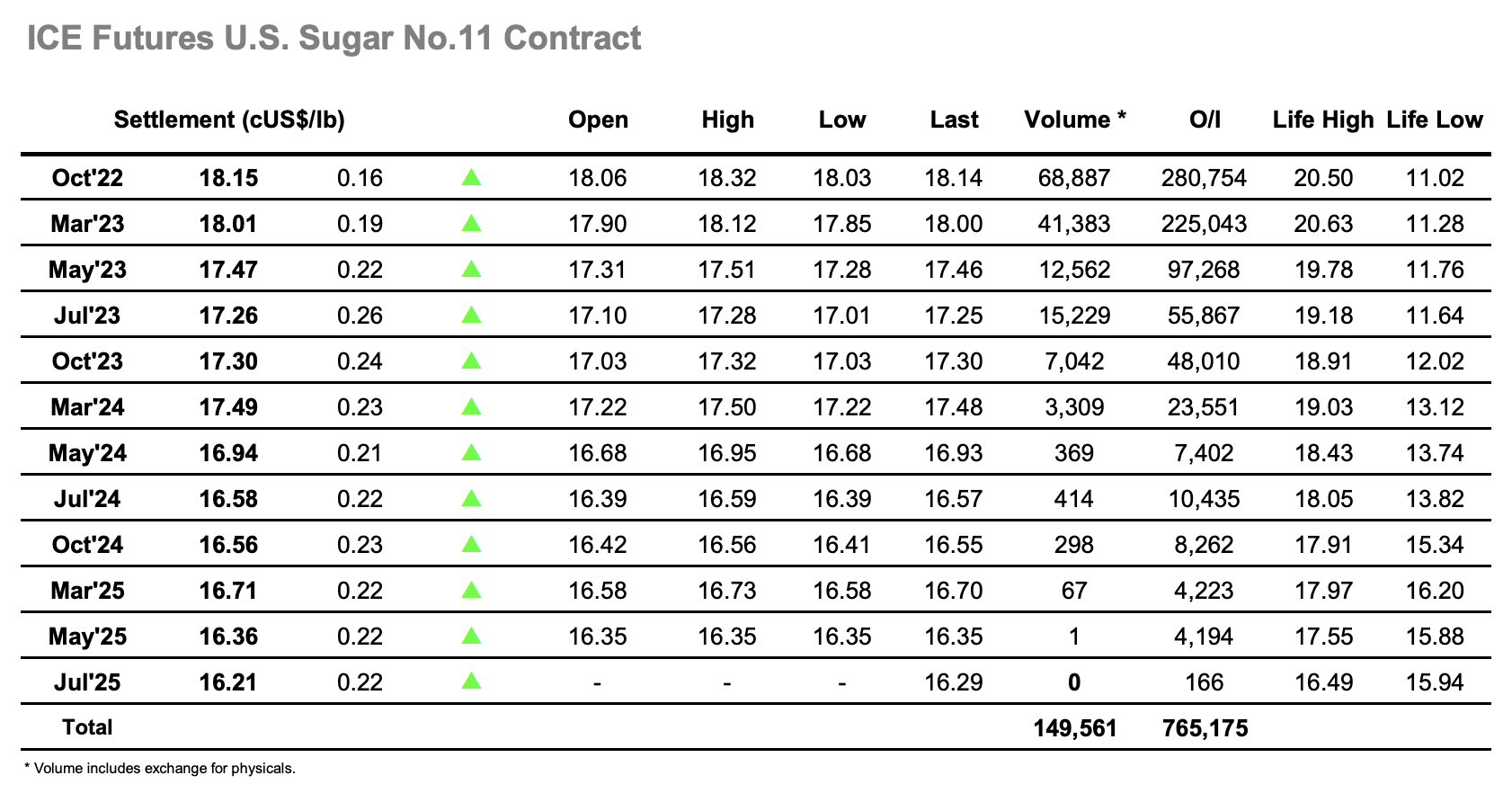

Oct’22 bolted out of the traps and traded up to 18.26 across the opening exchanges before easing back down to consolidate near to 18.15 for the rest of the morning. The macro was showing more positively today (albeit only to recover part of the week’s losses) however the greater sentiment was being driven by the white sugar market where the pre-expiry continues for Oct’22. No.11 continues to do its own thing with the lack of reaction seeing the spot white premium widen out beyond $170.00, and it was not until the early afternoon that some spec buying crept in to pull Oct’22 up to 18.32 and provide a little more stability though we still lagged significantly compared to others. Recent moves have stalled above 18.50 and for today at least the market was not even able to mount a push to that area with a more prolonged second push up again stalling against a relative wall of selling at 18.32 and so leading prices back down to mid-range for the closing stages. Spreads remained firm through the day though a flat movement down the board meant that few gains were made to the Oct’22 values. Selling appeared during the closing stages and sent Oct’22 crashing back down through the teens to settle at 18.15, sending the market into the 3-day weekend still firmly bound by the confines of the range.

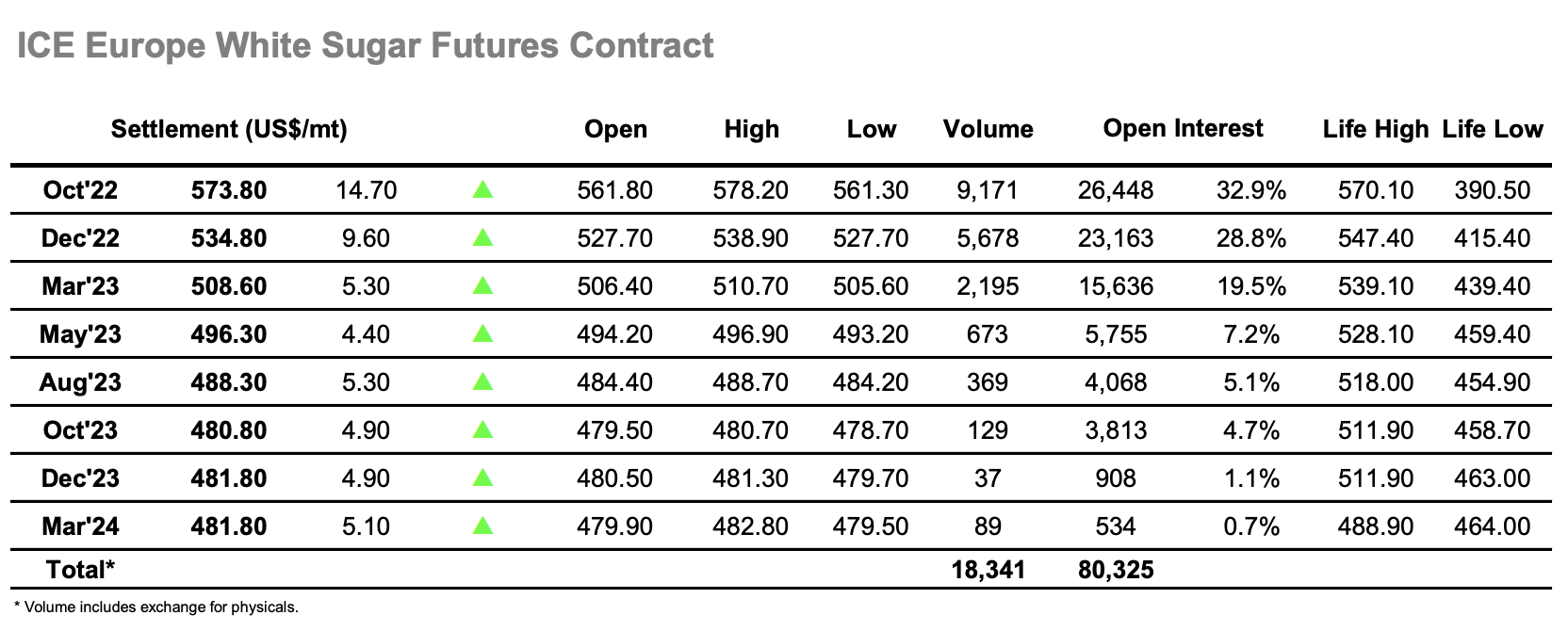

There were question marks as to whether Oct’22 could find the momentum to push through resistance in the mid $560’s and mount a challenge of the contract highs but these were answered emphatically with an early push through to $567 which provided technical momentum. Progress was more sedate for a period until late morning when a low volume push sent Oct’22 through to new contract highs in the low $570’s, a very unspectacular move with which to reach such a milestone. The flat price squeeze was combining with further solid Oct’22 spread buying to push Oct’22 up further still, with efforts through the early afternoon ultimately leading to a new high at $578.20 before retreating to the range against some profit taking. Oct/Dec’22 topped out at $40.00, just beneath yesterday’s widest level, but then consolidated a small way below to end the week at $39.00 while the flat price continued along quietly to settle at $573.80. This represents another strong technical showing though with open interest soon to cross and make Dec’22 the largest position the coming days will see Oct’22 have less influence on the day-to-day movements. Monday sees No.11 closed for a US holiday, an interesting opportunity for traders to try and further influence an already volatile board with fewer other influencing factors in play.