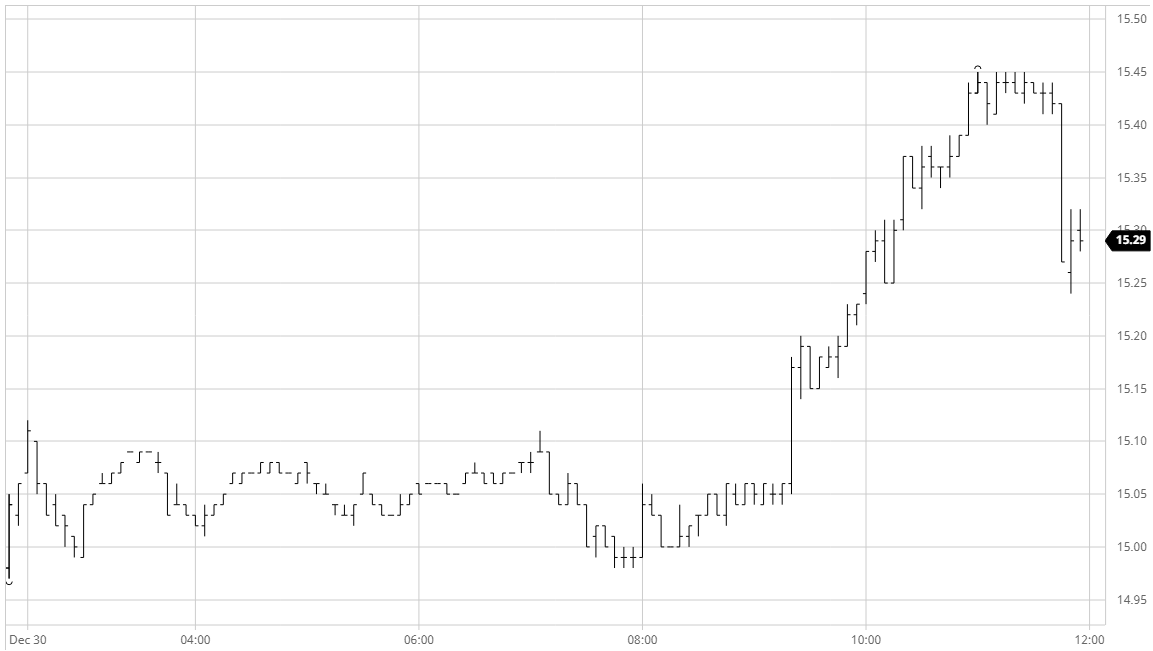

Sugar #11 Mar ’21

After a succession of relatively low volume sessions this morning plumbed new depts with barely 5,000 lots traded across the board as March’21 held in a narrow range either side of last night’s 15.04 settlement level. Even the US morning commenced with barely a murmur though a brief push from the short side soon after did send March’21 to a marginal new daily low at 14.98 before light defensive buying emerged to pull us back up to unchanged levels. Nearby spreads were little changed on the light volumes that they managed to pick up and we seemed set to stagnate in the range until spec buyers emerged with some more substantial buying. March’21 shot up to 15.20 on a 10 minute volume of 4,400 lots and suddenly we were back into pre-year end positivity with producer selling remaining rather thin on the ground. This set the tone for the rest of the session and with the specs reinvigorated there were further waves of heavier buying that took the price to 15.45 as we entered the final hour. Spreads were now much firmer as a consequence of the nearby buying with the March/May’21 out to 0.82 points while for the flat price we suddenly have the 15.66 high mark from 17th November back in our sights. We seemed set to end at the highs until the final 15 minutes when some position squaring/long liquidation occurred and sent March’21 back down to 15.24 in quick time, with the call then seeing some mixed activity to leave March’21 settling at 15.28. despite the late pullback this still provides a good platform for the fund longs as we wait to see what they have in mind as we move into the final session of the year tomorrow.

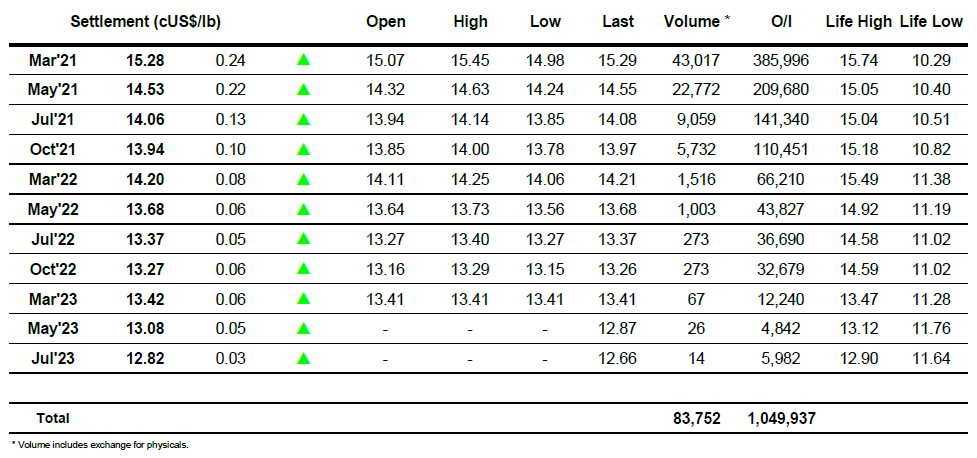

ICE Futures U.S. Sugar No.11 Contract

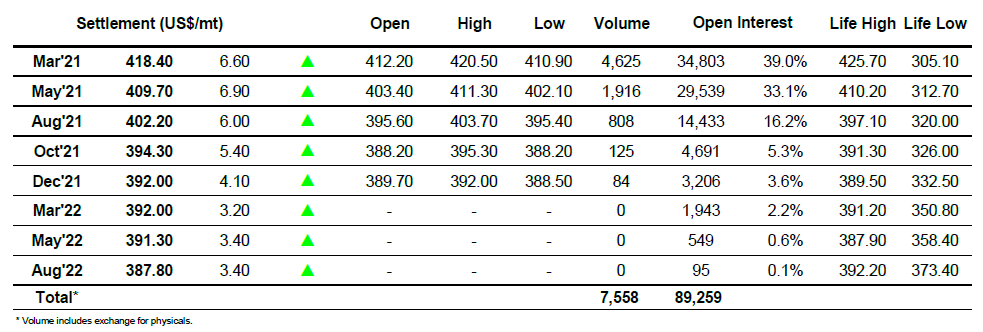

ICE Europe White Sugar Futures Contract