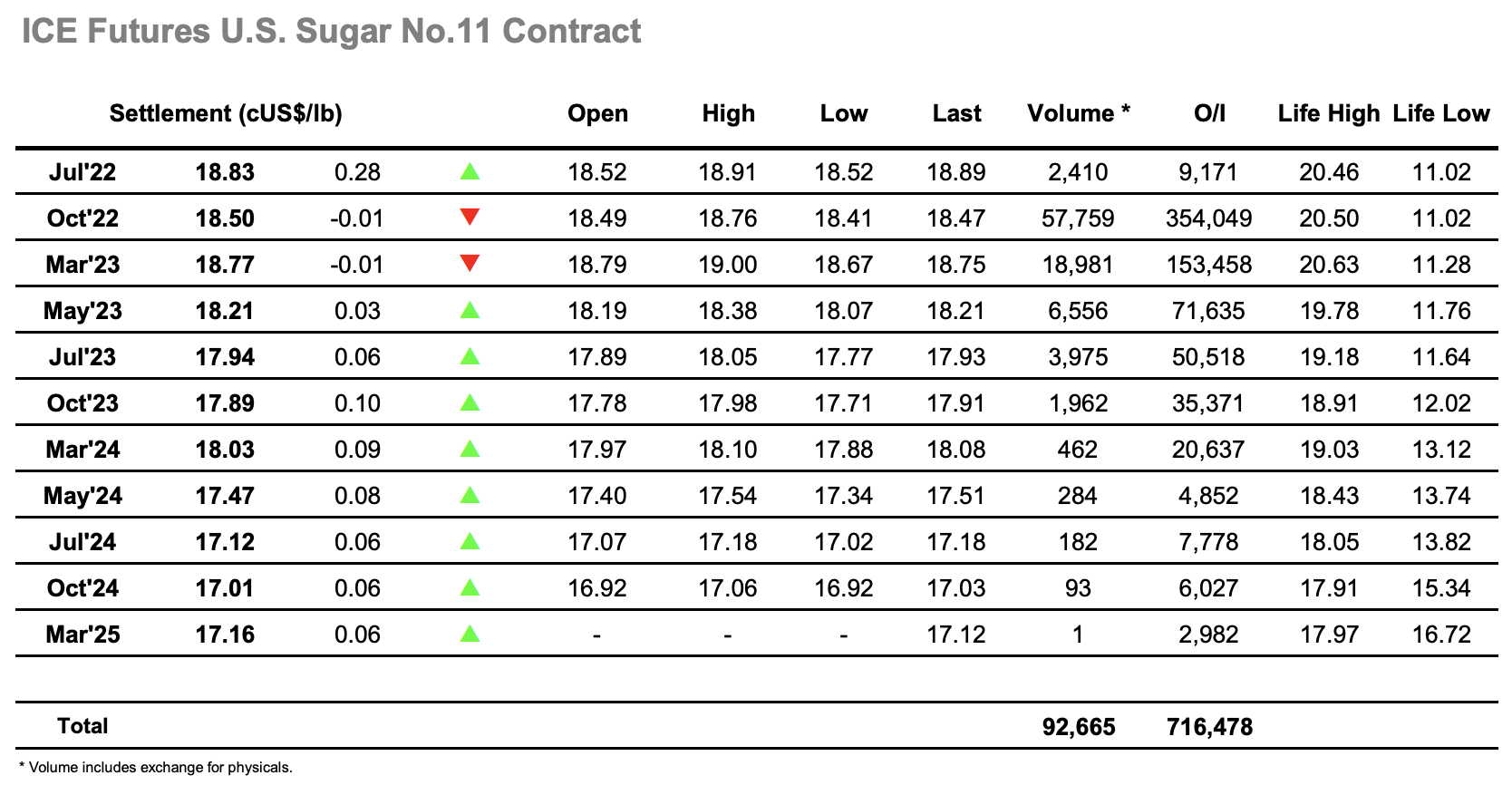

The day started with some calm activity near to overnight levels before some light buying emerged to send Oct’22 up to consolidate the 18.60 area. Morning volumes were low, particularly for the Jul/Oct’22 where most traders now seem set in their positions ahead of tonight’s expiry following a fair number of AA postings yesterday, leaving limited depth for those still needing to fine tune/liquidate positions. This provided a platform for the market to further extend the recent rally into the 18.70’s and all appeared steady until the start of the US morning drew out some sharp spec selling and sent Oct’22 crashing to 18.50. A quick reaction then saw the price start to recover and trigger spec buying (a horrid day trade possibly) and send the price up to 18.76 before another decline saw values in the 18.40’s and making new session lows. This action served to remind us that there remains very little direction presently and with the funds absent and smaller specs twisting in an illiquid environment it will remain tough to escape the current range. In amongst this activity Jul/Oct’22 was finding support ahead of expiry and traded as wide as 0.20 points premium which was its highest level since mid-December. With losses showing across the grains and energy sectors the market struggled to pick back up through the afternoon, eventually leading us to a marginally lower close at 18.50 following some late defensive buying. Jul’22 meanwhile ended firmly with a high at 18.91 and final trades for Jul/Oct’22 at 0.39 points before settling at 0.33 points.

· Jul’22 expired at 18.83 with 9,897 lots (502,792t) expected to be tendered. Full details will be published by the exchange tomorrow.