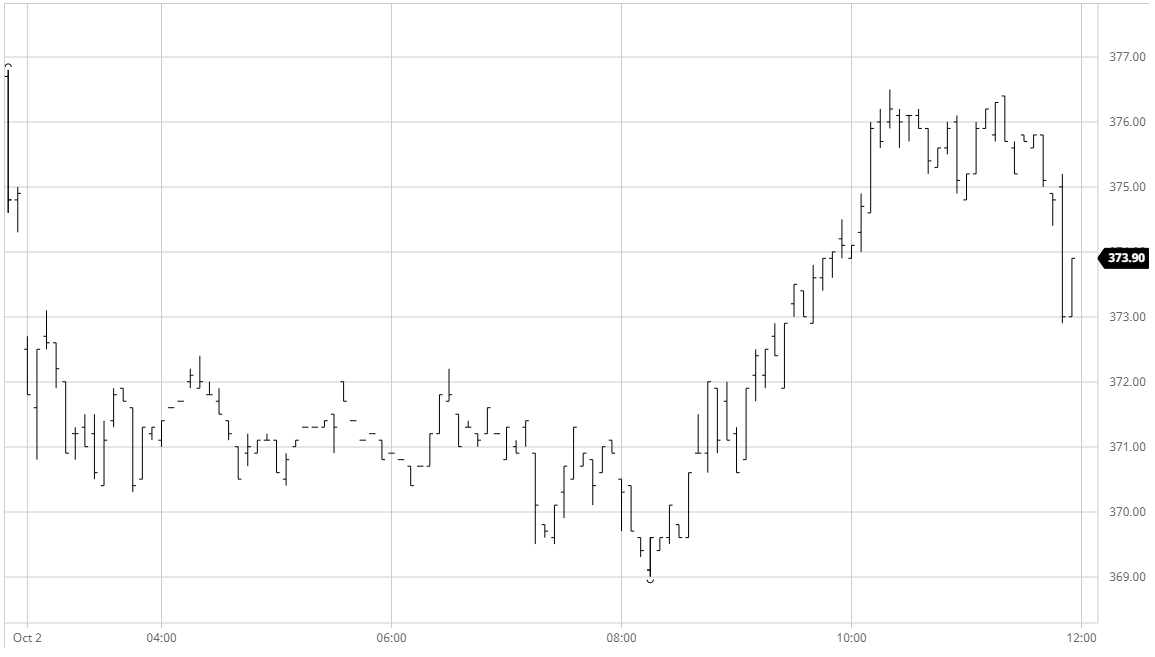

Dec 20 – White Sugar No 5

News that US president trump has tested positive for coronavirus prompted a risk off attitude to commodities this morning and we gapped lower with Dec’20 moving back town towards $370.00. In truth there was not actually much selling (or indeed volume) on the decline with the move seemingly providing further evidence that the recent strength is heavily reliant upon the specs and algorithmic traders with limited buying in place as they step back. A long slow morning of sideways trading continued into the early afternoon however a recovery then arrived as a White House statement that Trump shows only minor symptoms bought some buying back to the commodity sector. For many products this simply involved a reduction in the net losses but as we have seen recently there is a desire to be long sugar and this saw a better recovery than most of the sector as we moved into positive ground to reach $376.50. Despite the gains we continued to lag a little behind the No.11 and its far greater spec activity which narrowed the already pressured white premium values a little more, March/March’21 to $75.50 and May/May’21 to $83.50. This will continue to encourage bears that the recent strength is merely a spec dominated play although given their capacity to go long this game may have a little further to yet run. The final couple of hours saw consolidation near to the session highs however some pre-weekend long liquidation/position squaring sent values back into the range going out with white premium values concluding at session lows.

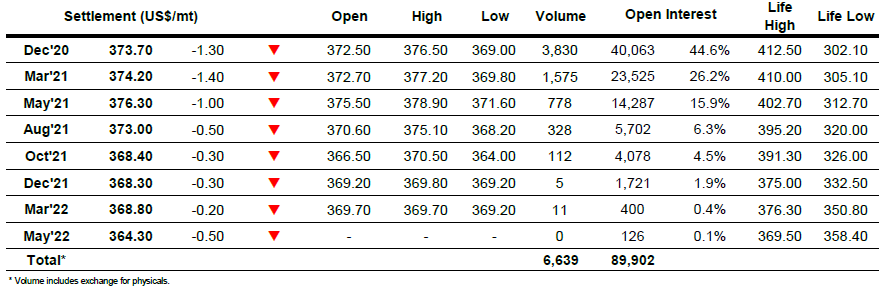

ICE Futures U.S. Sugar No.11 Contract

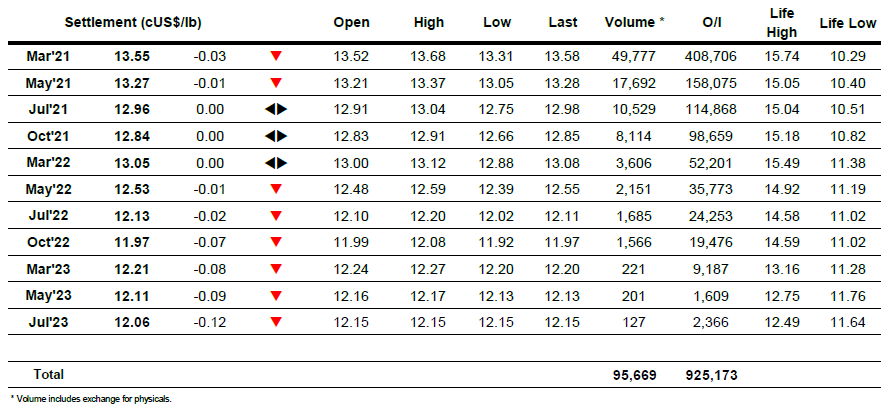

ICE Europe White Sugar Futures Contract