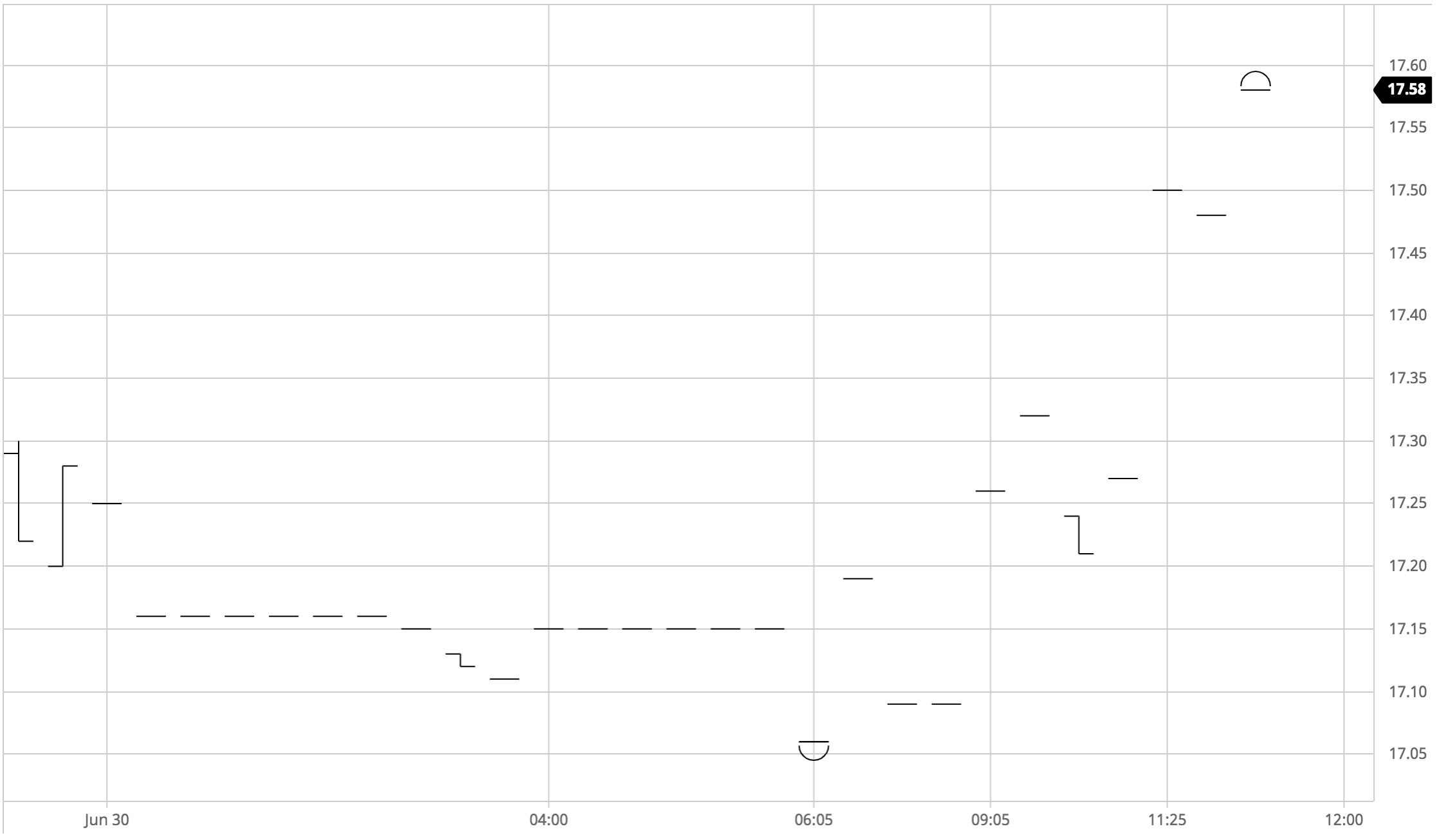

Sugar #11 Oct’21

A very slow start to the day saw Oct’21 holding a range either side of last night’s 17.54 settlement level and with a good deal of focus upon tonight’s Jul’21 expiry we continued quietly throughout the morning. The arrival of the US morning failed to bring any additional interest from specs and with the market maintaining the same non-descript range it seemed that we would be destined to reach the half year point in very quiet fashion. The specs had entirely different ideas however and moving through the afternoon we saw the first signs of activity from them help take Oct’21 up to 17.70, still well beneath the early June high of 17.94 but positive from a technical perspective. As we entered the final hour things took another significant upturn with a very aggressive burst of buying pushing through to new session highs with some light buy stops triggered in reaching 17.82 and suddenly the bulls were visible and talking the market higher still. Frosts in Brazil and a generally positive macro were both being spoken of and these factors combined with our own technical strength encouraged a final burst of spec buying for the close as Oct’21 rocketed on to 17.93, just a single point shy of its June high. So an impressive turnaround from a low of 16.44 at the start of last week leaves the market positively situated as Oct’21 takes over at the top of the board. Specs will no doubt want to maintain the initiative and continue higher and with producers generally quiet an 18c handle and the May’21 18.23 high mark suddenly feel well within reach.

· Tonight’s Jul’21 expiry has seen a small tender of 2,587 lots (131,426t), with the Jul/Oct’21 spread settling at -0.26 points. Early talk is that Viterra are the sole deliverer with Wilmar receiving.

Sugar #5 Oct’21

Yesterday’s rather flat session still served to cement recent gains and we continued in the same vein this morning with nearby values trading marginally lower but never really appearing to be under any great threat. Volumes were very light throughout the morning and the flat-lining extended well into the afternoon with the start of the Americas day failing to bring any fresh volume which would be needed to enliven the situation. It was not until mid afternoon that the market started to show signs of life and again the action was being dictated from the long side with specs pushing the Oct’21 contract, while Aug’21 got its own helping hand in the form of spread buying, reversing some of the recent losses with Aug/Oct’21 pushed back up into the teens from a morning low at -$24.50. Over the course of two waves of buying Aug’21 reached a high at $444.40 with Oct’21 up to $462.50 and though there was some profit taking seen at the higher levels we continued firmly as we moved into the final hour. Surging No.11 values then encouraged us to move higher still during the losing stages and we reached new highs for Aug’21 at $450.00 and Oct’21 at $468.10, and with Oct ’21 settling only just below at $467.00 there is an air of technical positivity moving into the third quarter of the year.

· White premium values made good strides of recovery today. Closing values showed Oct/Oct’21 up at $72.60, March/March’22 at $73.60 and May/May’22 at $88.80.

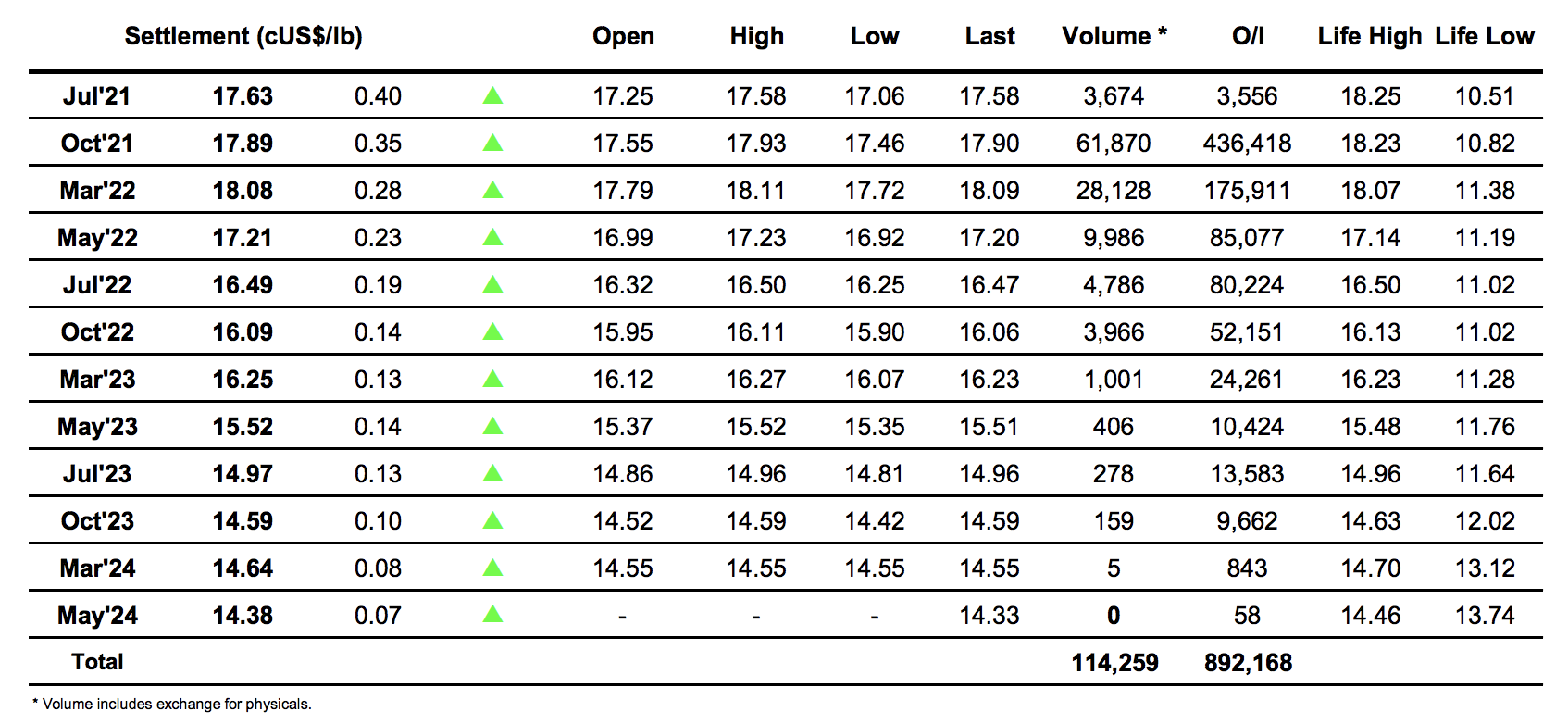

ICE Futures U.S. Sugar No.11 Contract

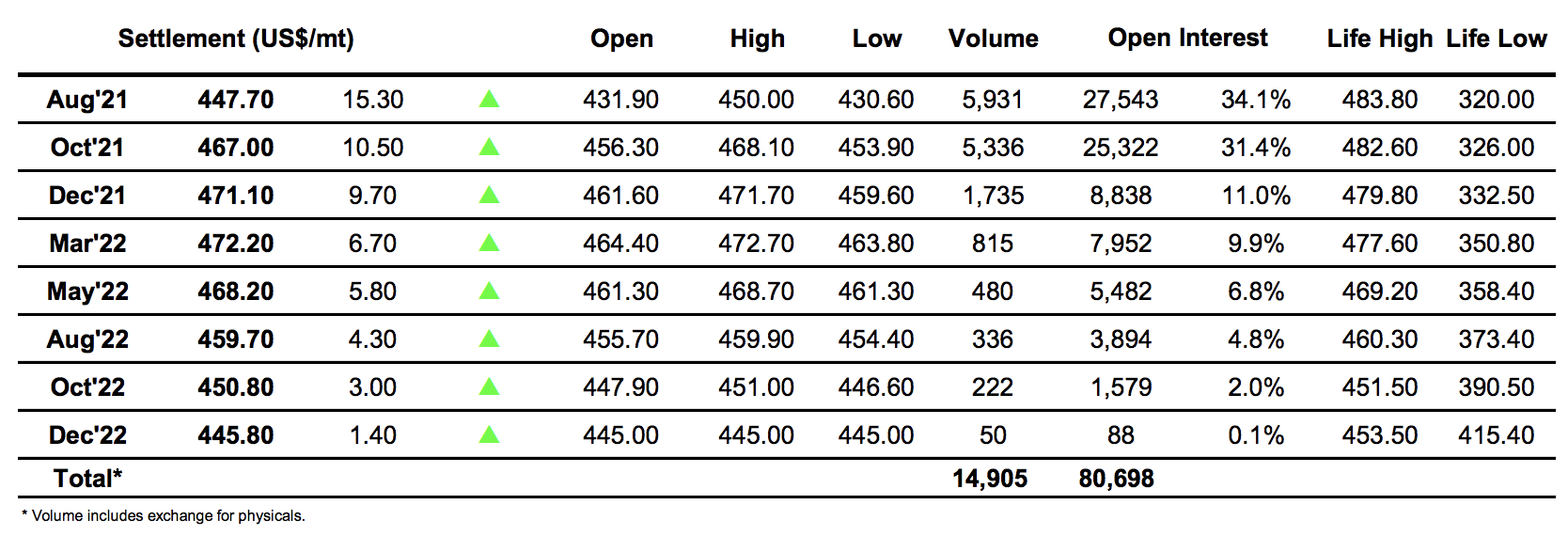

ICE Europe Whites Sugar Futures Contract