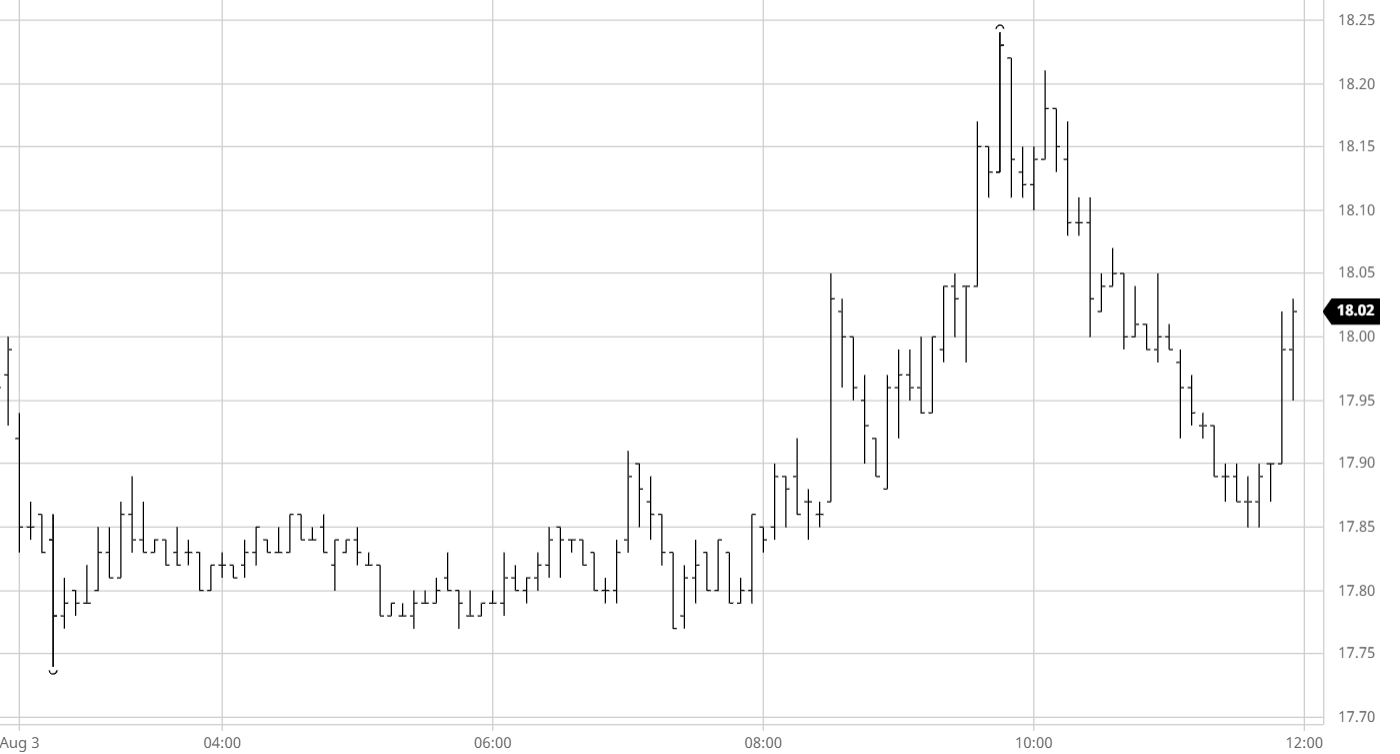

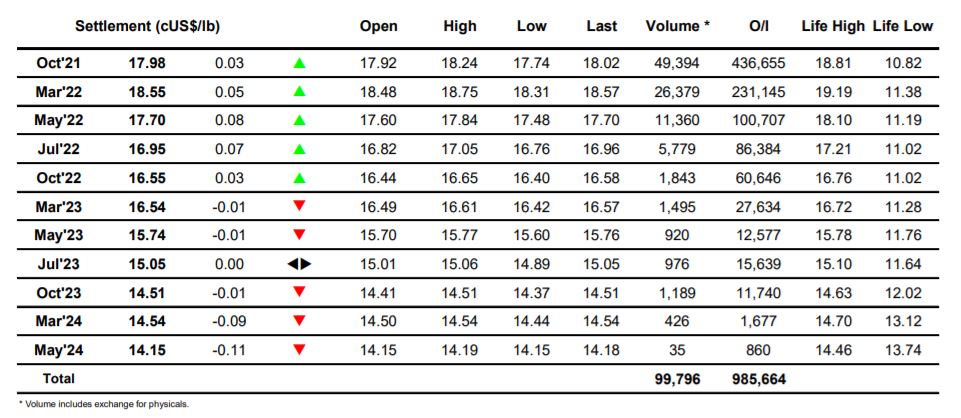

Sugar #11 Oct’21

The day began with lower values, more so due to a lack of buying than any other reason, and Oct’21 extended down through 17.80 to record a new low mark for the recent decline at 17.74. There has been no fresh news for the market this week and while there are many who remain broadly positive to prices for the medium term the macro turnaround is deterring buyers for the moment and so it was to be expected that we nurdled along sideways through the morning on low volumes. The same pattern was maintained through into the early afternoon until a push beyond 18c emphasised a lack of overhead selling with a second drive based upon some light spec/algo buying taking the price up sharply to 18.24 a while after. Long holders would have been hoping that this could form the basis of a turnaround to boost their positions but it was not too be with the flimsy nature of the environment highlighted soon after when long liquidation sent Oct’21 back through the same thin environment and leaving values marginally down on the day once more. A quiet final hour was only enlivened by MOC buying that pushed Oct’21 back up to settle marginally higher at 17.98 with the near term seeming likely to see a continuation of the same broadly sideways activity.

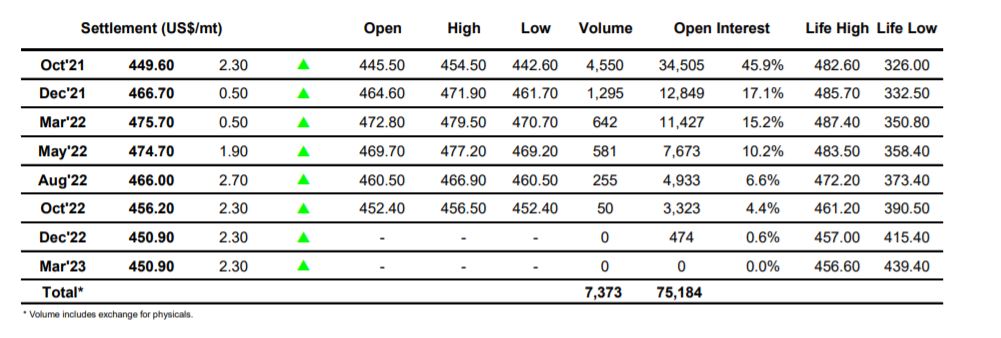

Sugar #5 Oct’21

Coming off the back of a more settled day the market was continuing to try and stabilise ahead of $442 support although with little buying on show to begin the day a gap lower and prints at $444.00 put us on the back foot more quickly than may have been anticipated. Things soon calmed with prices settling into a band either side of $445.00 and on low volume we continued broadly sideways for several hours with little activity of note aside from a small nudge up to fill the gap on the intra-day chart. It felt as though we were going to see another day of simple consolidation however a sharp burst of buying which sent Oct’21 above $449.00 set the wheels in motion for a little spec activity to emerge and process continued upward to a high of $454.50 before the buying cooled. The market then became plagued by its ongoing issue of lacking any continuation buying once the spec interest eases, illustrated perfectly by the $7 decline from the highs to be trading back around unchanged levels as the final hour arrived. Prices dipped a little further before the arrival of defensive closing buying which pushed the Oct’21 contract back upwards to settle at $449.60, a moderate net gain though overall suggesting further range action for the near term.

The white premiums continue to see some support at the current low levels but are finding it tough to rally very far. Closing values see Oct/Oct’21 at $53.20, March/March’22 at $66.70 and May/May’22 at $84.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract