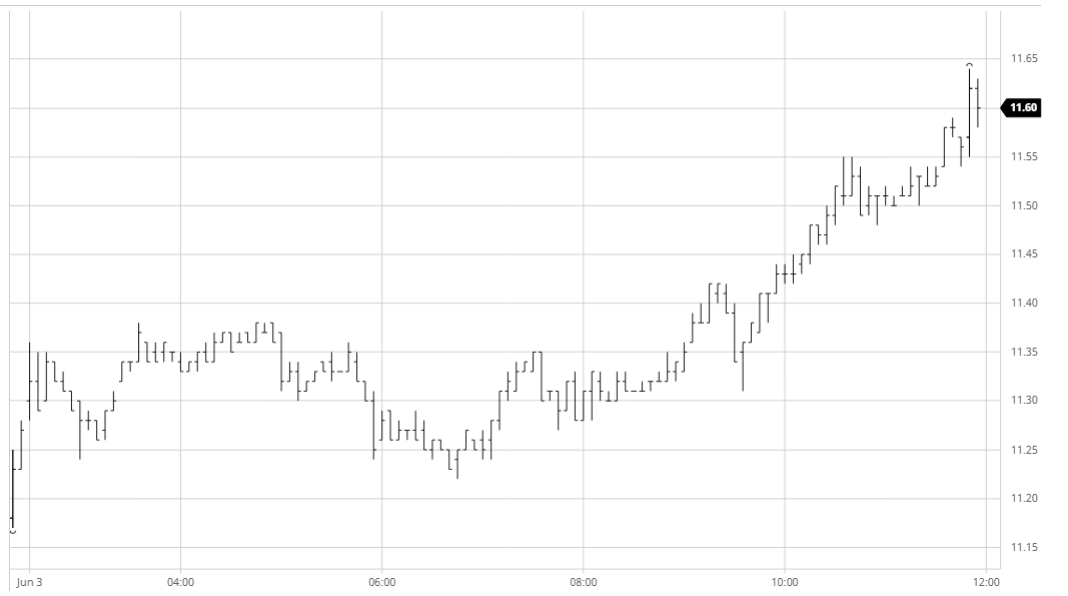

There was immediate strength for the market this morning as specs seized upon last night’s positive close for Jul’20 to make a quick push beyond the recent 11.32 high. There was scale selling from producers as we climbed and this limited the gains to the upper 11.30’s initially, however with specs buoyed by wider macro support there was no sign of the market falling back by very far. The only concern for bulls was the lack of spread support with Jul/Oct’20 trading either side of -0.08 points, though that it wasn’t falling seemed to be suitably positive. The USDBRL opening saw another recovery for the BRL as it moved back below 5.10, and with this action detracting from any desire by Brazilian producers to price heavily it gave the specs impetus to mount another push upward. By late afternoon this rally had extended beyond 11.50, and while the currency strength was aiding the move (daily high recorded at 5.0170) we were now moving independently of the macro, topping the CRB with the energy sector having fallen back into debit for the day. Whites were not finding the same positivity meanwhile, and though showing a solid set of gains we were seeing weaker WP values with the Aug/Jul’20 back beneath $120 this afternoon. Specs were now in full control and their continued buying also attracted some fund interest, eventually taking Jul’20 to a daily high 11.64 with settlement only just below at 11.62. This positive close has broken the recent technical band and provides some clear headroom with the next Jul’20 target the 12.12/12.23 gap established on 12th March. The spec community will be determined to continue driving towards this, the question now is whether they will find other willing buyers to assist.

No.11 Futures

No.11 Futures

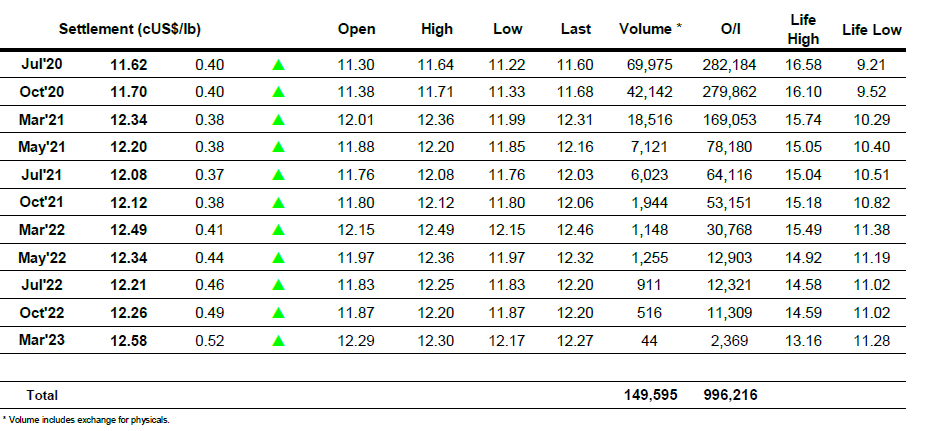

ICE Futures U.S. Sugar No.11 Contract

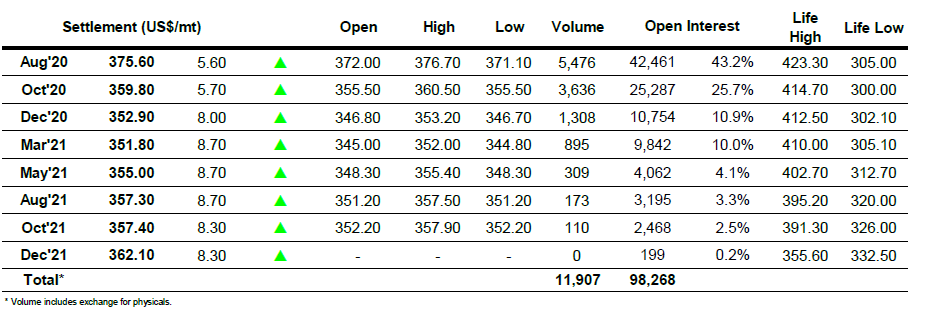

ICE Europe White Sugar Futures Contract