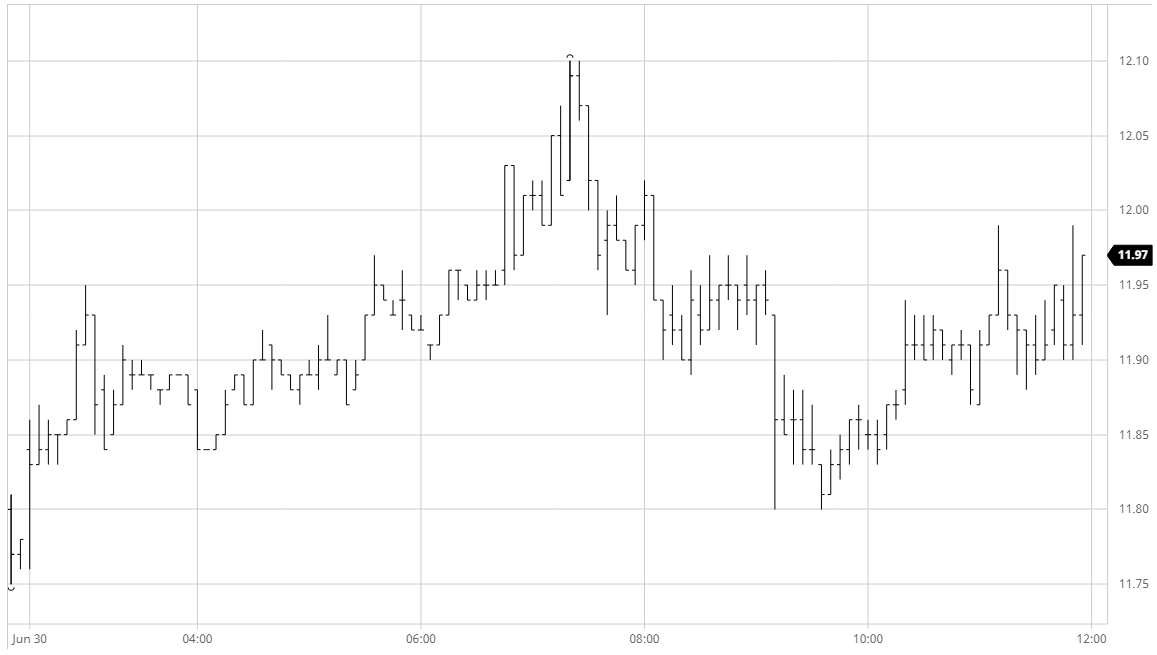

• Yesterday afternoons resurgent performance had clearly laid the groundwork for a continuation with steady buying holding prices in credit throughout an otherwise slow morning. Tonight’s Jul’20 expiry was proving to be similarly uneventful with little movement in the spread values, as Jul/Oct’20 remained at a small discount between -0.05 and -0.10 points on expectation of a small delivery. The increased volume that arrive with the US morning initially kicked Oct’20 ahead, working back up beyond 12c to soon reach a high of 12.10, however the macro support upon which we have become so reliant was lacking and as the spec buying eased we swiftly fell back from the highs. A short period of mid-range consolidation followed before another burst of long liquidation sent Oct’20 back to 11.80 before things once again calmed as specs retreated. Buyers returned during the final couple of hours and sent Oct’20 back towards 12c once more, likely defensive buying from longs to ensure a positive close as we mark the half year end.

• The Jul’20 tender has seen a relatively small delivery, currently thought to be 4,789 lots (243,293t) with the expectation that all will be of Brazilian growth. Full details will be published by the exchange tomorrow.

SB Oct- Sugar No.11

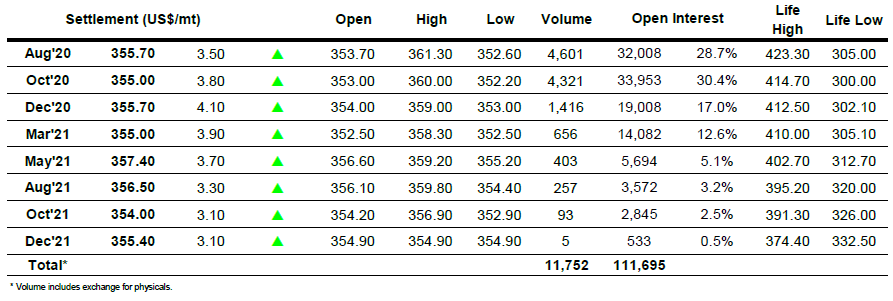

ICE Futures U.S. Sugar No.11 Contract

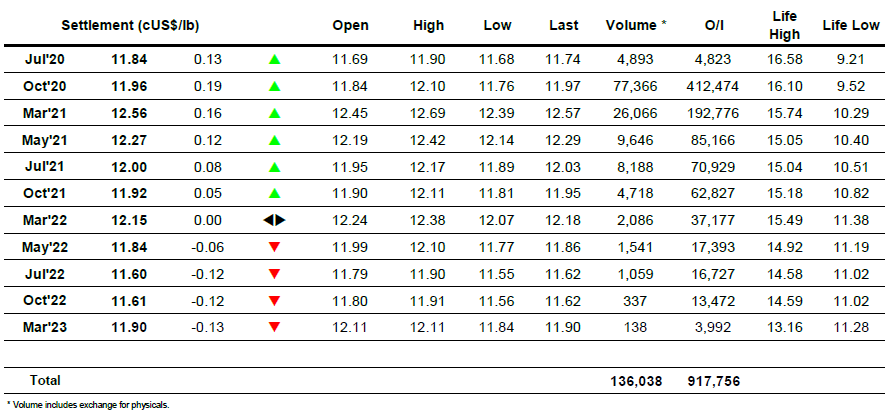

ICE Europe White Sugar Futures Contract