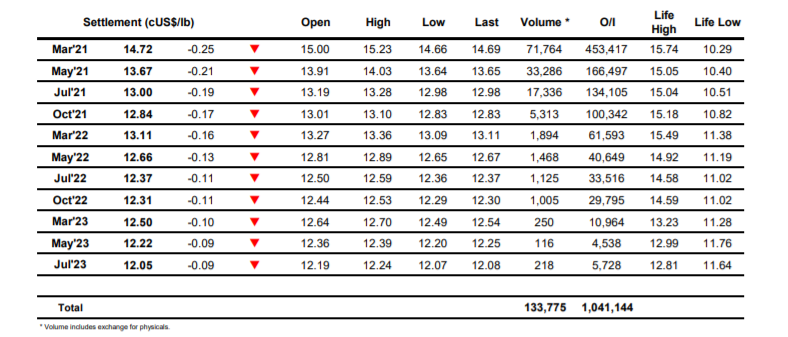

Mar 21 – Sugar No.11

A quiet but steady start to the day saw March’21 initially matching the recent 15.04 high mark, setting the platform to try and continue yesterday’s rally and push into higher ground once again. After a couple of hours of scene setting we made the move with a few buy stops triggered above 15.05 maintaining the move with a second push to send the front month up to 15.23. The higher levels naturally attracted a degree of producer selling but as with recent weeks the volume of said selling remained moderate at best and so values were able to comfortably mirror the firmer macro environment that saw gains for both equities and commodities with consolidation near to the highs. It was somewhat unexpected when a push beneath 15.15 led to some sudden long liquidation which led March’21 quickly back to 14.84 on just a few thousand lots of volume, at the same time giving back the morning spread gains which had seen March/May’21 widen to 1.20 points and March/Jul’21 reach 1.97 points. Despite the macro remaining firm and the USDBRL continuing above 5.70 the market entered a new phase for the afternoon with attempts to reignite the rally stalling in the vicinity of 15c and as we entered the final hour outright values were struggling near to session lows. Further late selling ensured a weak conclusion as March’21 traded down to 14.66, and eyes now turn towards the US election as events overnight are likely to have influence upon the macro and out own near term direction with further volatility seeming inevitable.

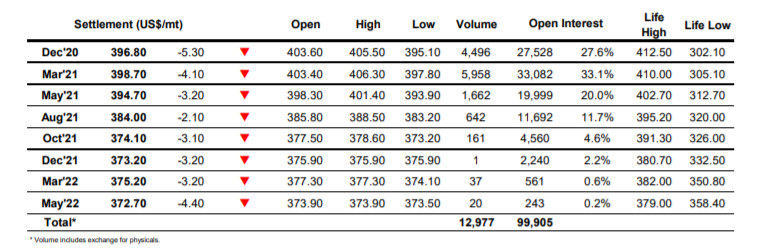

Dec 20 – Sugar No. 5

The sharp recovery of recent losses has put the market in a good position to try and continue higher and having initially consolidated near to unchanged levels we began to push upward to challenge the $405.00 level for Dec’20. Spec buying and new highs for No.11 helped to pull our values higher during the later morning but though we pushed up to record marginal new recent highs at 405.50 for Dec’20 and 406.30 for March’21 the market was lacking a spark and struggled to follow. Nearby white premiums suffered as a result of this with march/March’21 trading beneath $71 and by early afternoon we were on the back foot as a sharp correction saw nearby positions shed almost $6 in around 30 minutes. While this did not lead to a more severe correction we remained in the lower half of the day’s range throughout the afternoon, failing to match the gains being seen for the wider commodity macro. By the close we saw new session lows for Dec’20 at 395.10 and March’21 at 397.80, though with the hope that we may have some idea of the direction of the US election outcome before tomorrow’s opening there will likely be further macro led volatility to follow.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract