A broadly positive macro drew in some early buying to the market with the initial push seeing March’23 reach 17.90 before yet again stalling well in advance of 18c. Before the morning was through the same specs who had pushed higher had hit the exit button with a fall to 17.71 seen against this, and while little had changed from the macro side this latest mini-failure was sufficient to dent confidence and leave prices languishing in the 17.70s through the middle part of the day. Focus was on the Oct’22 contract ahead of tonight’s expiry, and with the Open Interest showing 22,795 lots remain we are seeming set for a delivery around 1m tons tonight. A tedious afternoon played out either side of 17.70 to send us into the weekend quietly, March’23 settling at 17.68 as it moves to the top of the board. Oct’22 expired at 18.42 with the Oct’22/March’23 valued at 0.74 points premium. Early news is that we will see 14,652 lots (744,458t) tendered with full details to be published by the exchange on Monday.

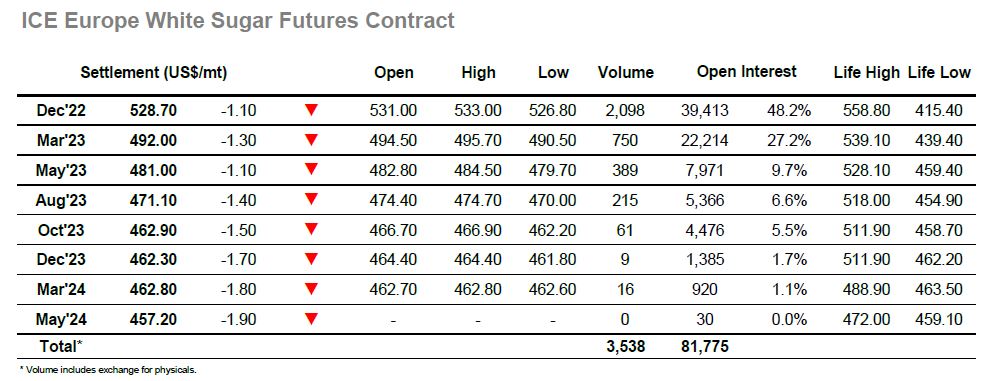

A low volume morning maintained recent rangebound trading, and though a couple of efforts were made to push the market against macro positivity any moves quickly faded on the $533.00 area, leading to a couple of rounds of liquidation. At just over $5 the range was the smallest we have seen for some time, and as the afternoon moved along this became barely half of that total as prices settled down to the lower end of the range. There were very few spreads and premiums changing hands, and though premium values improved marginally (March/March’23 to around $103) this was a factor of lower No.11 values as opposed to any material buying interest taking place. A small extension to $526.80 was followed by short covering and the remainder of the day played out at the lower end of the range, Dec’22 heading into the weekend at $528.70.