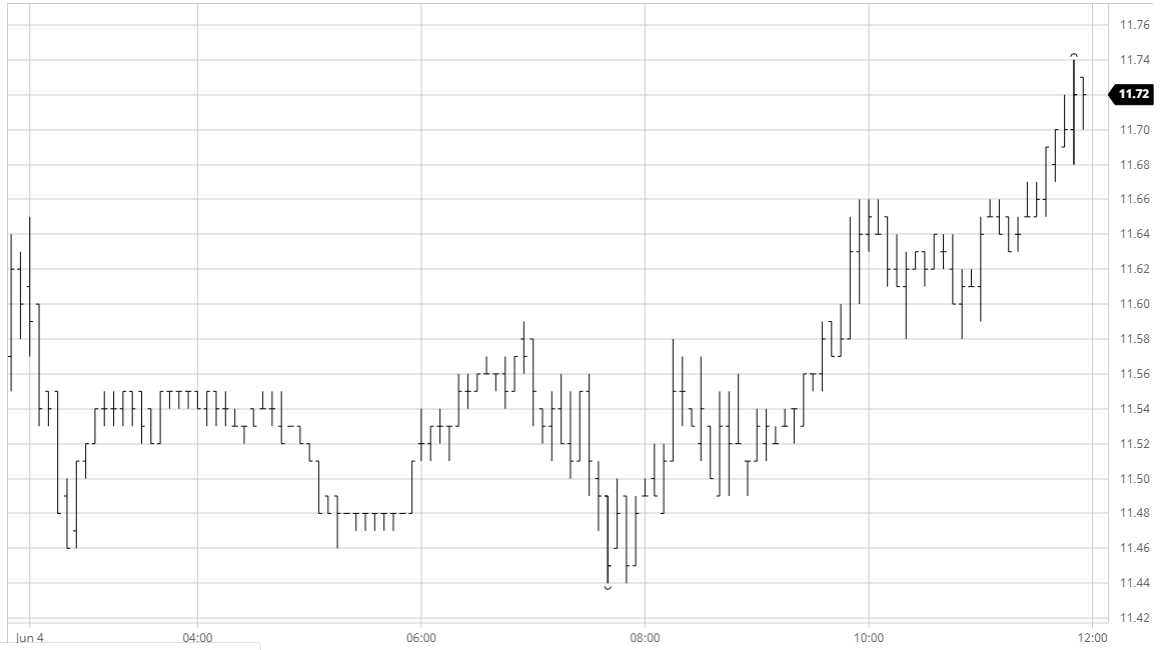

The day commenced relatively slowly as Jul’20 slipped downwards form an initial 11.65 high to trade at 11.46 before looking to quietly consolidate within the early range. There was no significant fresh news and with the specs seemingly content to hold on to yesterday’s gains we remained quiet throughout the morning. The only significant movement through this period was seen for the Aug/Jul’20 white premium which maintained its recent unpredictable yo-yo action by recovering all of yesterday’s losses to be trading back up to $127. The macro was putting in another relatively flat day and with the energy sector continuing to struggle the specs remained reluctant to commit significantly during the afternoon, though they did at least protect their existing longs by helping Jul’20 back upwards to the opening highs and erase the daily losses. This provided a platform for some fresh spec buying to emerge during the closing stages which took the front month to another new recent high of 11.74, ensuring another positive close which maintains the technical strength.

no.11 Futures

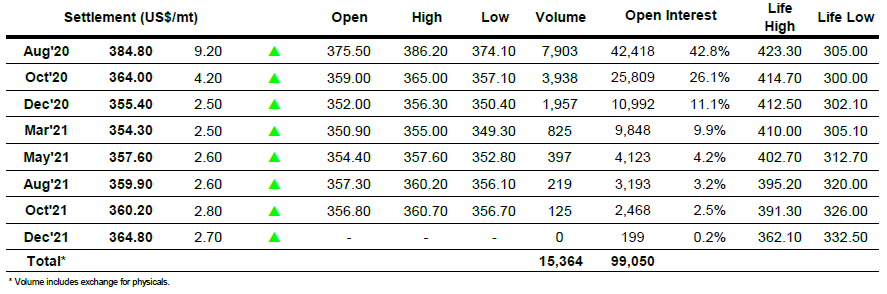

ICE Futures U.S. Sugar No.11 Contract

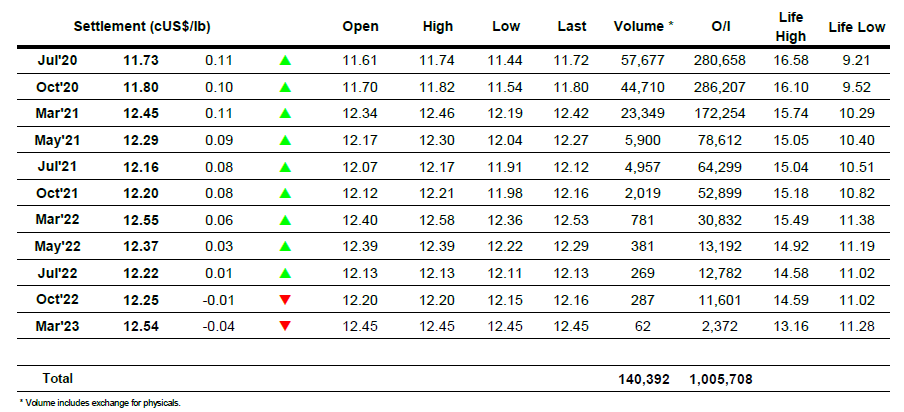

ICE Europe White Sugar Futures Contract