The strong end to July placed the market in a very strong technical position from which to try and further build so it was a little surprising to see values under pressure this morning. Selling was pushing into both the whites and No.11 markets with the whites particularly feeling the pressure as the morning saw Oct’20 trading as low as 369.80 to show losses of more than $11 while No.11 found support around the former Oct’20 high mark of 12.40, reaching 12.39 before showing signs of steadying. Having shown signs of stemming the decline ahead of the US opening it was to be expected that some fresh spec interest would re-emerge in order to defend their fresh long holding, and the early afternoon period saw prices duly climb back into the range against moderate defensive buying. The recovery provided a better platform from which to attack higher and the funds duly obliged midway through the afternoon, shooting aggressively through Friday’s high mark of 12.72 with assistance from the algo’s to reach 12.80. Progress was limited by some continuing producer scale selling, particularly for 2021 positions as they look to take advantage of the higher levels combined with advantageous currency (USDBRL was weakening back to 5.33). A pullback from the highs led to some long liquidation/profit taking however the bigger impact of this round of selling was again being felt in the whites where the white premium values had weakened further with Oct/Oct’20 trading down to $95 having settled at $103 on Friday evening. The final hour saw prices pushed back towards session highs as longs looked to ensure a positive conclusion to the day, something the was successfully achieved before a final slide sue to end of day position squaring.

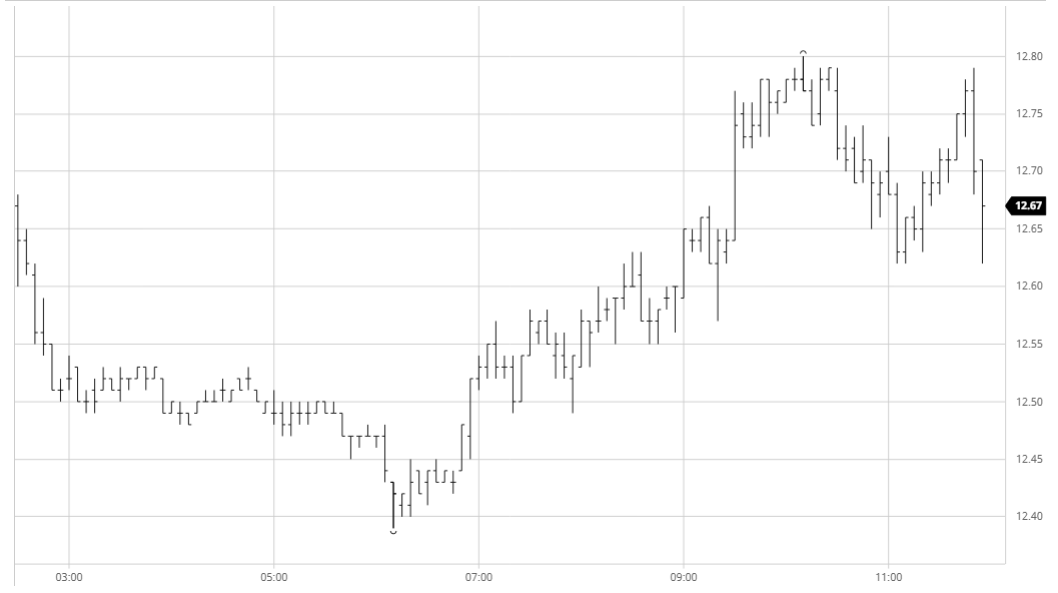

SB Oct – Sugar No.11

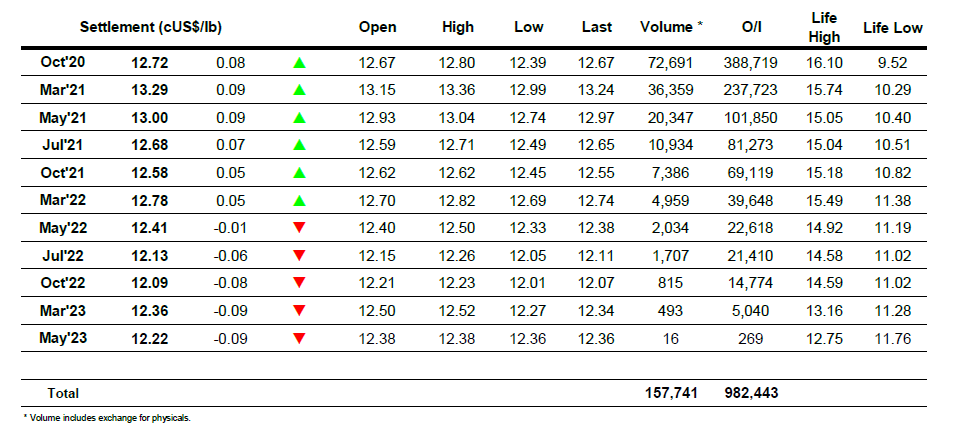

ICE Futures U.S. Sugar No.11 Contract

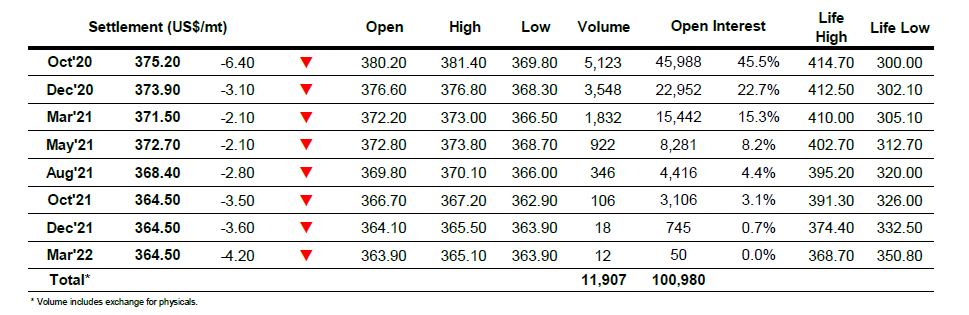

ICE Europe White Sugar Futures Contract