Sugar #11 Mar ’21

The day began rather calmly with some light physical offtake about the only feature as nearby values worked marginally higher. Conditions remained quiet with a pullback to 16c providing the only spark of interest however it did not lead to anything further and we continued to hold just above 16c through into the late morning. The one area which was showing some movement through this period were the nearby spreads with March/May’21 slipping back down beneath 0.80 points and it was this weakness the started to bring the flat price lower as we moved into the early afternoon, a slow and laborious stepped decline which reached a low point of 15.82 over a period of around three hours during which period the spread narrowed all the way to 0.70 points. A prolonged period spent consolidating in front of this area then looked to be taking us sleepwalking towards the close however as so often is the case recently we saw the specs step back in during the final hour to pull prices back upwards and set the platform for a better close. MOC buying duly followed which ensured that a slow session concluded with the smallest of gains as March’21 settled at 16.05 with March/May’21 also off of its lows at 0.73 points.

Sugar #5 Mar ’21

Despite the muted market performance yesterday there emerged some early buying to give prices a lift during the first hour with May’21 reaching a high mark of $445.90 on a price spike, though soon after it washed back down to $443 with the lack of any follow up buying yet again making a rally short-lived. This did not result in any significant reversal but rather set us into a repeat of yesterdays pattern with activity then taking place within proximity of $442 for several hours. March’21 open interest only declined slightly to 31,921 lots yesterday and the front month was having another orderly session today with only moderate position rolling taking place and the differential holding firmly near to $20. A dip to touch $440 midway through the afternoon merely prompted some light defensive buying which pulled values back towards unchanged levels once more. With March/May’21 volume remaining the dominant factor (despite managing fewer than 3,000 lots on the day) we continued sideways until the final hour when a defensive late push emerged to take us back towards morning highs and ensure a styled settlement level at 465.40.

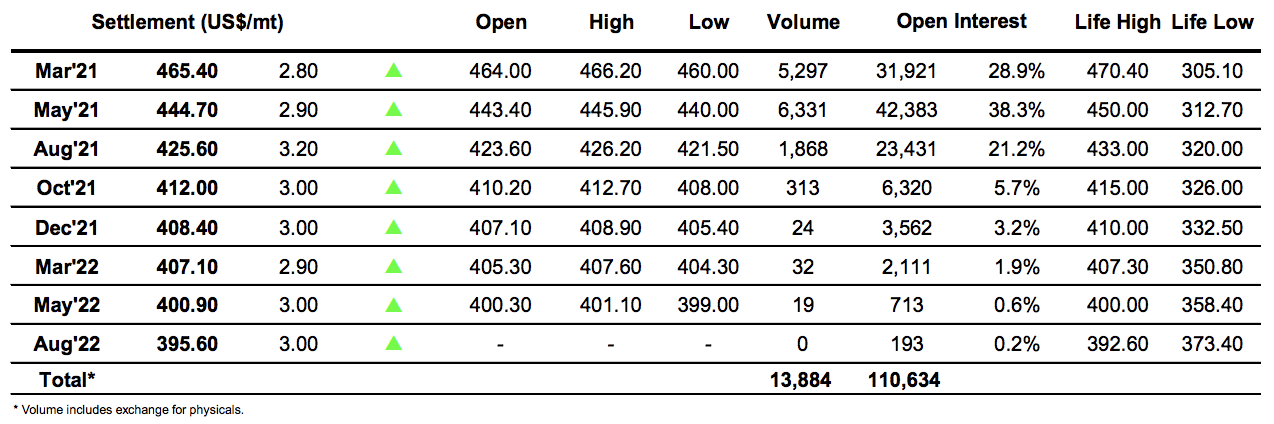

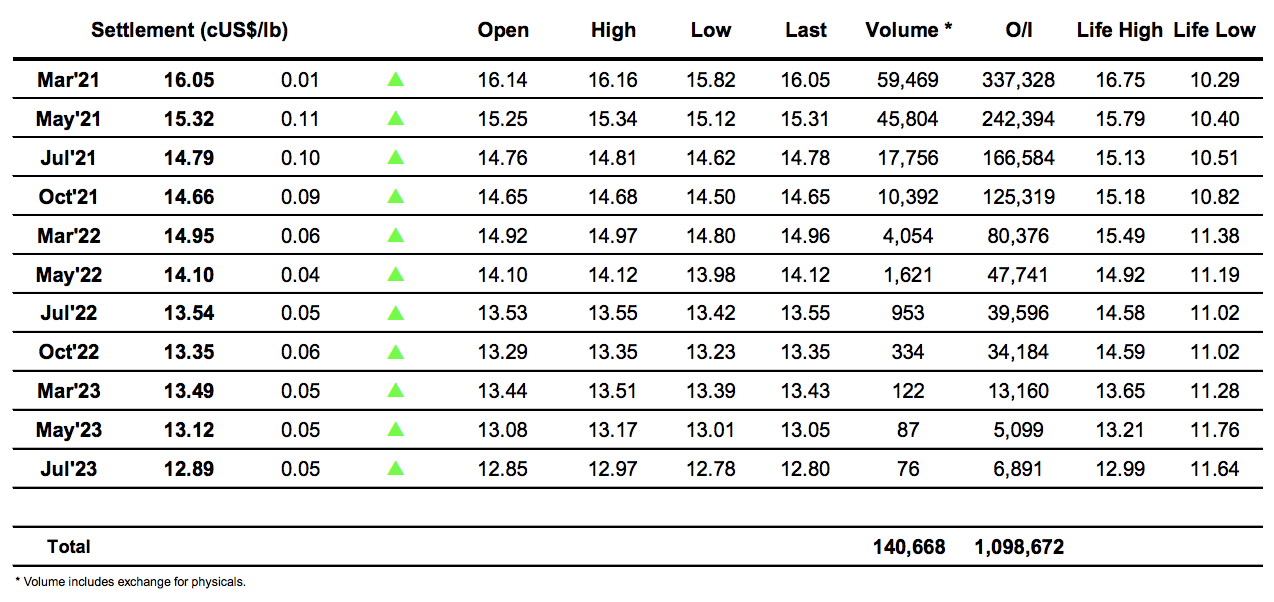

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract