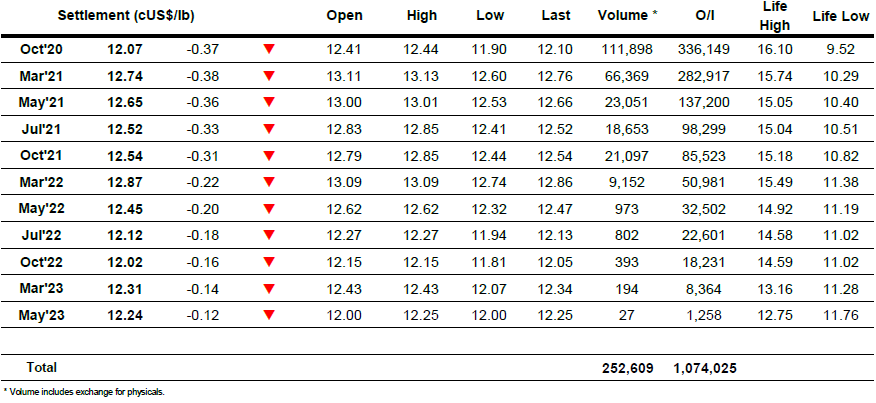

Continuing disappointing recent performances have had the market testing the short term support, and it did not hold for very long today as early selling emerged to push beneath the initial 12.40 support area. This set about a gradual decline which extended throughout the session with scale buying being comfortably filled though stops were few and far between making the move incredibly orderly. Outright selling was primarily emerging from specs with the technical weakness leading to some reductions in recent longs which is not really surprising given that the most recent COT report showed the fund long in excess of 191,000 lots. Producers meanwhile are largely standing aside, particularly those in Brazil as lower market levels combine with a recovery in the BRL (now back to 5.29) to lower returns in Reals for the time being. There was strong interest for the spreads ahead of the index roll which takes place next week as Oct/March pushed out to -0.70 points intra-day, though this was only a couple of points lower and represented a relatively firm performance given that the Oct’20 was by now pushing down to record an 11c handle. The only salvation came during the final stages as some short covering from day traders combined with bargain hunting to ensure that Oct settled back above 12c to prevent against the psychological damage that would bring, though still the technical picture appears damaged and weak and one cannot rule out further losses with no meaningful support on show until the July lows in the 11.50 area.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

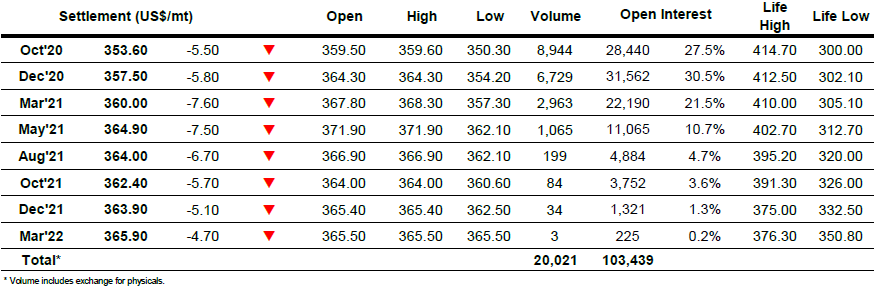

ICE Europe White Sugar Futures Contract