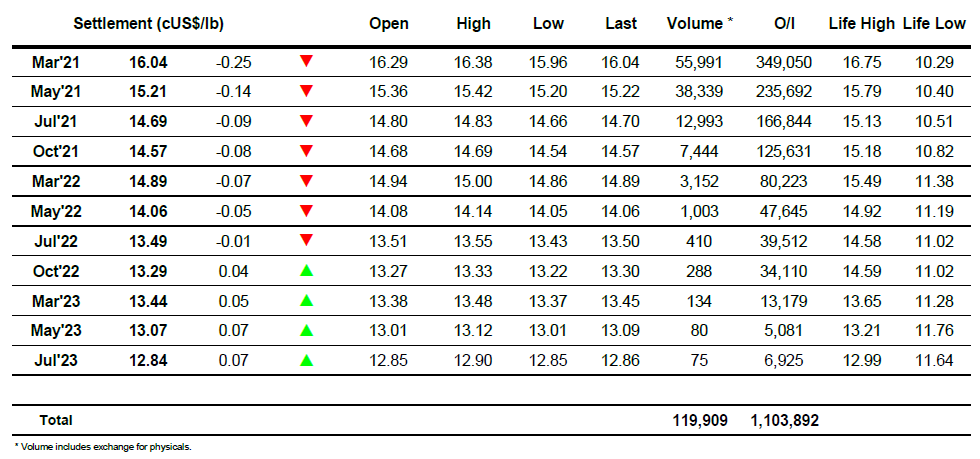

Sugar #11 Mar ’21

Opening buying sent March’21 up to 16.38 however this soon faded and a fall to 16.20 followed. The early choppiness continued with a run back up to 16.35 but unable to match the opening highs we slipped once more to be consolidating a narrow band in the upper teens/low 20’s as we eased our way into the afternoon. Activity was far calmer than recent days with the exception of the March/May’21 spread where some steady selling was attracted throughout the day which weakened the differential to 0.77 points. This may well be some early movement ahead of the index fund roll which will fully commence this Friday, and with hedge funds also long it will be interesting to see how the roll is approached. March’21 recorded a session low 15.96 against this week but though struggling to maintain the momentum of recent days there remained a desire from longs to defend the dip and bring prices back through 16c quite quickly. This area continued to be defended throughout the final couple of hours although values struggled to climb too far and despite some pre close buying which saw March21 back to 16.16 the call itself was met with selling which left settlement values near to the bottom of the days range while the end of the recent rally suggests that sideways action may prevail for the short term.

Sugar #5 Mar ’21

Light early volatility saw both March’21 and May’21 chop around in higher ground however by the later part of the morning things calmed for the March’21 and it entered a sideways pattern around $462/463. May’21 was also proving rather calm but was at least seeing any movement that took place in the spread, nudging a dollar or so wither way while March remained rather constant. This spread activity was remarkably calm when one considers that after today there are just seven sessions remaining until the first expiry of the year and though the March/May’21 range stretched from $18 to $22.70 over the session increasingly the action was centred around the $20 area on low volume that will do little to diminish today’s March’21 OI total of 33,621 lots. Activity throughout the afternoon continued to be quiet though we did see some movement for nearby white premium values due to No.11 activity, March/March’21 working between $105 and $108. The afternoon range was not even broken on an unusually calm close which saw March’21 end at $462.60 and May’21 at $441.80.

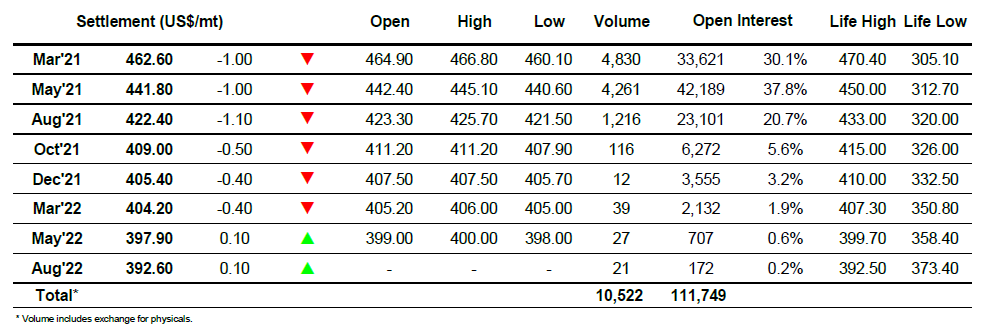

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract