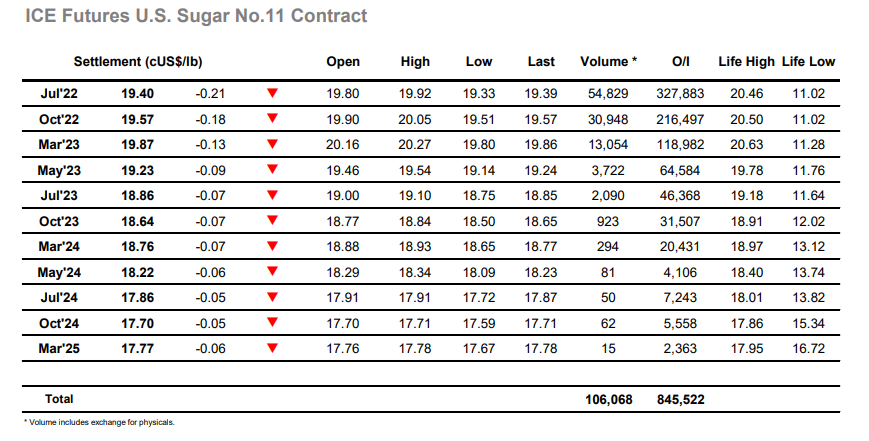

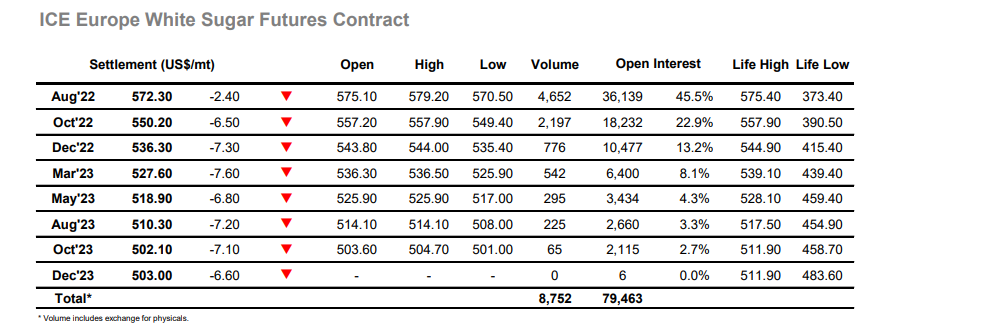

The market opened the week positively with a gap higher and rally to 19.92, reacting positively to the gains made by white sugar yesterday and the overnight gains in crude values on news that the EU are banning most Russian imports. The situation then settled down and the price eased back to hold at the opening 19.80 level on low volume for a period before further easing to fill the overnight gap ahead of the Americas day getting underway. Despite the firm crude values the wider macro was struggling to follow that move, and a burst of long liquidation sent July’22 back below 19.50 with the fundamentals clearly still acting as the prime driver for No.11 sentiment. The dip was picked up however there was a reluctance to take outright values back into credit which eventually dented confidence further and led prices to erode further to new session lows. The decline brought the 19.20/19.27 gap back into view though prices remained above it once again with a low seen at 19.33, something which may be hindering the market of late with the possibility that the presence of the gap is discouraging buyers from pushing more aggressively at times. Settlement was made at 19.40 to end the month at the lower end of the near-term range, and while there remain plenty who want the market to push higher in light of the current crude outlook a continuation of the status quo seems the most likely way forward for the time being.